Study shines a light on uranium mill tailings

05 June 2015

http://www.world-nuclear-news.org/WR-Study-shines-a-light-on-uranium-mill-tailings-0506158.html

Areva Resources Canada and researchers at the University of

Saskatchewan have completed a major study on the long-term condition of

uranium mill tailings at the McClean Lake mill using the Canadian Light

Source (CLS) synchrotron facility.

|

| McClean Lake (Image: University of Saskatchewan) |

Tailings - the waste from uranium ore milling operations - from McClean Lake are stored in the JEB tailings management facility, a former open pit mine. The management facility has been in operation since 1999, so drilling through the layers of material in the facility gives a snapshot of the tailings at different evolutionary stages.

Researchers used the CLS to investigate the life cycles of elements

such as lead, arsenic, and molybdenum via X-ray Absorption Near-Edge

Spectroscopy (XANES), a technique that can detect specific elements at

very low concentrations. University of Saskatchewan lead researcher

Andrew Grosvenor explained the approach. "We want to know how the

materials that contain these elements of concern are changing over time,

and if they reach a point where they form an insoluble product in which

case everything would stay put," he said.

The study has involved analysing 25 samples of tailings of different

ages and has for the first time succeeded in confirming the formation of

solid molybdenum materials that eventually stop the element dissolving

into water, as previously predicted by thermodynamic modelling.

McClean Lake is operated and 70%-owned by Areva Resources, with

Denison Mines holding 22.5% and Overseas Uranium Resources Development

(OURD) of Japan owning 7.5%. The mill produced over 50 million pounds of

concentrate from three open-pit mines from 1999 to 2010, and has since

been upgraded to mill ore from Cameco's Cigar Lake mine. It has been

described as the most technologically advanced uranium mill in the

world, able to process ore grades from less than 1% to 30% uranium

without dilution.

Based on current mining and milling projections, approximately 5

million cubic metres of tailings will be generated at the McClean Lake

Operation over the next 25 years, and will be stored in the JEB

facility.

The study's findings will be invaluable to the long-term care of the

McClean Lake site, and researchers are looking to move on to other

elements of concern. "Once you understand the geochemical reactions that

are occurring then you can start to predict what will be occurring over

the next 50, 100 or 1000 years in the environment," Grosvenor said.

The research has been published in the journal Environmental Science & Technology.Researched and written

by World Nuclear News

Uranium Markets

(Updated February 2015)

http://www.world-nuclear.org/info/nuclear-fuel-cycle/uranium-resources/uranium-markets/

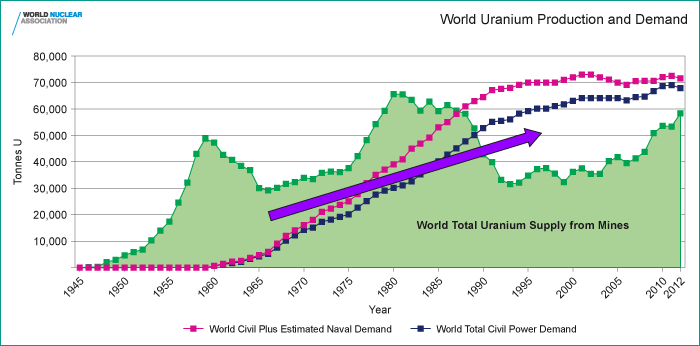

- Production from world uranium mines now supplies over 90% of the requirements of power utilities.

- Primary production from mines is supplemented by secondary supplies, principally by ex-military material and other inventories.

- World mine production has expanded significantly since about 2005.

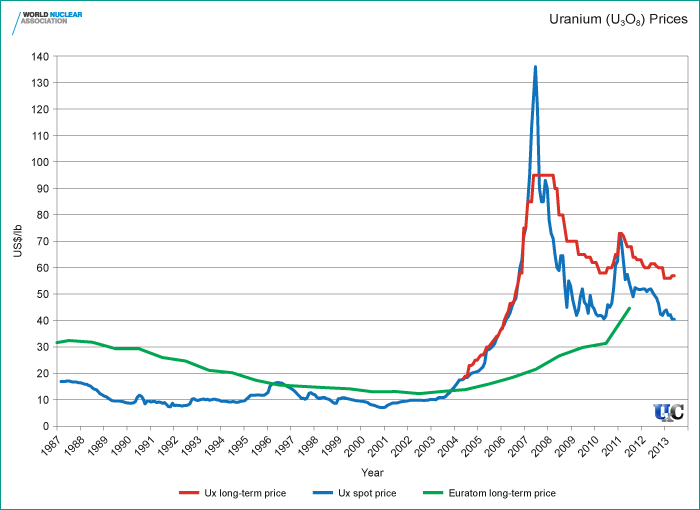

All mineral commodity markets tend to be cyclical, ie, prices rise

and fall substantially over the years, but with these fluctuations

superimposed on long-term trend decline in real prices, as technological

progress takes place at mines. In the uranium market, however, high

prices in the late 1970s gave way to depressed prices in the whole of

the period of the 1980s and 1990s, with spot prices below the cost of

production for all but the lowest cost mines. In 1996 spot prices

briefly recovered to the point where many mines could produce

profitably, but they then declined again and only started to recover

strongly late in 2003.

Nevertheless the quoted “spot prices" apply only to marginal trading

from day to day and in recent years have represented about one-quarter

of supply. Most trade is via 3-15 year term contracts with producers

selling directly to utilities. The contacted price in these contracts

is, however, often related to the spot price at the time of

delivery. However, as production has risen much faster than demand,

fewer long-term contracts are being written.

The reasons for fluctuation in mineral prices relate to demand and

perceptions of scarcity. The price cannot indefinitely stay below the

cost of production (see below), nor will it remain at very high levels

for longer than it takes for new producers to enter the market and

anxiety about supply to subside.

Graph courtesy of UxC

Note that the Euratom long-term price is the

average price of uranium delivered into the EU that year under long term

contracts. It is not the price at which long-term contracts are being

written in that year.

