World Uranium Mining Production | In Situ Leach Mining of Uranium | Environmental Aspects of Uranium Mining

Related pages

World Uranium Mining Production

(Updated 22 May 2015)http://www.world-nuclear.org/info/Nuclear-Fuel-Cycle/Mining-of-Uranium/World-Uranium-Mining-Production/

- Two-thirds of the world's production of uranium from mines is from Kazakhstan, Canada and Australia.

- An increasing proportion of uranium, now 46%, is produced by in situ leaching.

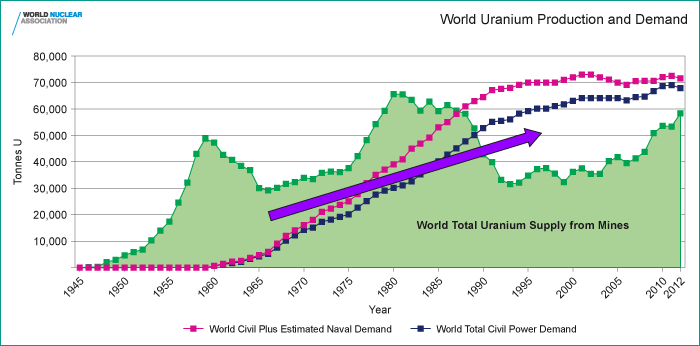

- After a decade of falling mine production to 1993, output of uranium has generally risen since then and now meets over 90% of demand for power generation.

Production from mines (tonnes U)

| Country | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

| Kazakhstan | 6637 | 8521 | 14020 | 17803 | 19451 | 21317 | 22451 | 23127 |

|---|---|---|---|---|---|---|---|---|

| Canada | 9476 | 9000 | 10173 | 9783 | 9145 | 8999 | 9331 | 9134 |

| Australia | 8611 | 8430 | 7982 | 5900 | 5983 | 6991 | 6350 | 5001 |

| Niger | 3153 | 3032 | 3243 | 4198 | 4351 | 4667 | 4518 | 4057 |

| Namibia | 2879 | 4366 | 4626 | 4496 | 3258 | 4495 | 4323 | 3255 |

| Russia | 3413 | 3521 | 3564 | 3562 | 2993 | 2872 | 3135 | 2990 |

| Uzbekistan (est) | 2320 | 2338 | 2429 | 2400 | 2500 | 2400 | 2400 | 2400 |

| USA | 1654 | 1430 | 1453 | 1660 | 1537 | 1596 | 1792 | 1919 |

| China (est) | 712 | 769 | 750 | 827 | 885 | 1500 | 1500 | 1500 |

| Ukraine (est) | 846 | 800 | 840 | 850 | 890 | 960 | 922 | 926 |

| South Africa | 539 | 655 | 563 | 583 | 582 | 465 | 531 | 573 |

| India (est) | 270 | 271 | 290 | 400 | 400 | 385 | 385 | 385 |

| Malawi | 104 | 670 | 846 | 1101 | 1132 | 369 | ||

| Brazil (est) | 299 | 330 | 345 | 148 | 265 | 231 | 231 | 231 |

| Czech Republic | 306 | 263 | 258 | 254 | 229 | 228 | 215 | 193 |

| Romania (est) | 77 | 77 | 75 | 77 | 77 | 90 | 77 | 77 |

| Pakistan (est) | 45 | 45 | 50 | 45 | 45 | 45 | 45 | 45 |

| Germany | 41 | 0 | 0 | 8 | 51 | 50 | 27 | 33 |

| France | 4 | 5 | 8 | 7 | 6 | 3 | 5 | 3 |

| Total world | 41 282 | 43 764 | 50 772 | 53 671 | 53 493 | 58 394 | 59,370 | 56,217 |

| tonnes U3O8 | 48 683 | 51 611 | 59 875 | 63 295 | 63 084 | 68 864 | 70,015 | 66,297 |

| percentage of world demand* | 64% | 68% | 78% | 78% | 85% | 86% | 92% | 85% |

Kazakh total includes Stepnogorsk. *WNA Global Nuclear Fuel Market Report data.

Mining methods have been changing. In 1990, 55% of world production came from underground mines, but this shrunk dramatically to 1999, with 33% then. From 2000 the new Canadian mines increased it again, and with Olympic Dam it is now 48%. In situ leach (ISL, or ISR) mining has been steadily increasing its share of the total, mainly due to Kazakhstan, and in 2014 for the first time was more than half of production. In 2014 production was as follows:

| Method | tonnes U | % |

| Underground & open pit (except Olympic Dam)* | 23,679 | 42% |

| In situ leach (ISL) | 28,467 | 51% |

| By-product* | 4,107 | 7% |

* Considering Olympic Dam as by-product rather than in underground category

Conventional mines have a mill where the ore is crushed, ground and

then leached with sulfuric acid to dissolve the uranium oxides. At the

mill of a conventional mine, or the treatment plant of an ISL operation,

the uranium then separated by ion exchange before being dried and

packed, usually as U3O8.

Some mills and ISL operations (especially in the USA) use carbonate

leaching instead of sulfuric acid, depending on the orebody. Where

uranium is recovered as a by-product, eg of copper or phosphate, the

treatment process is likely to be more complex.

During the 1990s the uranium production industry was consolidated by

takeovers, mergers and closures, but this has diversified in recent

years with Kazakhstan's diverse ownership structure. Over half of

uranium mine production is from state-owned mining companies, some of

which prioritise secure supply over market considerations. In 2014,

eleven companies marketed 88% of the world's uranium mine production:

| Company | tonnes U | % |

| KazAtomProm | 13801 | 25 |

| Cameco | 8956 | 16 |

| ARMZ - Uranium One | 6944 | 12 |

| Areva | 6496 | 12 |

| BHP Billiton | 3351 | 6 |

| CNNC & CGN | 2684 | 5 |

| Paladin | 2316 | 4 |

| Navoi | 2400 | 4 |

| Rio Tinto | 2296 | 4 |

| Other | 6973 | 12 |

| Total | 56,217 | 100% |

Note that these figures are based on marketed shares, not joint venture shares (e.g. Areva markets all Katco production).

The largest-producing uranium mines in 2014 were:

| Mine | Country | Main owner | Type | Production (tU) | % of world |

| McArthur River | Canada | Cameco (69.8%) | underground | 7356 | 13 |

|---|---|---|---|---|---|

| Tortkuduk & Myunkum | Kazakhstan | Katco JV/ Areva | ISL | 4322 | 8 |

| Olympic Dam | Australia | BHP Billiton | by-product/ underground |

3351 | 6 |

| SOMAIR | Niger | Areva (63.6%) | open pit | 2331 | 5 |

| Budenovskoye 2 | Kazakhstan | Karatau JV/ Kazatomprom-Uranium One | ISL | 2084 | 4 |

| South Inkai | Kazakhstan | Betpak Dala JV/ Uranium One | ISL | 2002 | 3 |

| Priargunsky | Russia | ARMZ | underground | 1970 | 4 |

| Langer Heinrich | Namibia | Paladin | open pit | 1947 | 4 |

| Inkai | Kazakhstan | Inkai JV/Cameco | ISL | 1922 | 3 |

| Central Mynkuduk | Kazakhstan | Ken Dala JSC/ Kazatomprom | ISL | 1790 | 3 |

| Rabbit Lake | Canada | Cameco | underground | 1602 | 3 |

| Budenovskoye 1, 3 & 4 | Kazakhstan | Akbastau JV/ Kazatomprom-Uranium One | ISL | 1594 | 3 |

| COMINAK | Niger | Areva (34%) | underground | 1501 | 3 |

| Rossing | Namibia | Rio Tinto (69%) | open pit | 1308 | 2 |

| Southern Moinkum & Khanzhugan | Kazakhstan | Mining Co Taukent/ Kazatomprom | ISL | 1174 | 2 |

| Top 15 total | 36,2550 | 64.5% | |||

Source: World Nuclear Association

New Mines

Since the recovery of uranium prices since about 2003, there has been

a lot of activity in preparing to open new mines in many countries. The

WNA reference scenario projects world uranium demand as about 66,883 tU

in 2015, and most of this will need to come directly from mines. Due to

the absence of Japanese consumption in the last couple of years and low

prices there has been some stockpile build-up over 2013-15, which will

come in as secondary supply in the next few years.

Some of the new mines expected to reach substantial production in the next few years are:

| Khiagda | Russia | 2014 |

| Four Mile | Australia | 2014 |

| Cigar Lake | Canada | 2014 |

| Husab | Namibia | 2015 |

| Mkuju River | Tanzania | 2016 |

| Imouraren | Niger | ?? |

Known Recoverable Resources of Uranium 2013

| tonnes U | percentage of world | |

| Australia |

1,706,100

|

29%

|

|---|---|---|

| Kazakhstan |

679,300

|

12%

|

| Russia |

505,900

|

9%

|

| Canada |

493,900

|

8%

|

| Niger |

404,900

|

7%

|

| Namibia |

382,800

|

6%

|

| South Africa |

338,100

|

6%

|

| Brazil |

276,100

|

5%

|

| USA |

207,400

|

4%

|

| China |

199,100

|

4%

|

| Mongolia |

141,500

|

2%

|

| Ukraine |

117,700

|

2%

|

| Uzbekistan |

91,300

|

2%

|

| Botswana |

68,800

|

1%

|

| Tanzania |

58,500

|

1%

|

| Jordan |

40,000

|

1%

|

| Other |

191,500

|

3%

|

| World total |

5,902,900

|

Reasonably Assured Resources plus Inferred Resources, to US$ 130/kg U, 1/1/13, from OECD NEA & IAEA, Uranium 2014: Resources, Production and Demand ("Red Book").

The total to US$ 260/kg U is 7.635 million tonnes U, and Namibia moves up ahead of Niger, and USA ranks just after Canada..

The total to US$ 260/kg U is 7.635 million tonnes U, and Namibia moves up ahead of Niger, and USA ranks just after Canada..

Report touts nuclear power as it faces hurdles

DENISE ALLABAUGH, STAFF WRITER

Published: October 5, 2015

Our Social Networks: Facebook- Sign Up

newsletter

http://standardspeaker.com/news/business/report-touts-nuclear-power-as-it-faces-hurdles-1.1953076

Pennsylvania’s five nuclear power plants contribute $2.36 billion to the state’s gross domestic product and help reduce carbon emissions, a report from global consulting firm The Brattle Group touted.

The report comes as nuclear power plants throughout the nation,

including Three Mile Island outside of Harrisburg, face economic

challenges, pressure from environmental groups and increased competition

from natural gas-fueled power plants.

The research shows Pennsylvania’s nuclear industry accounts for

15,600 in-state full-time jobs, both direct and secondary, and provides

$81 million in net state tax revenues annually.

That includes the 1,100 full-time jobs at the Susquehanna

nuclear plant in Salem Township which, according to Talen Energy

spokesman Todd Martin, also creates hundreds of supplemental jobs each

year to refuel one of the plant’s two reactors. The annual work, that

typically lasts about a month, brings in people from outside the area

who stay in hotels and eat at restaurants and that benefits the local

economy, he said.

Additionally, the Talen plant pays about $2.77 million in taxes

annually to Berwick Area School District, $1.2 million to Luzerne

County and $237,000 to Salem Township, according to figures Martin

provided.

The two units at the Susquehanna plant generate about 2,500

megawatts of electricity. That’s enough power to provide electricity to

about 2 million homes.

Martin said he didn’t want to speculate on the future of the Susquehanna plant.

PPL Corp. and Riverstone Holdings this summer spun off Talen as

a separate, combined business operating two dozen power plants. It

immediately became one of the largest competitive energy and power

generation companies in the United States.

Environmental concerns

Nuclear power plants use water to produce electricity, extract

and process uranium fuel and control wastes and risks. Average annual

carbon dioxide emissions would be about 52 million tons greater absent

the generation from Pennsylvania’s nuclear plants, according to The

Brattle Group report.

“Any nuclear operation is a low carbon option,” Martin said,

adding that nuclear energy also is sustainable and reliable. “Safety is a

key aspect of everything we do.”

Eric Epstein, chairman of Three Mile Island Alert, a nonprofit

citizens’ organization described as being dedicated to promoting “safe”

energy alternatives to nuclear power, denies the benefits touted by The

Brattle Group.

“The problem with the nuclear industry is they have never been

able to solve the riddle of the three W’s: where’s the waste going to

go, where’s the water going to come from and why won’t Wall Street

invest?” Epstein asked. “There is no private equity chasing nuclear

power because it’s an uneconomical investment.”

The Brattle Group report says nuclear power plants limit

greenhouse gas emissions and help keep electricity prices low, but

Epstein denies that nuclear energy is a “clean power source.”

“From the moment uranium is mined, milled, enriched, fabricated

and transported, it releases large quantities of airborne pollutants,”

he said.

He said nuclear energy cannot compete against alternative energy sources such as natural gas, which is cheaper.

Gas competes

The Salem Township nuclear plant could see its competition on

the horizon. Just a few miles away, Virginia-based Moxie Energy LLC

plans to build a 1,050-megawatt natural gas-fired power plant and

recently received approval from the state Department of Environmental

Protection for an air quality permit.

Aaron Samson, president and CEO of Moxie Energy, said they

still need a few more permits and hope construction could begin before

the end of the year.

Construction would take more than 32 months and employ more

than 250 workers. The plant would employ 26 to 30 full-time workers, he

said. The company intends to build the $800 million Moxie Freedom

facility on a 150-acre parcel in an industrial zone on Mingle Inn Road,

off Route 11.

Moxie Energy plans to use a combination of gas and steam

turbines, each of which will use natural gas, to produce energy. It

received approval from the Susquehanna River Basin Commission to use up

to 90,000 gallons of water per day in the energy generation process (in

comparison, the nuclear power plant uses about 20,000 gallons per minute). The water will come from wells on site.

While Samson said natural gas is clearly cheaper than nuclear

energy, he believes there needs to be diverse sources of energy and

nuclear energy has its place.

Challenges at TMI

The Three Mile Island nuclear plant in Dauphin County, whose

legacy includes the partial meltdown that occurred in 1979, faces new

challenges today.

Last month, no one bought a year’s worth of TMI’s electricity

at an energy-buying auction held by the PJM, the regional transmission

organization that coordinates the movement of power in all or parts of

13 states and the District of Columbia.

That led some to speculate about whether the nuclear plant owned by Exelon could be considered for closure.

Ralph DeSantis, Exelon’s spokesman at TMI, said it is a signal

that the plant is now “economically challenged” but it still has other

opportunities to receive revenue. The plant sells power every day in the

wholesale market, he said.

The economic challenges at Three Mile Island come in the wake

of plant shutdowns such as the Kewaunee plant in Wisconsin and the San

Onofre plant in California in 2013 and Vermont Yankee in 2014.

Mark Berkman, Ph.D., co-author of The Brattle Group report,

said it is critical to consider the significant value of nuclear plants

in a “landscape where several factors threaten some nuclear facilities

and could diminish the industry’s contribution to our electricity

supply, the economy and the environment.”

dallabaugh@citizensvoice.com

-

Asteroid Miner • 18 hours ago

Eric Epstein, chairman of Three Mile Island Alert, doesn't have enough math talent to read a simple chart. Nuclear power is the safest source of electricity there is.

Energy Source Death Rate (deaths per TWh) CORRECTED

Coal (elect, heat,cook –world avg) 100 (26% of world energy, 50% of electricity)

Coal electricity – world avg 60 (26% of world energy, 50% of electricity)

Coal (elect,heat,cook)– China 170

Coal electricity- China 90

Coal – USA 15

Oil 36 (36% of world energy)

Natural Gas 4 (21% of world energy)

Biofuel/Biomass 12

Peat 12

Solar (rooftop) 0.44 (0.2% of world energy for all solar)

Wind 0.15 (1.6% of world energy)

Hydro 0.10 (europe death rate, 2.2% of world energy)

Hydro - world including Banqiao) 1.4 (about 2500 TWh/yr and 171,000 Banqiao dead)

Nuclear 0.04 (5.9% of world energy)

source: http://nextbigfuture.com/2011/...Nice posts AM! Nuclear energy production is essentially hamstrung by a few interrelated issues. First there is the public's paranoia. They see NPPs as potential Hiroshima explosions because that's how basic science was expressed to them as children. They then elect politicians (2nd issue) who pander to their paranoia by expressing concern for nonexistent problems. Weapons are not made from Uranium. Even if terrorists were handed the Uranium, they couldn't do what the public fears.

The public don't understand it because it's not explained in simplistic terms like internal combustion engines. The average person could not grasp high school Calculus. The mathematics in Nuclear Science is daunting by comparison. The associated physics is not expressed in traditional Newtonian Mechanics which certainly compounds the difficulty.

If everyone could grasp it, everyone (countries) would have both the NPPs and the weapons. This includes every rogue/terrorist state the world over. Uranium is not all that hard to come by assuming one knows what to look for. Knowing how to initiate the reaction cascade then control it to suit one's purpose is where the talent lies. - Avoid closure of nuclear power plants by eliminating costly unnecessary safety measures. The coal industry pushes the nuclear "safety" issue to drive up the cost of nuclear power. Truth: Coal kills 3 million people every year and nuclear has killed zero in the US.

Example: Quit requiring that nuclear power plants [NPPs] be guarded by soldiers. There is no need for guards at a nuclear power plant because the reactor guards itself. There is no way a terrorist could steal reactor fuel from a reactor.

Stealing fuel from a reactor: So let me get this right: You want your terrorist to go inside the containment building and rob fuel from the reactor vessel? Your terrorist would die of radiation in 4 seconds. [So stay outside of the containment building.]

Your terrorist can't get anywhere near the reactor vessel anyway. The containment building walls, ceiling and floor of American containment buildings are a minimum of 1 meter [about 39 inches] thick concrete and HEAVILY reinforced with steel. There is so much steel reinforcing rod that when you look at one under construction, you wonder where there will be any room for concrete. The containment vessel has a ½ inch thick steel liner. The door is likewise impenetrable. A bank vault would be much easier to break into.

Generation 2 reactors: The reactor vessel itself is 5 inches thick stainless steel. In operation, it is very hot and pressurized. Your terrorist would be instantly killed by steam if he opened the reactor vessel.

Generation 4 sodium cooled reactor: You want your terrorist to dive into a pool of molten metal and swim down to the core. Is that right?

Only robots enter the containment building. Robots must wait for the reactor to be put into cold shutdown. That takes a week. Would a bank robbery take a week?

US reactors increase Kazakh uranium purchases

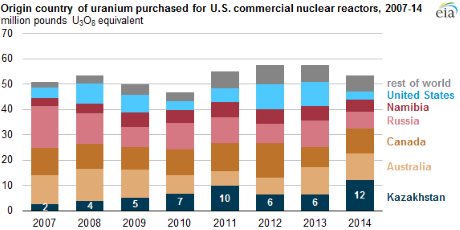

06 October 2015http://www.world-nuclear-news.org/UF-US-reactors-increase-Kazakh-uranium-purchases-0610157.htmlKazakhstan became the leading supplier of uranium to US nuclear power plants in 2014, overtaking Australia, according to the US Energy Information Administration (EIA). Of the uranium purchased by US reactor owners and operators, 23% was of Kazakh origin, while 20% came from Australia and 18% from Canada.