Demand

About 435 reactors with combined capacity of over 370 GWe, require

some 78,000 tonnes of uranium oxide concentrate containing 66,000 tonnes

of uranium (tU) from mines (or the equivalent from stockpiles or

secondary sources) each year. This includes initial cores for new

reactors coming on line. The capacity is growing slowly, and at the same

time the reactors are being run more productively, with higher capacity

factors, and reactor power levels. However, these factors increasing

fuel demand are offset by a trend for increased efficiencies, so demand

is dampened – over the 20 years from 1970 there was a 25% reduction in

uranium demand per kWh output in Europe due to such improvements, which

continue today.

Each GWe of increased new capacity will require about 150 tU/yr of

extra mine production routinely, and about 300-450 tU for the first fuel

load.

Fuel burnup is measured in MW days per tonne U, and many utilities

are increasing the initial enrichment of their fuel (eg from 3.3 towards

5.0% U-235) and then burning it longer or harder to leave only 0.5%

U-235 in it (instead of twice this).

Source: Uranium Institute 1992

The graph from Sweden's Oskarsamn 3 reactor shows that with

increasing fuel burn-up from 35,000 to 55,000 MWd/t a constant amount of

uranium is required per unit of electrical output, and energy used

(indicated by SWU) for increased levels of enrichment increases

slightly. However, the amount of fabricated fuel used in the reactor

drops significantly due to its higher enrichment and burn-up.

In the USA, utilities have pursued higher enrichment and burnups, but

in addition have reduced the tails assay from enrichment, owing to

higher uranium prices, so that significantly less natural uranium feed

is required. However, more enrichment is then needed, so there is a

clear trade-off between energy input to enrichment and uranium input.

Because of the cost structure of nuclear power generation, with high

capital and low fuel costs, the demand for uranium fuel is much more

predictable than with probably any other mineral commodity. Once

reactors are built, it is very cost-effective to keep them running at

high capacity and for utilities to make any adjustments to load trends

by cutting back on fossil fuel use. Demand forecasts for uranium thus

depend largely on installed and operable capacity, regardless of

economic fluctuations.

Looking ten years ahead, the market is expected to grow significantly. The WNA 2013 Global Nuclear Fuel Market Report

reference scenario (post Fukushima accident) shows a 31% increase in

uranium demand over 2013-23 (for a 36% increase in reactor capacity –

many new cores will be required). Demand thereafter will depend on new

plant being built and the rate at which older plant is retired – the

reference scenario has a 25.6% increase in uranium demand for the decade

2020 to 2030. Licensing of plant lifetime extensions and the economic

attractiveness of continued operation of older reactors are critical

factors in the medium-term uranium market. However, with electricity

demand by 2030 expected (by the OECD's International Energy Agency,

2008) to double from that of 2004, there is plenty of scope for growth

in nuclear capacity in a world concerned with limiting carbon emissions.

Supply

Mines in 2013 supplied some 70,800 tonnes of uranium oxide concentrate (U3O8) containing 59,370 tU, about 91% of utilities' annual requirements. (See also paper World Uranium Mining).

The balance is made up from secondary sources including stockpiled

uranium held by utilities, and in the last few years of low prices those

civil stockpiles have been built up again following their depletion

about 1990-2005. At the end of 2013 they were estimated at more than

90,000 tU in Europe and USA, and a bit less in east Asia, mostly in

China.

The perception of imminent scarcity drove the "spot price" for uncontracted sales to over US$ 100 per pound U3O8

in 2007 but it has settled back to $34-45 over the two years to the end

of 2014. Most uranium however is supplied under long-term contracts and

the prices in new contracts have, in the past, reflected a premium of

at lease $10/lb above the spot market.

Note that at the prices which utilities are likely to be paying for

current delivery, only one third of the cost of the fuel loaded into a

nuclear reactor is the actual ex-mine (or other) supply. The balance is

mostly the cost of enrichment and fuel fabrication, with a small element

for uranium conversion.

The above graph, from CRU Strategies, shows a cost curve for world

uranium producers in 2010, and suggests that for 53,500 tU/yr production

from mines in that year, US$40/lb is a marginal price. The cost curve

may rise steeply at higher uranium requirements in 2012 (with production

of 58,344 tU, 68,805 t U3O8).

With the main growth in uranium demand being in Russia and China, it

is noteworthy that the vertically-integrated sovereign nuclear

industries in these countries (and potentially India) have sought equity

in uranium mines abroad, bypassing the market to some extent. Strategic

investment in uranium production, even if it is not lowest-cost, has

become the priority while world prices have been generally low. Russia’s

ARMZ has bought Canada-based Uranium One, with 2013 production of over

5000 tU in several countries, and China’s CGNPC-URC has bought a

majority share of the large Husab project in Namibia, with potential

production of 5770 tU/yr (some to be sold into world markets). China’s

SinoU (CNNC) has bought a 25% share in Langer Heinrich in Namibia,

giving it over 500 tU/yr. It also has 37.5% of the SOMINA joint venture

in Niger, entitling it to over 1800 tU/yr in future, and up to 49% of

Zhalpak JV in Kazakhstan, adding another 500 tU/yr.

Supply from elsewhere

As well as existing and likely new mines, nuclear fuel supply may be from secondary sources including:

- recycled uranium and plutonium from used fuel, as mixed oxide (MOX) fuel,

- re-enriched depleted uranium tails,

- ex-military weapons-grade uranium,

- civil stockpiles,

- ex-military weapons-grade plutonium, as MOX fuel.

Commercial reprocessing plants are operating in France and UK, and

another is due to start up in Japan. The product from these re-enters

the fuel cycle and is fabricated into fresh mixed oxide (MOX) fuel

elements. About 200 tonnes of MOX is used each year, equivalent to less

than 2000 tonnes of U3O8 from mines.

Military uranium for weapons is enriched to much higher levels than

that for the civil fuel cycle. Weapons-grade is about 97% U-235, and

this can be diluted about 25:1 with depleted uranium (or 30:1 with

enriched depleted uranium) to reduce it to about 4%, suitable for use in

a power reactor. From 1999 to 2013 the dilution of 30 tonnes per year

of such material displaced about 9720 tonnes U3O8 per year of mine production. (see also paper on Military Warheads as a source of Nuclear Fuel).