EIA figures show Kazakhstan's growing role as a US supplier (Image: EIA)

Citing figures from its Uranium Marketing Annual Report, published in May 2015, the EIA said that 12 million pounds U3O8 (4616 tU) purchased from Kazakhstan was almost double the 6.5 million pounds (2500 tU) of Kazakh-origin uranium purchased by US plants in 2013.

"Average Kazakh uranium prices have been lower than other major supplying countries' prices for the past two years. Uranium from Kazakhstan was $44.47 per pound in 2014, compared with the overall weighted-average price of $46.65 per pound for the 41.3 million pounds of uranium purchased from producers outside Kazakhstan in 2014," the EIA said.

According to the EIA's figures, the weighted average price for 2014 deliveries of Australian uranium was $48.03 per pound, and $45.87 per pound for Canadian uranium.

Of the 53.3 million pounds U3O8 (20,500 tU) purchased to fuel US reactors in 2014, only 3.3 million pounds U3O8 (1270 tU) came from domestic production.

Kazakshtan has been the world's largest uranium producer since 2009, accounting for 41% of world production in 2014. Earlier this year national atomic company Kazatomprom announced plans to increase 2015 output to 23,400 tU, up from 22,800 tU in 2014.

Researched and written

by World Nuclear NewsKazakhstan aims for 22,800 tU output in 2015

12 March 2015http://www.world-nuclear-news.org/ENF-Kazakhstan-aims-for-22800-tU-output-in-2015-12031501.htmlKazatomprom, the world's biggest uranium producer, plans to increase output this year to 23,400 tU, up from 22,800 tU in 2014.

Nurlan Kapparov, head of the state-run company, announced the production target at its annual meeting to personnel held in Astana yesterday.

Kazatomprom has retained its leading position in the global uranium mining industry, he said, providing about 40% of the world’s total uranium production.

The company faces new challenges in 2015, however, in particular volatile spot uranium prices alongside an increase in uranium output, and issues related to cutting production costs, he said.

Kazatomprom remains committed to the principles of corporate social responsibility, he said. The company is focused on strengthening its human resources, including improvements to working conditions and staff morale, he said.

The average monthly salary at Kazatomprom enterprises increased in 2014 by 5.8% and the company funded the training of 295 students as prospective employees. The company employs 20,000 people.

An example of the importance the company attaches to social responsibility, Kapparov said KZT 2.5 billion ($13 million) had been allocated to maintaining the residential and recreational standards of mining villages in the Kyzylorda, East-Kazakhstan and Mangystau districts.

Kazatomprom enterprises regularly monitor safety and security at their uranium production sites and last year the number of detected violations of occupational and industrial safety requirements dropped by 28% compared to 2013, Kapparov said.

In 2014, Kazatomprom enterprises continued to ensure ecological safety at its production facilities, he said, adding that 23 of the company's affiliates and subsidiaries have ecological management standards certification. More than KZT 1.19 billon ($11 million) was spent last year on measures to reduce the negative environmental impact of uranium mining, including efficiency improvements to dust and gas collecting installations and water purification units.

Researched and written

by World Nuclear News

Kazakhstan continues front-end push

03 February 2012http://www.world-nuclear-news.org/ENF_Kazakhstan_continues_front_end_push_0302122.htmlKazakhstan has posted another year of record uranium production as it furthers its diversification into value-added nuclear fuel products.

Having already established itself as the leading national producer of uranium, Kazakhstan increased the output of its mines by 9% in 2011 to reach 19,450 tonnes of uranium - about 35% of global supply and more than double what the next biggest country, Canada, produced in 2010.

"Strategic objectives of KazAtomProm are focused on maintaining the leading position at the world uranium market."

KazAtomProm statementProduction started last year at the second mine of the Semizbai deposit, adding 200 tonnes of uranium per year to Kazakh figures. Uranium solution processing capacity at Budyonovskoye 2 increased to 3000 tonnes of uranium per year, handing output from two other mines. Further gains will come next year from Budyonovskoye 3, where construction of new mining facilities have been started as has construction of administration buildings and living quarters at Kharassan 2. Next year the country should have domestic supply for all the sulphuric acid it needs for leaching uranium from its shallow deposits.

Most of Kazakhstan's mines are joint ventures between state nuclear company KazAtomProm and overseas mining enterprises like Areva, ARMZ, Cameco and Uranium One as well as Chinese interests and Japanese consortia. From the total haul from 17 mines, KazAtomProm laid claim to 11,079 tonnes of uranium. Of this, 10,399 tonnes was shipped to long-term customers, it said.

Fuel speed ahead

Aside from producing uranium, KazAtomProm has strategic goals elsewhere in the front-end of the nuclear fuel cycle, which spans from the basic sourcing of uranium to the loading of manufactured nuclear fuel assemblies into a reactor. With Tenex it is looking at the joint establishment of a uranium enrichment plant at Angarsk in Russia; With Areva it is working towards a 400 tonne per year fuel fabrication line at Ulba and the possible provision of integrated front-end products. Another deal with Cameco investigated setting up a uranium conversion plant, but this is on hold.

Japanese utilities, technology companies and fuel traders have spent much time in Kazakstan negotiating on technical support, supplies of rare eath metals, uranium and nuclear fuel products.

In September 2011 KazAtomProm signed a strategic cooperation deal with China National Nuclear Corporation (CNNC) to supply ceramic uranium-oxide fuel pellets. A pilot batch was made at the Ulba Metallurgical Plant in Ust-Kamenogorsk and delivered to CNNC. In December another deal was struck with China's other nuclear utility, China Guangdong Nuclear Power Corporation covering long-term supply of fuel pellets.

Researched and written

by World Nuclear News

Uranium and Nuclear Power in Kazakhstan

(Updated September 2015)

http://www.world-nuclear.org/info/Country-Profiles/Countries-G-N/Kazakhstan/

- Kazakhstan has 12% of the world's uranium resources and an expanding mining sector, producing about 22,830 tonnes in 2014, and planning for further increase to 2018.

- In 2009 it became the world's leading uranium producer, with almost 28% of world production, then 33% in 2010, 36% in 2011, 36.5% in 2012, and 38% in 2013.

- A single Russian nuclear power reactor operated from 1972 to 1999, generating electricity and for desalination.

- Kazakhstan has a major plant making nuclear fuel pellets and aims eventually to sell value-added fuel rather than just uranium.

- The government is committed to a high level of uranium exports, and is planning to build a Russian nuclear power reactor at Kurchatov.

Kazakhstan has been an important source of uranium for more than 50 years. Over 2001 to 2013 production rose from 2022 to about 22,550 tonnes U per year, making Kazakhstan the world's leading uranium producer. Mine development has continued with a view to further increasing annual production by 2018, 23,400 tU being the target for 2015. Capacity is around 25,000 tU/yr, but in October 2011 Kazatoprom announced a cap on production of 20,000 tU/yr, which was evidently disregarded. Of its 17 mine projects, five are wholly owned by Kazatomprom and 12 are joint ventures with foreign equity holders, and some of these are producing under nominal capacity. In 2013, 9402 tU was attributable to Kazatomprom itself – 16% of world production, putting it slightly ahead of Cameco, Areva and ARMZ-Uranium One.

Kazakhstan has no national electricity grid, but a northern grid links to Russia and a southern one links to Kyrgystan and Uzbekistan. Electricity production was 93.9 TWh in 2013, 69 TWh (73%) from coal, 17 TWh from gas and 7.5 TWh from wind, according to the Energy Ministry. Net export was 2.3 TWh. In 2012 capacity was 20 GWe. In 2012 the government's energy system development plan had 150 TWh/yr production in 2030, with 4.5% of this from nuclear and 10% from renewables. The government planned investment in electricity production and grid of $7.8 billion by 2015, and foresees $64 billion by 2030.

Future electricity demand will depend to some extent on the country’s role from 2019 in the Eurasian Economic Community energy market. Also the State Grid Corporation of China (SGCC) is planning transmission links from China.

Kazatomprom is the national atomic company set up in 1997 and owned by the government. It controls all uranium exploration and mining as well as other nuclear-related activities, including imports and exports of nuclear materials. It announced in 2008 that it aims to supply 30% of the world uranium by 2015, and through joint ventures: 12% of uranium conversion market, 6% of enrichment, and 30% of the fuel fabrication market by then.

International collaboration

Kazatomprom has forged major strategic links with Russia, Japan and China, as well as taking a significant share in the international nuclear company Westinghouse. Canadian and French companies are involved with uranium mining and other aspects of the fuel cycle.

Russia

In July 2006 Russia and Kazakhstan (Kazatomprom) signed three 50:50 nuclear joint venture agreements totalling US$ 10 billion for new nuclear reactors, uranium production and enrichment. The first JV with Atomstroyexport is JV Atomniye Stantsii for development and marketing of innovative small and medium-sized reactors, starting with OKBM's VBER-300 as baseline for Kazakh units. Russia's Atomstroyexport expected to build the initial one.

The second JV with Tenex, confirmed in 2008, is for extending a small uranium enrichment plant at Angarsk in southern Siberia (this will also be the site of the first international enrichment centre, in which Kazatomprom has a 10% interest). It will eventually be capable of enriching the whole 6000 tonnes of uranium production from Russian mining JVs in Kazakhstan. See Fuel Cycle section below.

The uranium exploration and mining JVs Akbastau and Karatau with Tenex started with Budenovskoye in the Stepnoye area of south Kazakhstan, which commenced production in 2008. These complemented the Zarechnoye JV 250 km to the south which was set up in June 2006. However, in 2009 and 2010 the 50% ARMZ equity in these three was traded for an eventual 51% share of Canadian-based Uranium One Inc, which subsequently became wholly-owned by ARMZ. Uranium One Holdings (U1H) is now the holding company for all Russian uranium mining interests in Kazakhstan (and its equity in an acid plant).

In March 2011 Russia and Kazakhstan (Kazatomprom) signed stage II of this 2006 integrated cooperation program, involving uranium exploration and a feasibility study for a Kazakh nuclear power plant. Under this, and following JV development at Angarsk, Kazatomprom bought a 25% share of Russia's Novouralsk enrichment plant in 2013. (Separately, Kazatomprom has a 10% share in the International Uranium Enrichment Centre – IUEC - at Angarsk.)

At the end of May 2014 several agreements were signed between Rosatom and NAC Kazatomprom. One was a MOU for construction of a nuclear power plant using VVER reactors and with capacity up to 1200 MWe. It also involved fuel fabrication and nuclear waste management. A second agreement related to uranium mining at Kharasan-1, Akdala and South Inkai, where ARMZ has equity through Uranium One. A third agreement was a Comprehensive Development Program for Russia-Kazakhstan Cooperation in the Peaceful Uses of Atomic Energy, for nuclear power and fuel cycle matters.

Japan

In April 2007 a number of high-level agreements on energy cooperation were signed with Japan. These included some relating to uranium supply to Japan, and technical assistance to Kazakhstan in relation to fuel cycle developments and nuclear reactor construction. A further agreement on uranium supply and Japanese help in upgrading the Ulba fuel fabrication plant was signed in may 2008. Kazatomprom is keen to move from being a supplier of raw materials to selling its uranium as fabricated fuel assemblies. It said that it aimed to supply 40% of the Japanese market for both natural uranium and fabricated fuel from 2010 – about 4000 tU per year. Negotiations then commenced for a bilateral nuclear cooperation agreement between Kazakhstan and Japan. In May 2011 a high-level intergovernmental agreement on developing nuclear energy was signed.

In August 2006 The Japan Bank for International Cooperation had signed an agreement with Kazatomprom to support and finance Japanese firms in developing Kazakh uranium resources to supply Japan's power generation. In March 2009 three Japanese companies – Kansai, Sumitomo and Nuclear Fuel Industries – signed an agreement with Kazatomprom on uranium processing for Kansai plants. In March 2010 a joint venture with Sumitomo was set up: Summit Atom Rare Earth Company, and in June, Kazatomprom and Toshiba Сorp. agreed to set up a rare earth metals joint venture.

In September 2010, based on an April 2007 agreement, Japan Atomic Power Co, Toshiba and Marubini signed a technical cooperation agreement with the National Nuclear Centre (NNC) to study the feasibility of building nuclear power capacity. A further agreement to this end was signed in February 2013, between Japan Atomic Power Co (JAPC) and Marubini Utility Services, with NNC (see section below). At the same time an agreement between NNC and the Japan Atomic Energy Agency (JAEA) with JAPC concerned mining and processing of uranium and rare earth minerals. In June 2012 and February 2013 R&D agreements between NNC and JAEA were signed relating to the design, construction and operation of the Kazakhstan high-temperature gas-cooled reactor (HTR) of about 50 MW at Kurchatov. In June 2015 an agreement was signed between NNC and JAEA for stage 3 of a project to investigate sodium-cooled fast reactors in Kazakhstan.

China

In December 2006 China Guangdong Nuclear Power Group (now CGN) signed a strategic cooperation agreement with Kazatomprom, in May 2007 an agreement on uranium supply and fuel fabrication, and in September 2007 agreements on Chinese participation in Kazakh uranium mining joint ventures and on Kazatomprom investment in China's nuclear power industry. This is a major strategic arrangement for both companies, with Kazatomprom to become the main uranium and nuclear fuel supplier to CGN (accounting for a large share of the new reactors being built in China). In October 2008 a further agreement was signed covering cooperation in uranium mining, fabrication of nuclear fuel for power reactors, long-term trade of natural uranium, generation of nuclear electricity and construction of nuclear power facilities. In December 2014 a further agreement was signed with similar scope but focused on establishing a joint venture in Kazakhstan for the production of 200 t/yr of fuel assembles. A CGN subsidiary, Sino-Kazakhstan Uranium Resources Investment Co, has invested in two Kazakh uranium mines, Irkol and Semizbai, through the Semizbai-U LLP joint venture. In 2015 CGN Mining Co bought the equity in Semizbai-U.

A framework strategic cooperation agreement was signed with China National Nuclear Corporation (CNNC) in September 2007 and this was followed in October 2008 with another on "long-term nuclear cooperation projects" under which CNNC is to invest in a uranium mine. Late in 2007 Kazatomprom signed an agreement with both GCNPC (now CGN) and CNNC for them to take a 49% stake in two uranium mine joint ventures and supply 2000 tU per year from them. Kazatomprom estimates that 20% of its uranium output goes to China, with the possibility of this increasing with demand as production heads for 25,000 tU/yr. In February 2011 CNNC signed a contract to buy 25,000 tU.

Early in 2009 Kazatomprom signed an agreement with CGNPC for establishment of a specialized company for the construction of nuclear power plants in China, since Kazakh plans to work with Russia's Atomstroyexport developing and marketing innovative small and medium-sized reactors had been put on hold. In mid-2009 a feasibility study on this joint CGNPC project was underway, but no more has been heard since.

In mid-2014 Kazatomprom said that 55% of Kazakh uranium production was exported to China.

At the end of August 2015, among $23 billion of China-Russia deals, JSC Samruk-Kazyna, the national holding company owning Kazatomprom, signed deals worth $5 billion with Chinese companies and Kazatomprom agreed on transit of its products via China to North America.

In 2013 China agreed to a $5 billion stake in the new Kashagan oil project, trumping a bid from India, and underlining China’s Central Asian resource aspirations.

India

In January 2009 Kazatomprom signed an agreement with India's Nuclear Power Corporation (NPCIL) to supply 2100 tonnes of uranium to India and undertake a feasibility study on building Indian PHWR reactors in Kazakhstan. NPCIL said that it represented "a mutual commitment to begin thorough discussions on long-term strategic relationship." Under this agreement, 300 tonnes of natural uranium will be supplied by Kazatomprom in the 2010-11 year.

In April 2010 Kazakhstan signed a nuclear cooperation agreement with South Korea, paving the way for export of Korean SMART 100 MWe nuclear reactors and for joint projects to mine and export Kazakh uranium.

In addition Kazakhstan has signed intergovernmental agreements on nuclear energy cooperation with the USA and Euratom.

South Korea

The Kazakh Industry and Trade Ministry has held talks with South Korea's KEPCO, (Korea Electric Power Corporation) on uranium mining and nuclear power plant construction in Kazakhstan, apparently on KEPCO's initiative.

Toshiba

At the corporate level, in 2007 Kazatomprom purchased a 10% share in Westinghouse. Toshiba had bought the company from BNFL for $5.4 billion early in 2006, and the Shaw Group then took 20% and IHI Corp. 3%. Toshiba originally envisaged holding only 51%, and this deal reduced its holding to 67%. The Kazatomprom link strengthened the company's upstream links for fuel supplies, and should enhance its marketing of nuclear reactors (the vendor usually supplies the first core for a new reactor, and ongoing fuel services may be offered in addition). It also brought Kazatomprom more fully into the industry mainstream, with fuel fabrication in particular.

This led to a decision to set up with Toshiba a nuclear energy institute in the northeastern town of Kurchatov, near Semipalatinsk, which is already a centre of R&D activity. This was announced by Kazatomprom and the Kazakh prime minister in September 2008 and will focus on skills development in all aspects of the nuclear fuel cycle as well as reactor technology. Other Japanese companies such as Toyota and Marubeni are expected to support the institute, especially in its rare earth metals department which aims to utilise present waste materials as the basis of a billion-dollar high-tech export industry. Three research reactors are operated by the Institute of Atomic Energy at Kurchatov.

Cameco

In May 2007 Canada's Cameco Corporation signed an agreement with Kazatomprom to investigate setting up a uranium conversion plant, using its technology, and also increasing uranium production at its 60% owned Inkai mine.

In June 2008 Cameco and Kazatomprom announced the formation of a new company – Ulba Conversion LLP – to build a 12,000 t/yr uranium hexafluoride conversion plant at the Ulba Metallurgical Plant (UMZ) in Ust-Kamenogorsk. Cameco would provide the technology and hold 49% of the project. A preliminary feasibility study was undertaken jointly by Kazatomprom and UMZ, then the project was put on hold. In mid-2013 Cameco announced that a full feasibility study was planned for 2014, and subject to that, construction of 6000 t/yr capacity would start in 2018, for 2020 operation. In January 2014 the government referred to the proposed plant as a ‘strategic goal’, but in mid-2015 Kazatomprom said it remained on hold.

In December 2013, a draft prefeasibility study (PFS) for a uranium refinery in Kazakhstan was completed. Cameco and Kazatomprom will determine if a feasibility study is justified based on this. Proceeding with the project will require government approvals for the transfer of Cameco’s proprietary uranium refining technology from Canada.

In November 2013 Canada and Kazakhstan signed a nuclear cooperation agreement.

Areva

In June 2008 Areva signed a strategic agreement (MOU) with Kazatomprom to expand the existing Katco joint venture from mining 1500 tU/yr to 4000 tU/yr (with Areva handling all sales), to draw on Areva's engineering expertise in a second JV (49% Areva) to install 1200 tonnes per year fuel fabrication capacity at the Ulba Metallurgical Plant, and in a third JV (51% Areva) to market fabricated fuel.