The following graph gives an historical perspective, showing how

early production went first into military inventories and then, in the

early 1980s, into civil stockpiles. It is this early production which

has made up the shortfall in supply from mines since the mid 1980s.

However, the shortfall is diminishing towards the level of continuing

secondary supplies.

The USA and Russia have agreed to dispose of 34 tonnes each of

military plutonium by 2014. Most of it is likely to be used as feed for

MOX plants, to make about 1500 tonnes of MOX fuel which will

progressively be burned in civil reactors.

The following graph (WNA 2011 Market Report reference scenario)

suggests how these various sources of supply might look in the decades

ahead:

Sources:

WNA Global Nuclear Fuel Market Reports.

IEA World Energy Outlook – to date.

WNA Global Nuclear Fuel Market Reports.

IEA World Energy Outlook – to date.

Uranium production figures, 2003-2013

(December 2014)

http://www.world-nuclear.org/info/Facts-and-Figures/Uranium-production-figures/

| Country or area | Production (tU) | % change | ||||||||||

| 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2012-13 | |

| Argentina |

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Armenia |

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

| Australia |

7572

|

8982

|

9516

|

7593

|

8611

|

8430

|

7982

|

5900

|

5983

|

6991

|

6350

|

-9

|

| Belgium |

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

| Brazil |

310

|

300

|

110

|

190

|

299

|

330

|

345

|

148

|

265

|

231

|

198

|

-17

|

| Bulgaria |

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

| Canada |

10,457

|

11,597

|

11,628

|

9862

|

9476

|

9000

|

10,173

|

9873

|

9145

|

8998

|

9332

|

+4

|

| China ^ |

750

|

750

|

750

|

750

|

712

|

769

|

750

|

827

|

885

|

1500

|

1450

|

-3

|

| Czech Rep |

452

|

412

|

408

|

359

|

306

|

263

|

258

|

254

|

229

|

228

|

225

|

+1

|

| Finland |

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

| France |

9

|

7

|

7

|

0

|

4

|

5

|

8

|

7

|

6

|

3

|

0

|

-100

|

| Germany |

104*

|

77*

|

94*

|

65*

|

41*

|

0

|

0

|

0

|

52

|

50

|

27

|

-46

|

| Hungary |

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

| India^ |

230

|

230

|

230

|

230

|

270

|

271

|

290

|

400

|

400

|

385

|

400

|

+4

|

| Japan |

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

| Kazakhstan |

3300

|

3719

|

4357

|

5279

|

6637

|

8521

|

14,020

|

17,803

|

19,451

|

21,317

|

22,567

|

+6

|

| Korea, S |

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

| Lithuania |

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

| Malawi |

0

|

0

|

0

|

0

|

0

|

0

|

104

|

670

|

846

|

1101

|

1132

|

+3

|

| Mexico |

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

| Namibia |

2036

|

3038

|

3147

|

3077

|

2879

|

4366

|

4626

|

4496

|

3258

|

4495

|

4315

|

-4

|

| Netherlands |

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

| Niger |

3143

|

3282

|

3093

|

3434

|

3135

|

3032

|

3243

|

4198

|

4351

|

4667

|

4528

|

-3

|

| Pakistan^ |

45

|

45

|

45

|

45

|

45

|

45

|

50

|

45

|

45

|

45

|

41

|

-9

|

| Portugal |

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

| Romania^ |

90

|

90

|

90

|

90

|

77

|

77

|

75

|

77

|

77

|

90

|

80

|

-11

|

| Russia^ |

3150

|

3200

|

3431

|

3430

|

3413

|

3521

|

3564

|

3562

|

2993

|

2872

|

3135

|

+9

|

| Slovakia |

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

| Slovenia |

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

| South Africa |

758

|

755

|

674

|

534

|

539

|

655

|

563

|

583

|

582

|

465

|

540

|

+16

|

| Spain |

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

| Sweden |

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

| Switzerland |

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

| UK |

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

na

|

| Ukraine^ |

800

|

800

|

800

|

800

|

846

|

800

|

840

|

850

|

890

|

960

|

1075

|

+12

|

| USA |

779

|

878

|

1039

|

1692

|

1654

|

1430

|

1453

|

1660

|

1537

|

1596

|

1835

|

+15

|

| Uzbekistan |

1589

|

2016

|

2300

|

2270

|

2320

|

2338

|

2429

|

2400

|

3000

|

2400

|

2400

|

-20

|

| Total |

35,576

|

40,178

|

41,179

|

39,670

|

41,282

|

43,853

|

50,772

|

53,663

|

53,494

|

58,344

|

59,673

|

+2

|

| Legend | |||||||||

| na | not applicable | ||||||||

| .. | not yet available | ||||||||

| * | from decommissioning | ||||||||

| ^ | UI/WNA estimate | ||||||||

Commissioning nuclear in Australia? A call to action

5 June 2015

http://www.neimagazine.com/opinion/opinioncommissioning-nuclear-in-australia-a-call-to-action-4594192/?utm_source=twitterfeed&utm_medium=twitter

Commissioning nuclear in Australia? A call to action

The

World Nuclear Association calls on the global nuclear community to

share its expertise with the South Australian Nuclear Royal Commission

so that it can plot a path for civil nuclear power. By Agneta Rising

It

is only natural that Australia should consider an expanded role in the

nuclear fuel cycle as it attempts to address its climate, energy and

economic challenges. The country already has one of the most advanced

nuclear research and medical facilities in the world and it is one of

the largest suppliers of uranium. However, Australia currently makes no

use of nuclear to generate electricity - in fact, it has laws in place

prohibiting this. Most other civil nuclear fuel cycle activities are

banned under law.

[Photo: Olympic Dam (Credit: BHP Billiton]

A

Royal Commission into expanding nuclear fuel cycle activities is a

chance to move on. The Commission is limited to investigating the

opportunity for economic nuclear development in the state of South

Australia, but in practice anything beyond further mining would require

change at the national level. These kinds of opportunities come along

very rarely. The South Australian Royal Commission offers nuclear

industry professionals worldwide a chance to showcase their knowledge,

expertise, experience and technology.

The Commission has released four 'Issues Papers' on:

1) uranium exploration, extraction and milling (comments by 24 July);

2) fuel conversion, enrichment, fabrication and reprocessing (3 August);

3) electricity generation(3 August);

4) waste management (24 July).

1) uranium exploration, extraction and milling (comments by 24 July);

2) fuel conversion, enrichment, fabrication and reprocessing (3 August);

3) electricity generation(3 August);

4) waste management (24 July).

Should

the South Australian government choose to expand South Australia's

nuclear role, those who make high quality submissions may find

opportunities in an exciting new market.

Nuclear energy in Australia - recent history

The

anti-nuclear movement in Australia has been very influential. This led

to a national prohibition on fuel fabrication, nuclear power, enrichment

and reprocessing facilities, as set out in the federal Environment

Protection and Biodiversity Conservation Act of 1999 and Australian

Radiation Protection and Nuclear Safety Act of 1998. In the late 1970s

it also led to the federal Australian Labor Party limiting uranium

mining and export.

"Half of South Australia's 5.3GWe capacity is gas-fired"

The

question of whether Australia should develop nuclear energy has been

raised several times over the last 60 years, usually by conservative

politicians (represented by the Liberal Party of Australia). The country

has abundant coal close to population centres, and by using this for

more than 80% of electricity it has enjoyed some of the world's lowest

power prices. But climate change concerns have changed the outlook, and

South Australia has always been less well-off than the eastern states in

terms of electricity options. Half of South Australia's 5.3GWe capacity

is gas-fired, and its average wholesale power price is 30% higher than

in the eastern states.

A previous Liberal coalition federal

government commissioned a high-level inquiry into nuclear energy and it

reported positively in 2006 (the Uranium Mining, Processing and Nuclear

Energy Review, UMPNER). It concluded that any long-term energy strategy

for Australia should include nuclear alongside coal, gas and renewable

energy, and that commercial opportunities existed in uranium mining,

processing and enrichment and in waste storage. Much has changed since

then, notably the uranium price. UMPNER chairman Dr Ziggy Switkowski

said that the Royal Commission inquiry was "timely for a number of

reasons" and that "nuclear power still offers the greatest option in

providing cost-effective, clean, base-load energy".

Dr Switkowski

noted that "Australia, especially South Australia, will tick many boxes

required for a vibrant nuclear industry: a leader in the nuclear

nonproliferation regime, benign and sparsely populated geology, more

than a third of the world's known uranium resources with established

international markets, skilled workforce and experience in the nuclear

supply chain, effective regulators and strong compliance ethos, support

for industry development, job creation, and new intrastate commerce and

export opportunities."

Nuclear plants in Australia?

Around

1960, nuclear power was considered for the large new power station at

Port Augusta in South Australia, and in 1969 the South Australian

government proposed a nuclear power plant in the state to supply the

eastern states' grid.

"In 1976, the South Australian government...said nuclear power appeared inevitable"

In

1976, the South Australian government, in its submission to the Ranger

Uranium Mine Inquiry, said nuclear power appeared inevitable for the

state, perhaps by 2000. History proved different.

The 2006 UMPNER

inquiry reported that nuclear power would be 20-50% more expensive than

coal-fired power at that time and it would only be competitive if "low

to moderate" costs (US$12-30/tCO2) were imposed on carbon emissions. It

said: "Nuclear power is the least-cost low-emission technology that can

provide base-load power" and has low life cycle impacts. Since then,

household power prices have doubled.

The National Generators Forum

published a report in 2006 (Reducing Greenhouse Gas Emissions from

Power Generation) which concluded: "Stabilising emissions at present

levels and meeting base-load requirements could be achieved with nuclear

power at comparatively modest cost." Nuclear power would halve an

expected increase in electricity prices of 120% to 2050 and "At $20 per

tonne of CO2 price, nuclear starts to become more cost-effective than

current fossil fuel technologies."

Whether nuclear power is

feasible for Australia therefore depends on climate mitigation policies,

on reducing coal or on a carbon price. Absent this, a more innovative

approach will be needed to secure financing.

Enrichment possibilities

Back

in the 1960s Australia started an enrichment research programme. The

feasibility of an enrichment industry was investigated in the 1970s but

work was never taken forward, in part due to the Labor party policy

noted above. Nevertheless, the country boasts some serious credentials

in the area and has pioneered research into new enrichment technology.

An

Australian company started to develop a laser-based uranium enrichment

technology in the mid-1990s. In 2006 it entered into an exclusive

agreement with an international partner to commercialise the technology.

In 2012 Global Laser Enrichment, as the enterprise is now known,

received an operating licence from the US Nuclear Regulatory Commission,

and in 2013 it began exclusive negotiations with US Department of

Energy for a tails processing facility.

Whether enrichment, and especially laser enrichment, could be a future option for Australia is surely an open question.

Nuclear waste considerations

Like

all countries with a nuclear research and medical sector, Australia has

its share of radioactive waste. A national initiative was launched last

year seeking land-owner volunteers to step forward with potential sites

for facilities to store intermediate-level waste, and for the disposal

of low-level waste. Australia does not technically have any high-level

waste. Its research reactor spent fuel is reprocessed abroad and the

returned waste is classified as long-lived intermediate-level waste.

"A

major research programme carried out in the 1990s to identify a

suitable site for a potential multinational repository put Australia top

of the list"

Nuclear power plants would change that equation.

They would require a high-level waste repository, but could also help to

subsidise the disposal of the comparatively small volume of medical and

research waste.

There has never been serious consideration of a

commercial reprocessing facility in Australia. However if nuclear power

plants were introduced the question of whether to pursue a closed or

open fuel cycle would have to be addressed.

A major research

programme carried out in the 1990s to identify a suitable site for a

potential multinational repository, Pangaea Resources, put Australia top

of the list. However the proposal was unpopular and did not proceed.

Whether attitudes have changed could be a question for the Commission.

An advanced proposal

One

South Australian has not been shy in seeking to shape the debate.

Senator Sean Edwards proposes "that South Australia stakes its claim in

the global nuclear fuel recycling industry." It would mean using the

world's spent fuel for fast reactors, via a reprocessing plant. The

venture would be supported financially because overseas governments

would pay South Australia to take their fuel.