In October 2009 the two parties signed another agreement to establish the IFASTAR joint venture (Integrated Fuel Asia Star - 51% Areva) to establish the feasibility of marketing an integrated fuel supply for Asian customers (ie selling the enriched and fabricated fuel, not simply Kazakh uranium or Areva front-end services), and of building a 400 t/yr nuclear fuel fabrication line at the Ulba plant. IFASTAR is to be based in Paris, and will market the fuel.

In October 2010 an agreement was signed to set up the joint venture company (51% Kazatomprom) to build the 400 t/yr fuel fabrication plant based on an Areva design at the Ulba Metallurgical Plant, starting operation at the end of 2013 or in 2014. In November 2011 a further agreement was signed in relation to the plant. In January 2014 the government was still talking about the prospective plant as a ‘strategic goal’, with plans to be made by year end.

Mines

At a corporate and project level in mining, the following table summarises international equity links:

Company, project or mine Foreign investor and share Value of share or project if known Inkai JV (Inkai mines) Cameco 60% Betpak Dala JV (South Inkai, Akdala mines) Uranium One 70% $350 million for 70% in 2005 Appak JV (W.Mynkuduk) Sumitomo 25%, Kansai 10% $100 million total in 2006 JV Karatau (Budenovskoye 2 deposit) Uranium One 50% (bought from ARMZ in 2009) 117 million Uranium One shares (giving 19.9% ownership) + $90 million Akbastau JSC (Budenovskoye 1, 3, 4 deposits) Uranium One 50% (bought from ARMZ in 2010) Zhalpak CNNC 49% Katco JV (Moinkium, Tortkuduk mines) Areva 51% $110 million in 2004 Kyzylkum JV (Kharasan 1 mine) Uranium One 30%, Japanese 40% (Marubeni, Tepco, Toshiba, Chubu, Tohoku, Kyushu) $75 million in 2005 for 30%, $430 million total in 2007 (both mines) Baiken-U JV (Kharasan 2 mine) Japanese 95% (Marubeni, Tepco, Toshiba, Chubu, Tohoku, Kyushu) $430 million total in 2007 (both mines) Semizbai-U JV (Irkol, Semizbai mines) CGN 49%, also CNEIC Zarechnoye JSC (Zarechnoye & S.Zarechnoye mines) Uranium One 49.67% (bought from ARMZ in 2010), Krygyzstan 0.66% ARMZ paid $60 million total

Early in 2012 Kazatomprom announced that it would increase its share in mining activities nationally from 46% to 51% by buying out Japanese (and possibly some Uranium One) equity in the Kyzylkum and Baiken-U JVs, where it currently holds 30% and 5% respectively. Both JVs are mining the Kharasan deposit in the western part of Syrdarya province.

In 2009 investigations were launched into how, and at what prices, certain Kazakh entities came to hold title to particular mineral deposits before those rights were sold to international investors, particularly some of those above. In June 2009 Kazatomprom reassured its foreign joint venture and equity partners in uranium mining, from Japan, Russia, Canada, France and China that existing arrangements with foreign partners would not be changed, despite criminal charges being laid against former Kazakh executives.

The transfer to Uranium One of ARMZ's half shares in Akbastau and Zarechnoye (valued at US$ 907.5 million) in 2010 involved payment by ARMZ of US$ 610 million in cash (at least US$ 479 million of which would be paid directly to shareholders – other than ARMZ – as a change of control premium) and ARMZ increasing its shareholding in Uranium One from 23% to at least 51.4% through a share issue. It subsequently took over the whole company.

Uranium mining

Uranium exploration started in 1948 and economic mineralisation was found is several parts of the country and this supported various mines exploiting hard rock deposits. Some 50 uranium deposits are known, in six uranium provinces. Reasonably Assured Resources plus Inferred Resources to US$ 130/kgU were 679,000 tU in 2013.

In 1970 tests on in situ leach (ISL) mining commenced and were successful, which led to further exploration being focused on two sedimentary basins with ISL potential.

Up to 2000 twice as much uranium had been mined in hard rock deposits than sedimentary ISL, but almost all production is now from ISL. Uranium production dropped to one-quarter of its previous level 1991 to 1997, but has since increased greatly.

Kazakh Uranium Production and Revenueyear 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 tonnes U 2022 2709 2946 3712 4362 5281 6637 8521 14020 17803 19450 21317 22548 22829 revenue 19954 23822 28330 36849 50567 89422 Source: Kazatomprom, currency KZT million

In 2009 Kazakhstan became the world's leading source of mined uranium, producing almost 28% then, 33% in 2010, 36% in 2011, 36.5% in 2012 and 38% in 2013.

Kazakh Uranium Production by Mines (tonnes U)

Some figures estimated. Stepnogorsk figures may be omitted from Katatomprom public statements.Province and Group Mine 2010 2012 2013 2014 Chu-Sarysu, Eastern Tortkuduk (Katco) 2439.3 2661 3558 both 4322 both Moinkum (northern, Katco) 889.1 1000 Southern Moinkum (Taukent/GRK) 442.5 500 1129 both 1174 both Kanzhugan (Taukent/GRK) 561.9 575 Chu-Sarysu, Northern Uvanas (Stepnoye-RU/GRK) 300.3 215 1192 both 1154 both Eastern Mynkuduk (Stepnoye-RU/GRK) 1029.2 1019 Central Mynkuduk (Ken Dala.kz) 1242.4 1622 1800 1790 Western Mynkuduk (Appak) 442.2 1003 998 870 Inkai-1, 2, 3 (Inkai) 1636.7 1701 2047 1922 Inkai-4 (South Inkai) 1701.4 1870 2030 2002 Akdala (Betpak Dala) 1027.1 1095 1020 1007 Budyonovskoye 1, 3 (Akbastau) 739.6 1203 1499 1594 Budyonovskoye 2 (Karatau) 1708.4 2135 2115 2084 Syrdarya, Western North and South Karamurun (GRK) 1016.7 1000 1000 941 Irkol (Semizbai-U) 750 750 750 700 Kharasan 1 (Kyzylkum) 260.1 583 752 858 Kharasan 2 (Baiken-U) 262.2 603 888 1135 Syrdarya, Southern Zarechnoye (Zarechnoye) 778.2 942 931 876 Northern, Akmola region Semizbay (Semizbai-U) 224 470 411 400 RU-1 (Vostok, Zvezdnoye) 352.1 370 331 298 TOTAL 17,803.4 21,317 22,451 23,127

The last surviving underground mines at Grachev and Vostok in the Northern province had been operating since 1958 and are now rather depleted. KazSabton operated them, having taken over from Tselinny Mining & Chemical Co in 1999. It treated the ore at the Stepnogorsk mill, yielding some 250 tU per year. Production from the Stepnogorsk Mining & Chemical Complex plant at some 300 tU/yr is the only non-ISL production. The Semizbai ISL project is also in the Northern province, Akmola region, and Semizbai-U was formed in 2006 to mine it.

In the Balkash province some mining of volcanogenic deposits occurred during the Soviet era. In the Ili province east of this there is some uranium in coal deposits.

In the Caspian province the Prikaspisky Combine operated a major mining and processing complex on the Mangyshalk Peninsula in the 1960s and this led to the founding of Aktau. It was privatised as Kaskor in 1992 and operations ceased in 1994.

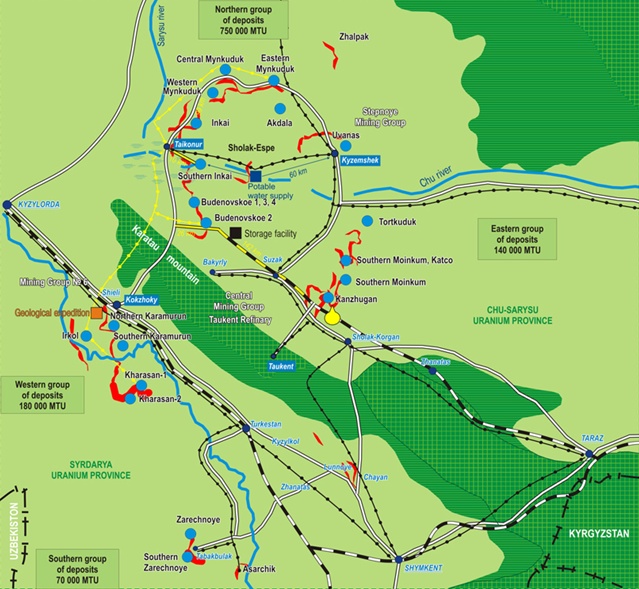

map from KazAtomProm 2007. Scale: Kyzlorda to Shieli/ Kokzhoky is about 100km.

map from KazAtomProm 2007. Scale: Kyzlorda to Shieli/ Kokzhoky is about 100km.

All except one of the operating and planned ISL mine groups are in the 40,000 square kilometre Chu-Sarysu province in the central south of the country and controlled by the state corporation Kazatomprom. Mines in the Stepnoye area have been operating since 1978, some in the Tsentralnoye area since 1982 – both in the Chu-Sarysu basin/uranium district, which has more than half the country's known resources. It is separated by the Karatau Mountains from the Syrdarya basin/uranium district to the south, where mines in the Western (No.6) area have operated since 1985. All have substantial resources.

The ISL mines and projects in the two central southern provinces are in four groups, as set out below. Production costs from these are understood to be low. Mining is at depths of 100-300 metres, though some orebodies extend to 800 metres. Uranium One in September 2007 was quoting "cash cost" figures of $8.00 to $10.50/lb for three mines it is involved with, though these may not include wellfield development and current figures are quoted below. A further feature of Kazakh uranium mining is that Kazatomprom plans to establish new mines in three years, compared with twice this time or more in the West, due to regulatory hurdles.