On the ABC

Environment blog on 18 March, Edwards said, "In developing this proposal

I have been in talks with potential foreign partners who have raised

the possibility of meeting our capital costs if we meet their recycling

needs. Read: no start-up costs. Those talks continue."

Continuous,

reliable low-cost electricity would transform the state's economy.

After processing and reuse of fuel, small amounts of relatively

short-lived waste would remain. "The science is sound, the business case

has been made and the public is behind us. The challenge is a political

one," notes Edwards. There has been remarkably little pushback on this

proposal.

The Commission is keeping an open mind regarding

outcomes and is seeking to identify the pathway offering the most

potential for economic rejuvenation to the state. However, it does raise

intriguing questions as to exactly what kind of technology a nuclear

newcomer might realistically expect to introduce. Is there a possibility

to skip a generation? What are the benefits and risks of early

adoption?

Public opinion shift

The time appears right for a

new investigation and a Royal Commission is the most powerful and

rigorous body that can be created under Australian law to deal with such

a matter.

Public attitudes have begun to shift, making a national

policy change achievable. In 2014, a polling of 1200 people carried out

by the South Australian Chamber of Mines and Energy found that 48% of

respondents support nuclear energy, while only 33% recorded any form of

opposition. Just under 20% were neutral. These levels of acceptance are

enviable, even for countries with nuclear energy and a clear basis to

explore opportunities.

It will take a lot to change political

inertia in Australia, but your expert response to the Issues Papers is a

great starting point. Get involved, and help make a difference!About the author

Agneta Rising is Director General of the World Nuclear Association.

Russia achieves serial nuclear power plant construction

03 June 2015

http://www.world-nuclear-news.org/C-Russia-achieves-serial-nuclear-power-plant-construction-03061502.html

Russia has increased its competitive edge in the nuclear

plant construction market through the serial production of new reactors,

the head of NIAEP-JSC ASE said yesterday. The company was formed in

2012 from the merger of Rosatom subsidiaries Nizhny Novgorod design

institute and Atomstroyexport in order to consolidate Russia's nuclear

power engineering expertise into a single division. Last year, it

absorbed Atomenergoproekt.

NIAEP-JSC ASE director Valery Limarenko spoke to reporters in Moscow

during Atomexpo, Rosatom's annual conference and exhibition.

"Something we have and no one else does is that we have learned to

replicate nuclear power plants," Limarenko said. "Ask anyone else at

this exhibition involved in nuclear power plant construction or

operation if it is possible to build the same project in different

countries. They will tell you that it isn't because a unit is

tailor-made for each client."

Limarenko was referring to the different requirements among plant

customers regarding seismicity, climate, water temperature, design

regulations, localisation and investment.

"Serial production of nuclear power plants for construction around

the world is a very difficult thing to do, but we have managed it

because we are building a series of standard designs with various

options covering seismicity, climate and the other parameters. Our

competitive ability is very high because a company that can build a

series of projects, has a very strong position on the market," he said.

NIAEP-JSC ASE consists of more than 20 entities, Limarenko said, with

the major players being Atomstroyexport, which specialises in the

construction of overseas nuclear power plants; NIAEP, which builds units

in Russia; and general design company Moscow Atomenergoproekt. It also

includes engineering company Spetzenergomontazh and Nikimt-Atomstroy,

which designs and builds used nuclear fuel facilities.

The enlarged company employs 18,500 people at its Moscow and Nizhny

Novgorod offices, of which 4000 are nuclear power plant designers.

Five victories

The company had five "victories", or highlights, last year, he

said. The first was the start-up of unit 3 of the Rostov nuclear power

plant near Volgodonsk in Russia two months ahead of schedule, in

December. The same month, unit 1 of the Kudankulam nuclear power plant

entered commercial operation. The third victory was the signing, also in

December, of an intergovernmental agreement for Russia to build two new

reactors in India. The fourth was the signing in November of a protocol

to an intergovernmental agreement to build two new reactors in Iran. In

December, Russia also signed a contract for the Paks Phase 2 project in

Hungary.

NIAEP-JSC ASE had a portfolio in 2014 worth about $60 billion and it plans to beat that figure in 2015, Limarenko said.

Thanks to its formation from other Rosatom subsidiaries, the company

has all the structures required to design, construct and manage all the

processes related to procurement and supply, he said. This year, it will

further update its project management process with an information

support system known as Multi-D. Rosatom has said that this technology

enables it to carry out detailed modelling of construction and

installation processes based on 3D-object models, which "significantly

increases" the quality and speed of its work.

NIAEP-JSC ASE is able to remain within or below the budget of its

projects, Limarenko said, thanks to its cost management system. "Similar

to what designers do when they draw a 3D model of a nuclear power

plant, a so-called smart model, we create a similar model in terms of

costs," he said. "It is a mathematical model that is not static, but can

be developed over time to consider several factors. With the breakdown

of labour costs, price of equipment and price of materials, we know how

much we have spent and how much we are going to spend at any moment.

This system enables us to determine how much a project costs in any

country with a link to a specific project and a particular place."

This year

Key tasks for this year, according to Limarenko, are

commissioning of "the world's first" Generation III+ reactor - unit 1 of

the Novovoronezh II plant. Next, it aims to commission unit 2 of the

Kudankulam nuclear power plant, a Generation III project, he said. The

third task will be to sign a general contract in Bangladesh where the

company has already signed contracts covering the reactor design and the

preparatory period of work.

NIAEP-JSC ASE is on schedule with unit 1 of the plant it is building

at Ostrovets in Belarus, he said, and unit 2 there will be ahead of

schedule. That project is also below budget, he added. This Generation

III+ design is also being used for its Leningrad II and Baltic projects,

he said. It will also be used for the Hanhikivi and Paks projects in

Finland and Hungary, respectively, as well as for the plant it plans to

build for Vietnam, he said.

Asked about progress at unit 1 of the Kudankulam plant, Limerenko

said the reactor was now operating at 67% of its capacity, while unit 2

has entered the commissioning phase. In addition, India and Russia last

year signed an agreement to build units 3 and 4.

"Now we are in negotiations about the design contract for units 3 and

4, which we expect to sign in the next couple of months," he said.

These units will be of the VVER-Toi (typical optimised, with enhanced

information) design, which will require a four-year construction period

between first concrete and commissioning, he said. Other projects that

will use VVER-Toi technology include Kursk II in Russia and Akkuyu in

Turkey, he added.

NIAEP-JSC ASE has completed the requirements of the first two

contracts for its project in Bangladesh, he said, an engineering survey

and the design of the reactor. A third contract will cover the

preparatory period before the start of construction.

"I was at the site a month ago and talked with the [Bangladesh]

energy minister and we evaluated that everything was going well,"

Limarenko said.

Asked about the equipment prepared for an Atomstroyexport project the

Bulgarian government cancelled in 2012, Limeranko said "I hope the day

will come when we get to complete the Belene plant". The main equipment

of the nuclear island is ready and is currently in storage. "It's in a

normal condition and in reliable hands.”

Limarenko said he was optimistic about the company's prospects in Iran.

Unit 1 at the Bushehr nuclear power plant is a VVER V-446 pressurised

water reactor unit, which began commercial operation in September 2013.

German constructor Siemens KWU began work on two pressurized water

reactors at the Bushehr site on the Persian Gulf in 1975, but work was

abandoned in 1979. Russian companies later completed the project.

Construction of unit 2, a VVER-1000 reactor, is to start this year.

Unit 1 is currently in a two-year warranty period, during which

Russian nuclear specialists remain at the site on a consultative basis

and to provide technical support. That period ends soon, Limarenko said,

"and we are planning the handover in September". NIAEP-JSC ASE is now

carrying out general survey works for units 2, 3 and 4, he said,

referring to an agreement signed in November last year for Russia to

build up to eight new nuclear power reactor units in Iran - four at

Bushehr and four at another, yet to be determined site.

Asked about the potential impact on the projects of the P5+1 talks

with Iran on the country's nuclear program, Limarenko said he expected

sanctions against the country to be lifted soon.

"As I understand it, these talks have been very tough, but are

developing to the mutual satisfaction of all parties involved to support

Iran in its pursuit of the peaceful atom," he said. We expect that

after the end of the talks, all sanctions [against Iran] will be lifted

and our cooperation in nuclear power plant construction in Iran will

continue. We have the framework of an existing contract."

Researched and written

by World Nuclear News

by World Nuclear News

The realities of Mo-99 production

27 May 2015

http://www.world-nuclear-news.org/V-The-realities-of-Mo-99-production-27051502.html

Reviews of the various molybdenum-99 (Mo-99) production

initiatives currently under way in the USA and Canada tend either to

ignore or to reference vaguely the important role of existing capacity

in Australia, Belgium, the Netherlands and South Africa in the supply of

Mo-99 to the USA, writes Don Robertson.

The sweeping statement that the USA currently imports the majority of

its Mo-99 supply from "subsidised, aging facilities abroad most of

which is produced with HEU" is most certainly not a fair or reasonable

description of the Mo-99 industry in the rest of the world. If it were

not for these alleged subsidised, aging, HEU based facilities abroad

then, for example the USA would be without Mo-99 during the annual

extended NRU (National Research Universal, in Canada) shutdowns.

Proclamations of the virtues of various production processes that are

under development lack realism when it comes to projected time scales

and costs associated with the construction and licensing of these

proposed Mo-99 production facilities. In the early attempts to establish

domestic production in the USA, the National Nuclear Security

Administration Global Threat Reduction Initiative put forward a program

which was aimed at identifying and supporting Collaborative Agreement

partners. In terms of the program, these partners were required to

produce 3000 6 day Curies of LEU-based Mo-99 by the end of 2013. None of

the partners were able to achieve this target and this is still the

case some two years later.

“Technetium-99m has become a trivially priced low

value commodity with there being no correlation between the market price

and the true cost of production.”

Don Robertson

Don Robertson

This optimism regarding timescales is however quite understandable as

it is only those, who have already constructed and operated large scale

commercial Mo-99 production facilities, who will fully appreciate the

complexities of production and the associated regulatory hurdles. It is

therefore somewhat surprising that even Nordion is making optimistic

projections as to when their novel SGE process will have achieved

commercial readiness.

Most of the domestic programs were motivated on the basis of a supply

shortage after October 2016 when medical isotope production was

destined to cease in the NRU reactor. This was a position which had been

consistently maintained until early in 2015 at which stage the Canadian

government announced that it would support the extension of NRU

operations until the end of March 2018 to help support global medical

isotope demand should shortages occur in this time. Since it would

appear that none of the current US domestic programs will be in

commercial production by 2016, one could imagine that NRU will

seamlessly continue to operate beyond October 2016 enabling Nordion to

continue the supply of Mo-99 except for the annual NRU shutdown when

presumably the suppliers from abroad will once again be required to step

up to the plate.

Clearly capacity constraints are a major concern but this is the

symptom arising from the real crisis confronting the industry namely the

inappropriate pricing of technetium-99m (Tc-99m) and hence Mo-99.

Historically, Mo-99 production evolved out of government research

institutes and as a result government subsidisation was implicit in the

industry. Because of these historical subsidisations, Tc-99m has become a

trivially priced low value commodity with there being no correlation

between the market price of the isotope and the true actual cost of

production.

Back in 2009 there was an isotope supply crisis resulting from the

extended closure of NRU. The supply shortages resulted in disruptions in

the availability of critical nuclear medicine based diagnostic

procedures. This impact on global healthcare led the OECD's Nuclear

Energy Agency, at the request of its member countries, to establish the

High Level Group on the Security of Supply of Medical Radioisotopes.

Soon after its inception, this group identified and publicised that the

unreliable supply of Mo-99 and Tc-99m could be directly attributed to

the inappropriate pricing structure of the supply chain. It was

emphasised that, unless this was urgently addressed, supply disruptions

would continue, jeopardising the future of nuclear medicine diagnostic

imaging. Unfortunately five years later, despite this warning, little to

no progress has been made with the rectification of the situation and

there is continual downward pressure on the price of Tc-99m.