Inkai is the largest ISL mine, and Cameco's description of its operation is: Uranium occurs in sandstone aquifers as coatings on the sand grains at a depth of up to 300 metres. Uranium is largely insoluble in the native groundwater which is not potable due to naturally high concentrations of radionuclides and dissolved solids. Using a grid of injection and production wells, a mining solution containing an oxidant (sulfuric acid) is circulated through the orebody to dissolve the uranium. The uranium-bearing solution (generally containing less than 0.1% uranium) is then pumped to a surface processing facility where the uranium is removed using ion exchange resin. The water is re-oxidized and re-injected into the orebody. The uranium is stripped from the resin, precipitated with hydrogen peroxide and then dried to form the final product, U3O8. This process is repeated to remove as much uranium as is economically feasible. When mining at the site is complete, the groundwater will be restored to its original quality.

This is a closed loop recirculation system since the water from the production well is reintroduced in the injection wells. Slightly less water is injected than is pumped to the surface to ensure that fluids are confined to the ore zones intended for extraction. Monitor wells are installed above, below and around the target zones to check that mining fluids do not move outside a permitted mining area.

Acid production

ISL uranium production in Kazakhstan requires large quantities of sulfuric acid*, due to relatively high levels of carbonate in the orebodies. A fire at a sulfuric acid production plant in 2007 led to shortages, and due to the delayed start-up of a new plant, rationing continued until mid 2008. Extra supplies were sought from Uzbekistan and Russia, but uranium production well into 2009 was affected. Uranium One revised its 2008 production downwards by 1080 tU, which it said was "primarily due to the acid shortage" for its South Inkai and Kharasan projects (70% and 30% owned respectively) which were just starting up. In August 2009 Cameco reported that production at Inkai would remain constrained through 2009 due to acid shortage.

* 70-80 kg acid/kgU (comprising 15-20% of the operating expense), compared with Beverley in Australia at around 3 kg/kgU.

A new 1.2 million t/yr Canadian acid plant feeding from the Kazakhmys copper smelter in Balkhash started production at the end of June 2008, financed by an EBRD loan to abate sulfur dioxide emissions from copper smelting. A 360,000 t/yr acid plant at the Stepnogorsk Mining and Chemical Combine started in 2006. A second Stepnogorsk plant of 180,000 t/yr capacity, from Italy, is expected to be operational in 2010.

Another new acid plant, SKZ-U of 500,000 t/yr capacity, was commissioned in December 2011 at Zhanakorgan, next to the Kharasan mines in the Western (#6) mining group or Kyzlorda region, to serve those mines from 2011 and reach design capacity in 2012. In 2013 it produced 356,600 t of acid and 16.9 MWh of power. At full capacity it burns 170,000 t/yr of solid sulfur derived from oil and gas production by Tengizhevroil in western Kazakhstan. Uranium One is participating in a joint venture with Kazatomprom (49%) and Japanese interests in this US$ 216 million project and has a 19% interest with Japanese interests 32%.* The new plant supplies all the Western region mines: Kharasan, Irkol and Karamurun.

* Construction of the plant was being carried out by SKZ-U LLP joint venture, in which Baiken-U LLP (40%) and Kyzylkum LLP (60%) are the stakeholders. Uranium One declares a 19% "joint control interest" in SKZ-U from 2009.

A further acid plant of 180,000 t/yr capacity is planned in connection with the Pavlodar Oil Refinery in northeast Kazakhstan, using 60,000 t/yr of sulfur from the refinery.

In 2009 Kazatomprom with other mining companies and two acid producers, KazZinc JSC and Kazakhmys, set up a coordinating council to regulate acid supplies and infrastructure. Cameco reported that acid supply was adequate through 2010.

Kazakh ISL uranium minesRegion ISL Mine Resources

tUOperator Annual production

target tU/yrStart production,

full prod'nChu-Sarysu Province, Chu-Sarysu district Northern/Stepnoye group Uvanas 8100Stepnoye-RU LLP (K'prom) 4002006East Mynkuduk 22,000 1300 2006, 2007 Inkai 1, 2, 3 reserves 52,000, in 153,000 resourcesInkai JV: Cameco 60%, K'prom 40% 2000,

4000 later2008, 2010, 2015 for expansionSouth Inkai (Inkai 4) Reserves 13,000, in 15,260 indicated,

17,100 inferredBetpakDala JV: Uranium One 70%, K'prom 30% 20002007, 2011Akdala 10,359 total10002006, 2007Central Mynkuduk (Mynkuduk) 52,000JSC Ken Dala.kz Stepnogorsk (K'prom) 20002007, 2010West Mynkuduk 26,000Appak JV: K'prom 65%, Sumitomo 25%, Kansai 10% 10002008, 2010Akbastau (Budenovskoye 1, 3, 4) 31,600 reserves, in 47,293 resourcesJV Akbastau: K'prom 50%, Uranium One 50% 1000 (1) 2000 (3,4)

2009, 2015

2010Karatau (Budenovskoye 2) 52,000 reserves, in 64,000 resources JV Karatau: K'prom 50%, Uranium One 50% 2000 (to 3000) 2008, 2011 Zhalpak 15,000JV with China ??(CNNC 49% was proposed) 500-10002014Central/Eastern (Tsentralnoye) group Tortkuduk

(Moinkum North)24,000Katco JV, Areva 51%, K'prom 49% 25002007, 2008Moinkum* (southern Moinkum, Katco) - northernin above10002006, 2007South Moinkum (east Moinkum)

- southern

35,000Taukent Mining & Chemical Plant LLP (K'prom) 15002006Kanzhugan / Kaynarski 22,0006002008Chu-Sarysu Province, Syrdarya district Western (no.6) group Kharasan 1 (north) 15,693 plus 17,940 inferred Kyzylkum JV, Japanese 40%, Uranium One 30%, K'prom 30% 3000 2010, 2014 Kharasan 2 (south) ? Baiken-U JV, Japanese 95%, K'prom 5% 20002010, 2014Irkol 30,000Semizbai-U JV (K'prom 51%, CGN-URC 49%) 7508/2008, 2010N. Karamurun 16,000 Mining Group 6 LLP (K'prom) 1000 2007, 2010 S. Karamurun 18,000Mining Group 6 LLP (K'prom) 250 2009 Southern group

Zarechnoye 12,500 plus 4500 inferredZarechnoye JV: K'prom 49.67%, Uranium One 49.67% 1000 2007, 2012 Southern Zarechnoye "insufficient to support development" 600 deferred Northern Province Akmola region Semizbai Semizbai-U JV (K'prom 51%, CGN 49%) 700 2009, 2011 Kazatomprom mining subsidiaries and joint venturesCompany or JV Mines Mining Company LLP (GRK)

(Stepnoye-Ru LLP, Mining Group No.6 LLP)Uvanas

East Mynkuduk

North & South KaramurunGRK: Ken Dala.kz JSC Central Mynkuduk GRK: Taukent Mining-Chemical Plant LLP Kanzhugan

South MoinkumKatco JV (with Areva 51%) South Mynkuduk

Moinkum 1 & 2

TortkudukInkai JV (with Cameco 60%) Inkai 1, 2, 3 Zarechnoye JV (with Uranium One 49.67%) Zarechnoye

South ZarechnoyeAPPAK JV (with Sumitomo 25% & Kansai 10%) West Mynkuduk Betpak Dala JV (with Uranium One 70%) Akdala

South InkaiKaratau JV (with Uranium One 50%) Karatau/Budenovskoye 2 Akbastau JV (with Uranium One 50%) Akbastau/Budenovskoye 1, 3, 4 Kyzylkum JV (with Uranium One 30%

& Japanese 40%)(North) Kharasan 1 Baiken-U JV (with Japanese 95%) (South) Kharasan 2 Semizbai-U JV (with CGN 49% & CNEIC) Semizbai

IrkolZhalpak JV (with CNNC 49%?) Zhalpak The mines and regions

Stepnoye or Northern mining group

The Stepnoye or Northern mining group in the Chu-Sarysu basin consists of Uvanas, East Mynkuduk, Akdala and Inkai mines, with Central and West Mynkuduk, South Inkai, Budenovskoye and Zhalpak planned. All are amenable to in-situ leaching (ISL).

Uvanas is a small deposit which commenced operation in 2006.

Inkai was discovered in 1976, and the Inkai Joint Venture (JVI) developed the Inkai mine in this part of the Chu-Sarysu basin and holds rights to blocks 1,2&3. JVI was set up in 1996 (then including Uranerz), and now Cameco holds 60% with Kazatomprom (40%). Following a two-year feasibility study completed in 2004, and regulatory approval in 2005, JVI started commercial production from ISL in 2008 and ramped up to 2000 tU/yr from blocks 1&2 – 2013 production was 1900 tU. Eventual production from blocks 1&2 is envisaged as 4000 tU/yr, and application for this is in train.

JVI is developing block 3, and in 2015 will start operation of the test wellfields there and begin uranium production with the test leach facility.

Total cost of the JVI development was projected as US$ 200 million, though remaining capital costs at the start of 2010 were quoted at $359 million. The main processing plant on block 1 has an ion exchange capacity of 1000 tU/yr and a product recovery capacity of 2000 tU/yr. A satellite 1000 tU/yr IX plant is on block 2 and two further such plants are proposed. JVI holds an exploration licence for block 3. Cameco has reported 52,000 t U3O8 proven and probable reserves plus 8440 t indicated and 98,300 t inferred resources for blocks 1 & 2 (Dec 2009, NI 43-101 compliant). Operating cost over the life of the mine are estimated to be $17.55/lb concentrate (March 2010).

In September 2005 UrAsia Energy Ltd of Canada agreed to pay US$ 350 million for 70% of the Betpak Dala joint venture which owns the South Inkai project and the Akdala mine. The company (UrAsia) is now Uranium One Inc.