Since it has been generally accepted that any form of government

subsidisation should be removed from the industry all Mo-99 producers

are presumably obliged to manage their businesses on sound commercial

principles and of necessity deliver an appropriate ROI to shareholders

and investors. Unfortunately the increasing operational costs on the one

hand and the constant downward pressure on the price of Tc-99m and

hence Mo-99 has resulted in a business environment which does not

readily present itself as an attractive investment opportunity.

Over the years SPECT (Single photon emission computed tomography)

diagnostic imaging has grown to a level where some 100 000 Tc-99m based

scans are performed per day with an installed infrastructure of some 22

000 SPECT cameras worldwide. The market value of this industry, which

significantly contributes to the general well-being of the global

population, is estimated to be in the region of $13 billion. This

important industry remains extremely vulnerable due to a tendency of

some downstream participants in the supply chain to chase short term

profitability at the expense of long term sustainability. It has, for

example, been shown that if the current price of Mo-99 were doubled

(which would enable producers to move towards some form of business

sustainability), the final cost of a diagnostic procedure would increase

by around 2%. Despite this the downward pressure on the price of Tc-99m

and Mo-99 remains.

Over the years there have been significant investments in failed

Mo-99 production ventures. Even today significant sums are being

expended on a variety of novel production methods which are very

interesting from a scientific perspective but might well not be able to

make the transition from laboratory scale to full blown commercial

production. Those that are able to successfully make the transition will

take a lot longer and cost much more than was initially projected.

Furthermore, if the Tc-99m and Mo-99 pricing level is not radically

revised the technologically successful ventures will be at best marginal

businesses.

There is undoubtedly a need for additional Mo-99 capacity but the

greater SPECT market will have to reconcile to the fact that the surety

of supply required to support this $13 billion industry will come at a

price. Hopefully some of the US domestic programs will successfully

transition to viable commercial businesses but this will take time and

until this happens the US market will remain dependent on the

"subsidised, aging facilities from abroad producing HEU based Mo-99".

Don Robertson

Comments? Please send them to editor@world-nuclear-news.org

Don Robertson is the retired managing director of NTP Radioisotopes

SOC Ltd, a subsidiary of the South African Nuclear Energy Corporation

(Necsa). NTP Radioisotopes conducts its operations from the Pelindaba

nuclear facility near Pretoria.

China, Egypt agree to nuclear cooperation

28 May 2015

http://www.world-nuclear-news.org/NP-China-Egypt-agree-to-nuclear-cooperation-2805154.html

A memorandum of understanding (MOU) to cooperate in the

construction of power reactors has been signed between China National

Nuclear Corporation (CNNC) and the Egyptian Nuclear Power Plant

Authority (NPPA).

|

| The signing of the MOU (Image: CNNC) |

The MOU was signed during a CNNC delegation's visit to Egypt

between 21 and 23 May. The signing was witnessed by Egypt's first

undersecretary of the ministry of electricity and renewable energy

Hassan Mahmoud Hassanein.

In a statement CNNC said the signing of the MOU marks a new phase in

work to develop nuclear energy in Egypt and that the company has now

become "one of the official partners for Egypt's nuclear power

projects".

In February, Egypt and Russia signed an MOU on the construction of a

nuclear power plant in the North African country. Russian state nuclear

corporation Rosatom and the Egyptian ministry of electricity and

renewable energy "agreed to launch detailed discussions on the

prospective project," Rosatom said in a statement.

Rosatom subsidiary Rusatom Overseas and the NPPA signed a project

development agreement for a nuclear power plant with a desalination

facility.

The El-Dabaa site on Egypt's Mediterranean coast was selected for a

nuclear plant in 1983, but this scheme was scrapped after the Chernobyl

accident in Ukraine. However, in 2006, the same site was named in plans

to build a 1000 MWe reactor for electricity generation and water

desalination by 2015, in a $1.5-$2 billion project that would be open to

foreign participation.

Early in 2010 the proposal had expanded to four plants by 2025, the

first costing about $4 billion and being on line in 2019 or 2020. Plans

were put on hold in 2011 until the political situation stabilised

following the ousting of former president Hosni Mubarak.

Researched and writtenby World Nuclear News

Egypt and Russia agree to build nuclear reactors

10 February 2015

http://www.world-nuclear-news.org/NP-Egypt-and-Russia-agree-to-build-nuclear-reactors-10021501.html

Egypt and Russia have agreed to build a nuclear power plant

together and officials from both countries have signed a memorandum of

understanding on the proposed project.

Egypt's president, Abdel-Fattah el-Sissi, announced the plan during a

joint press conference in Cairo with Russian President Vladimir Putin

who is on a state visit to Egypt.

Within the framework of the visit, Russian state nuclear corporation

Rosatom and the Egyptian Ministry of Electricity and Renewable Energy

"agreed to launch detailed discussions on the prospective project,"

Rosatom said in a statement.

Rusatom Overseas and Egyptian Nuclear Power Plants Authority have

signed a project development agreement for a nuclear power plant with a

desalination facility.

Sergey Kirienko, Rosatom director general, said the agreement

provides for the construction of two nuclear power units, with the

prospect of a further two.

"In a very short period of time, we need to prepare for the signing

of two intergovernmental agreements - one on nuclear power plant

construction and one on financing. During the negotiations, we have been

set the task to perform at maximum speed, and Rosatom is ready for

that."

Researched and writtenby World Nuclear News

Russia's Nuclear Fuel Cycle

(Updated 22 May 2015)

http://www.world-nuclear.org/info/Country-Profiles/Countries-O-S/Russia--Nuclear-Fuel-Cycle/

- A major increase in uranium mine production is planned.

- There is increasing international involvement in parts of Russia's fuel cycle.

- Exports are a major Russian political and economic objective.

Contents

- Uranium resources and mining

- Fuel Cycle Facilities: front end

- Used Fuel and Reprocessing

- Wastes

- Decommissioning

- Organisation

- Regulation and safety

- Exports: fuel cycle

- Exports: general, plants and projects

- International Collaboration

- Research & Development

- Public Opinion

- Non-proliferation

- Appendix: Background: Soviet nuclear culture

Russia uses about 3800 tonnes of natural uranium per year. After

enrichment, this becomes 190 tU enriched to 4.3% for 9 VVER-1000

reactors (at 2004, now 13), 60 tU enriched to 3.6% for 6 VVER-440s, 350

tU enriched to 2.0% for 11 RBMK units, and 6 tU enriched to 20% (with 9

tU depleted) for the BN-600. Some 90 tU recycled supplements the RBMK

supply at about 2% enrichment. This RepU arises from reprocessing the

used fuel from BN, VVER-440 and marine and research reactors.