South Inkai mine started trial production in 2007 and was ramping up to expected 1900 tU/yr in 2011. Commercial production officially began in January 2009, and in that year 830 tU was produced. Cash operating cost in 2009 was $21/lb of concentrate, expected to drop to $19 in 2013, though significant capital requirement remains then.

South Inkai in mid-2013 has 5641 tU measured and indicated resources, 5077 tU proven and probable resources and 17,099 tU inferred resources. Average grade is 0.015%, 0.010% and 0.040% respectively. Uranium One projected average cash cost of production for 2014 as $18/lb U3O8.

Akdala started up in 2006 and produced 1031 tU in 2008 and 1046 tU in 2009, at cash operating cost of $14/lb of concentrate, expected to increase to $15 in 2013. In two orebodies Akdala in mid 2013 has 2286 tU measured & indicated resources, and 2058 tU proven & probable resources. Inferred resources are 6015 tU. Uranium One projected average cash cost of production for 2014 as $16/lb U3O8.

Central Mynkuduk mine started up in 2007 and was expected to reach capacity of 2000 tU/yr by 2010. It is operated by the Ken Dala.kz joint stock company, part of Kazatomprom (has been reported as Ortalyk LLP).

West Mynkuduk: Early in 2006 KazAtomProm signed a US$ 100 million joint venture agreement with Sumitomo Corp (25%) and Kansai Electric Power Co (10%) to develop the deposit. First production from the Appak JV was in June 2008 with design capacity of 1000 t/yr expected in 2010. Sumitomo will supply uranium from the mine to Japanese power utilities.

The East Mynkuduk mine was launched in May 2006 by Kazatomprom to achieve its planned 1000 t/yr production in 2007.

The Karatau mine at the south end of the Budenovskoye deposit started production in 2008 (655 tU), and ramped up to a capacity of 2000 tU/yr by 2011. Capacity of the Budenovskoye 2 uranium recovery plant reached 3000 tU/yr in 2011, serving both Karatau and Akbastau. Karatau in mid-2013 has reserves of 52,000 tU in measured and indicated resources of 63,839 tU and proven and probable resources of 51,960 tU. Average resource grade is 0.074% and 0.035% respectively. Uranium One projected average cash cost of production for 2014 as $11/lb U3O8.

The Akbastau mine (Budenovskoye 1, 3, 4) just north of this started production at the end of 2009 and produced 385 tU that year, with recovery from pregnant liquor being at Karatau. It expected almost 1000 tU production in 2011 and ramping up to 3000 tU/yr by 2015, with $200 million being spent to achieve that. Akbastau 1-3 in mid 2013 have reserves of 31,600 tU, in combined measured and indicated resources of 47,293 tU, and proven and probable resources of 31,598 tU. Uranium One projected average cash cost of production for 2014 as $13/lb U3O8.

In July 2006 both Budenovskoye operations became 50:50 JVs with Russia, complementing Zarechnoye, but in 2009 ARMZ's share in Karatau was sold to Uranium One. In 2010 ARMZ's share in Akbastau was also transferred to Uranium One.

Zhalpak: A Chinese (CNNC)-Kazatomprom joint venture is being set up to develop the deposit. This could produce up to 1000 tU/yr from resources of 15,000 tU, starting about 2014.

Central or Eastern mining group

The Central or Eastern mining group (Tsentralnoye) in the Chu-Sarysu basin comprises Moinkum, Southern Moinkum, Kanzhugan, Tortkuduk mines, plus the new refinery.

Moinkum (Muyunkum): Following three years' pilot plant operation, Areva and the state utility Kazatomprom agreed in April 2004 to set up a 1500 tU/yr in situ leach (ISL) uranium venture at Moinkum in this part of the Chu-Sarysu basin. Areva holds 51% and funded the US$ 90 million Katco joint venture, having spent some US$ 20 million already since 1996. Operation began in June 2006, with capacity eaching almost its full 500 tU in 2007.

Tortkuduk (Moinkum North) is also part of the Katco JV and produced over 2400 tU in 2010. At the end of 2013 Areva quoted Katco resources as 23,749 tU, mostly inferred.

A June 2008 agreement expanded the Katco joint venture from mining 1500 tU/yr to 4000 tU/yr and sets up Areva to handle all sales from it through to 2039. In 2008 Areva reported total Muyunkum phase 1 production as 1356 tU.

The Kanzhugan deposit supports the Kaynar mine which was due to start up in 2008, with nominal capacity of 300 tU/yr. South Moinkum is also operated by Taukent Mining & Chemical Co, a 100% subsidiary of Kazatomprom.

Western mining group (#6)

The Western mining group (#6) is in the Syrdarya basin and comprises the North and South Karamurun mines operated by Mining Company #6, with Irkol and (North) Kharasan 1 & 2.

Kharasan: In 2005 UrAsia Energy Ltd (now Uranium One Inc) of Canada paid US$ 75 million for a 30% share of the Kyzylkum joint venture which owns the (North) Kharasan project. Kharasan in mid-2013 has measured & indicated resources of 8561 tU, and proven and probable resources of 7132 tU. Inferred resources are 17,940 tU. Uranium One projected average cash cost of production for 2014 as $24/lb U3O8.

Kharasan 2 is to the south of this and was owned by Kazatomprom but is now controlled by the Baiken-U joint venture, including 95% Japanese equity. Pilot production commenced in 2009.

In April 2007 several Japanese companies bought 40% of the Kharasan project to directly take 2000 tU/yr when it is in full production at 5000 tU/yr about 2014. Of that share, Marubeni had 55%, Tepco 30%, Chubu 10% and Tohoku 5%. When Toshiba agreed to sell part of Westinghouse to Kazatomprom, it agreed to buy 9% of Kharasan from Marubeni (i.e. 22.5% of the Japanese stake). Then Kyushu Electric Power Co bought 2.5% of the Japanese stake, leaving Marubeni with 30%. The Energy Asia Japanese consortium share involved with both JVs is now: Marubeni 30%, Tepco 30%, Toshiba 22.5%, Chubu 10%, Tohoku 5% and Kyushu 2.5%. Project funding is $70 million from the Japan Bank for International Cooperation and $30 million from Citibank. Uranium One retains 30% equity of (north) Kharasan 1 through Kyzylkum JV.

A 2000 tU per year processing facility is matched with a 1000 tU/yr satellite plant. Pilot production commenced in April 2009 with Kharasan 1 to reach 3000 tU/yr by 2014, and Kharasan 2 to reach 2000 tU/yr in 2014. In fact Uranium One reported that commercial production level for Kharasan 1 was reached in mid-2012. Pre-commercial mining commenced in 2008 first significant production for both was early 2010. Production from the $430 million project will primarily supply Japanese utilities. In August 2009 Kazatomprom announced that a wrong technological decision in 2006 regarding development of the deposits had "led to a failure of the 2008-09 production program" and consequent lack of funds, but this was being rectified. Uranium One said that bore holes had been drilled incorrectly and that organic matter was increasing acid consumption.

Irkol started up in 2008, and ramped up for 750 tU/yr by 2010. In October 2008 China's CGN-URC took a 49% share of it through the Semizbai-U JV (see introductory section and below). China Nuclear Energy Industrial Corp (CNEIC) is also involved, possibly as customer for part of the Chinese share of production. The mine was formally opened in April 2009 with some fanfare, as the first mine to be put into commercial operation within the framework of the Kazakhstan-CGNPC nuclear power agreement. All the production is sold to CGN.

Karamurun: North Karamurun was expected to start up in 2007, South Karamurun in 2009.

Southern mining group

The Southern mining group in the same Syrdarya basin has the Zarechnoye mine.

Zarechnoye, discovered in 1977, started production early in 2009. Reserves were earlier quoted at 19,000 tU, but in mid-2013 measured & indicated resources are 7988 tU and proven and probable resources 4510 tU. Inferred resources are 4500 tU. The US$ 60 million Zarechnoye joint venture involved Kazatomprom (49.67%), ARMZ (49.67% – to provide finance) and Kyrgyzstan's Kara Baltinski Mining Combine (0.66%), which finally treats and calcines the product there, 400 km east. The mine produces over 930 tU/yr. In mid-2010 ARMZ agreed to transfer its share to Uranium One. Uranium One projected average cash cost of production for 2014 as $28/lb U3O8.

South Zarechnoye was discovered in 1989 and was being developed by the same joint venture to commence production in 2014, eventually at 620 tU/yr. However, the project was put on hold in 202 due to low uranium price and a reduced resource estimate. In November 2013 Uranium One reported that “mineral resources on this property are insufficient to support development”.

In June 2006 Tenex signed a US$ 1 billion uranium supply contract with Zarechnoye JV for up to 6000 tU per year from 2007 to 2022. Initially this will come from Zarechnoye mine, but Budenovskoye will also contribute.

Northern Kazakhstan province

Outside of these two basins, in the Northern Kazakhstan province, the Vostok underground mine continues in production, with Zvezdnoye. The Semyibai ISL mine was commissioned at the end of 2009 with a capacity of 500 tU/yr from a uranium-rare earths deposit, and the second stage 200 tU/yr came on line in 2011. In 2008 China's CGN-URC took a 49% share of it and in 2015 this equity passed to CGN Mining Co Ltd. It is managed, with Irkol, by Semizbai-U LLP, a joint venture. China Nuclear Energy Industrial Corp (CNEIC) is also involved, possibly as customer for part of the Chinese share of production.

Earlier, Itochu Corp of Japan has signed a uranium purchase agreement with KazAtomProm for some 3000 tonnes of uranium over 10 years to be marketed in Japan and the USA. KazAtomProm intends to use a US$60 million loan from Japan¹s Mizuho Corporate Bank to raise uranium production at the Central Mynkuduk deposit to 1000 tU/yr, of which Itochu Corp will receive 300t.

Kazkh Uranium Resources (old data) 6 Provincesprovince resources: tonnes U proportion of Kazakh Chu-Sarysu 60.5% Northern (Stepnoye) group 750,000 Eastern (Tsentralnoye) group 140,000 Syrdarya 12.4% Western (#6) group 180,000 Southern (Zarechnoye) group 70,000 Northern 256,000 16.5% Ily 96,000 6% Prikaspyi/ Caspian 24,000 1.8% Balkhash 6,000 0.4%

The Chu-Sarysu and Syrdarya deposits are all suitable for ISL recovery, the Northern deposits are mostly in hard rock apart form some ISL at Semizbai, Ily mineralisation is in coal deposits, Caspian has phosphate deposits, and Balkhash has some hard rock volcanic mineralisation but the major deposits were exhausted in the Soviet era. A 2014 estimate puts 77% as amenable for ISL.

All uranium is exported, and with the 2006 joint venture agreements, Russia is the main immediate customer, but China now receives more than half of production.

Health and environment

Kazatomprom said that its enterprises in 2014 continued to ensure ecological safety at its mines, and 23 of the company's affiliates and subsidiaries have ecological management standards certification. More than KZT 1.19 billon ($11 million) was spent in 2014 on measures to reduce the environmental impact of uranium mining, including efficiency improvements to dust and gas collecting installations and water purification units.

Occupational safety and security at uranium production sites is monitored and in 2014 the number of detected violations of occupational and industrial safety requirements dropped by 28% compared with 2013.

Fuel cycle: front end

The internationally-significant Ulba Metallurgical Plant (UMP) at Oskomen also known as Ust Kamenogorsk in the east of the country was commissioned in 1949. It has a variety of functions relevant to uranium, the most basic of which since 1997 is to refine most Kazakh mine output of U3O8. (It also produces beryllium, niobium and tanatalum.)

In June 2008 the formation of a new company – Ulba Conversion LLP – was announced, to build a 12,000 t/yr uranium hexafluoride conversion plant here, with Cameco providing the technology and holding 49% of the project. Ulba has produced HF since 1952, and the new conversion subsidiary would fit in with Russian JV enrichment arrangements. Construction was expected to start in 2009 but the project was put on hold. In May 2013 Cameco said that it expected construction of the plant with 6000 t/yr capacity to commence in 2018, with first production in 2020, subject to a feasibility study from 2014.

Kazatomprom has a JV with Russia's TVEL for uranium enrichment, (agreed with Tenex in 2006 and set up in 2008). Initially this envisaged adding to the enrichment plant at Angarsk in southern Siberia where Russia has its main conversion plant and a small enrichment plant now being expanded to 4.2 million SWU/yr. Kazatomprom and Tenex agreed to finance a 5 million SWU/yr increment to this. Each party would contribute about US$ 1.6 billion and Kazatomprom would hold 50% equity. When this looked uneconomic due to surplus enrichment capacity, in March 2011 Russian equity in the JV was transferred from Tenex to TVEL and the Kazatomprom-TVEL JV Uranium Enrichment Centre (Closed Joint Stock Company UEC) was offered a share in the Urals Electrochemical Combine (Open Joint Stock Company UECC) which has a 10 million SWU/yr plant at Novouralsk instead. The Kazakh share in UEC would be 50%, related to the need to enrich 6000 tU/yr, and estimated to cost up to $500 million (though amount not disclosed). In the event the joint venture CJSC UEC took up a 25% share of UECC in September 2013 and became entitled to half its output – 5 million SWU/yr. In 2014 the UEC share was 4.99 million SWU. This is distinct from the International Uranium Enrichment Centre (IUEC).

In September 2007 the joint stock company Angarsk International Uranium Enrichment Centre (IUEC) was registered with 10% Kazatomprom ownership and the balance Techsnabexport (Tenex). This share is being sold down to other partners – Ukraine confirmed 10% share in 2008, and Tenex is to hold only 51% eventually.

Since 1973 Ulba has produced nuclear fuel pellets from Russian-enriched uranium which are used in Russian and Ukrainian VVER and RBMK reactors. Some of this product incorporates gadolinium and erbium burnable poisons. Other exports are to the USA and Asia. Ulba briefly produced fuel for submarines (from 1968) and satellite reactors. Since 1985 it has been able to handle reprocessed uranium, and it has been making fuel pellets incorporating this for western reactors, supplied through TVEL.

Ulba Metallurgical Plant is majority owned by Kazatomprom and 34% by Russia's TVEL and has major new investment under way. It has secured both ISO 9001 and ISO 14001 accreditation. In 2007 a technological assistance agreement was signed with Japan apparently in line with government announcements that it would move towards selling its uranium as fabricated fuel or at least fuel pellets rather than just raw material. (One agreement is on fabrication of nuclear fuel components, between Kazatomprom, Kansai Electric and Sumitomo Corp.) In 2010, UO2 powder for Japan was certified by Japan's Nuclear Fuel Industries, and fuel pellets for China by CNNC's China Jianzhong Nuclear Fuel.

Kazatomprom has said that it aims to supply up to one third of the world fuel fabrication market by 2030, with China to be an early major customer. In June 2008 Areva signed a memorandum of understanding to provide engineering expertise to build a 1200 t/yr fuel fabrication plant as part of the Ulba complex, utilising fuel pellets from it. It will include a dedicated 400 t/yr line (51% owned by Kazatomprom, 49% Areva) specifically for fuel for French-designed reactors, including those in China. CGN has confirmed that Kazatomprom is to become a major nuclear fuel supplier, and late in 2014 Kazatomprom said it was considering "establishing the joint Kazakhstan-Chinese production of fuel assemblies”. The other 800 t/yr line will be wholly owned by Kazatomprom. Kazatomprom is also negotiating technology transfer agreements to enable it to supply fabricated fuel for Westinghouse reactors, now that it owns a 10% stake in Westinghouse.

International Atomic Energy Agency LEU bank

The government in April 2015 approved a draft agreement with the International Atomic Energy Agency (IAEA) on establishing a low-enriched uranium (LEU) 'fuel bank' in Kazakhstan. The government nominated Kazakhstan to host an international LEU reserve on its territory under the auspices of the IAEA in 2010. According to international norms, such a 'fuel bank' must be located in a country with no nuclear weapons and be fully open to IAEA inspectors. The 'fuel bank' will be a potential supply of 90 tonnes LEU (as UF6) for the production of fuel assemblies for nuclear power plants. Any state wishing to develop nuclear energy will be able to apply to Kazakhstan for the uranium fuel needed for its nuclear power plants if other sources become problematical.

The Ulba Metallurgical Plant was proposed in 2012 as the site of this IAEA 'fuel bank', but in February 2013 it was reported that due to seismic considerations and local opposition it would not be sited there. However, negotiations with the IAEA concluded in February 2014 remained focused on the Ulba site at Ust-Kamenogorsk, aka Oskemen. (This is separate from Russia's similar concept under IAEA auspices.) In June 2015 the IAEA Board approved plans for the ‘IAEA LEU Bank’ to be located at the Ulba Metallurgical Plant and operated by Kazakhstan, and a formal agreement with Kazakhstan was signed in August. It is expected to start operation in 2017. A transit agreement with Russia for shipping LEU was also approved.

'LEU IAEA’ is defined as LEU owned by the IAEA in the form of uranium hexafluoride (UF6) with a nominal enrichment of U-235 to 4.95%. ‘IAEA LEU Bank’ means a physical reserve of IAEA’s stored LEU of up to 60 full containers of the 30B type or later versions. Type 30B cylinders each hold 2.27 t UF6 (1.54 tU), hence about 92 tU. The IAEA shall bear the costs of the purchase and delivery (import-export) of LEU, the purchase of equipment and its operation, technical resources and other goods and services required for the functioning of the LEU ‘fuel bank’. Kazakhstan will meet the costs of LEU storage, including payment of electricity, heating, office space and staff costs. The document allows for the possible transfer of the LEU ‘fuel bank’ to another site from the Ulba Metallurgical Plant. The agreement has a ten-year duration with automatic renewal at the end of this period.

The IAEA LEU Bank is fully funded by voluntary contributions including $50 million from the US-based Nuclear Threat Initiative (NTI) organization, $49 million from the USA, up to $25 million from the European Union, $10 million each from Kuwait and the United Arab Emirates, and $5 million from Norway.

Nuclear power: past

The BN-350 fast reactor at Aktau (formerly Shevchenko), on the shore of the Caspian Sea, was built under Russia's Minatom supervision. It was designed as 1000 MWt capacity but never operated at more than 750 MWt (potentially 350 MWe) and after 1993 it operated at only about 520 MWt when funds were available to buy fuel. It was operated by the Mangistau Power Generation Co. (MAEK), and was a prototype for the BN-600 reactor at Beloyarsk.

The plant successfully produced up to 135 MWe of electricity and 80,000 m3/day of potable water over some 27 years until it was closed down in mid 1999. About 60% of its power was used for heat and desalination and it established the feasibility and reliability of such cogeneration plants. (In fact, oil/gas boilers were used in conjunction with it, and total desalination capacity through ten multi-effect distillation (MED) units was 120,000 m3/day.)

The power complex structure at Aktau, including three gas-fired power plants, is operated by MAEK-Kazatomprom LLP, set up in 2003. It produces 500 MWe and 40,000 m3/day of potable water, using cogeneration distillation.

Nuclear power: future

Kazakh plans for future nuclear power include 300 MWe class units as well as smaller cogeneration units in regional cities. In 2012 the government had a draft master plan of power generation development in the country until 2030. According to this plan, a nuclear electricity share then should be about 4.5%, requiring about 900 MWe of nuclear capacity. Current generating capacity is about 20 GWe, and 2030 needs are projected as 150 billion kWh.