There is high-level concern about the development of new uranium

deposits, and a Federal Council meeting in April 2015 agreed to continue

the federal financing of exploration and estimation works in Vitimsky

Uranium Region in Buryatia. It also agreed to financing construction of

the engineering infrastructure of Mine No. 6 of Priargunsky Industrial

Mining and Chemical Union (PIMCU). The following month the Council

approved key support measures including the introduction of a zero rate

for mining tax and property tax; simplification of the system of

granting subsoil use rights; inclusion of the Economic Development of

the Far East and Trans-Baikal up to 2018 policy in the Federal Target

Program; and the development of infrastructure in Krasnokamensk.

Uranium resources and mining

Russia has substantial economic resources of uranium, with about 10%

of world reasonably assured resources plus inferred resources up to US$

130/kg – 487,000 tonnes U (2011 'Red Book'). Historic uranium

exploration expenditure is reported to have been about $4 billion. The

Federal Natural Resources Management Agency (Rosnedra) reported that

Russian uranium reserves grew by 15% in 2009, particularly through

exploration in the Urals and Kalmykia Republic, north of the Caspian

Sea.

Uranium production has varied from 2870 to 3560 tU/yr since 2004, and

in recent years has been supplemented by that from ARMZ Kazakh

operations, giving 7629 tU in 2012. In 2006 there were three mining

projects in Russia, since then others have been under construction and

more projected, as described below. Cost of production in remote areas

such as Elkon is said to be US$ 60-90/kg. Spending on new ARMZ domestic

projects in 2013 was RUR 253.5 million, though in November 2013 all

Rosatom investment in mining expansion was put on hold due to low

uranium prices.

Plans announced in 2006 for 28,600 t/yr U3O8

output by 2020, 18,000t of this from Russia* and the balance from

Kazakhstan, Ukraine, Uzbekistan and Mongolia have since taken shape,

though difficulties in starting new Siberian mines makes the 18,000 t

target unlikely. Three uranium mining joint ventures were established in

Kazakhstan with the intention of providing 6000 tU/yr for Russia from

2007: JV Karatau, JV Zarechnoye and JV Akbastau. (see below and Kazakhstan paper)

* See details for April 2008 ARMZ plans. In 2007

TVEL applied for the Istochnoye, Kolichkanskoye, Dybrynskoye,

Namarusskoye and Koretkondinskoye deposits with 30,000 tU in proved and

probable reserves close to the Khiagda mine in Buryatia.

From foreign projects: Zarechnoye 1000 t, Southern Zarechnoye 1000 t, Akbastau 3000 t (all in Kazakhstan); Aktau (Uzbekistan) 500 t, Novo-Konstantinovskoye (Ukraine) 2500 t. In addition Russia would like to participate in development of Erdes deposit in Mongolia (500t) as well as in Northern Kazakhstan deposits Semizbai (Akmolonsk Region) and Kosachinoye.

*(this chart is now slightly out of date but still gives a general picture)

AtomRedMetZoloto (ARMZ) is the state-owned company which took over

Tenex and TVEL uranium exploration and mining assets in 2007-08, as a

subsidiary of Atomenergoprom (79.5% owned). It inherited 19 projects

with a total uranium resource of about 400,000 tonnes, of which 340,000

tonnes are in Elkonskiy uranium region and 60,000 tonnes in

Streltsovskiy and Vitimskiy regions. The rights to all these resources

had been transferred from Rosnedra.

JSC ARMZ Uranium Holding Company (as it is now known) became the

mining division of Rosatom in 2008, responsible for all Russian uranium

mine assets and also Russian shares in foreign joint ventures. In 2008,

78.6% of JSC Priargunsky, all of JSC Khiagda and 97.85% of JSC Dalur was

transferred to ARMZ. In March 2009 the Federal Financial Markets

Service of Russia registered RUR 16.4 billion of additional shares in

ARMZ placed through a closed subscription to pay for uranium mining

assets, on top of a RUR 4 billion issued in mid 2008 to pay for the

acquisition of Priargunsky, Khiagda and Dalur. In November 2009 SC

Rosatom paid a further RUR 33 billion for ARMZ shares, increasing its

equity to 76.1%.

In 2009 and 2010 ARMZ took a 51% share in Canadian-based Uranium One

Inc, paying for this with $610 million in cash and by exchange of assets

in Kazakhstan: 50% of JVs Akbastau, Karatau and Zarechnoye, mining the

Budenovskoye and Zarechnoye deposits. (An independent financial advisor

put the value of ARMZ's stakes in the Akbastau and Zarechnoye JVs at

$907.5 million.) Uranium One has substantial production capacity in

Kazakhstan, including now those two mines with Karatau, Akdala, South

Inkai and Kharasan, as well as small prospects in USA and Australia. In

2013 ARMZ completed the purchase of outstanding shares in Uranium One,

and it became a full subsidiary of ARMZ.

Following this, Rosatom established Uranium One Holding NV (U1H) as

its platform for all international uranium mining assets belonging to

Russia, with headquarters in Amsterdam. It lists assets in Kazakhstan,

USA, Australia and Tanzania. In 2013 it accounted for 5086 tU production

at average cash cost of $16/lb U3O8, and reported

229,453 tU measured, indicated and inferred resources (attributable

share). The company plans to extend its interests into rare earths. Its

‘strategic partner’ is JSC NAC Kazatomprom.

ARMZ remains responsible for uranium mining in Russia. At the end of

2013 it was 82.75% owned by Rosatom and 17.25% TVEL. Exploration

expenditure has nearly doubled in two years to about US$ 52 million in

2008. In 2013 the government approved an exploration budget of RUR 14

billion ($450 million) through to 2020, principally in the Far East and

Northern Siberia. Deposits suitable for ISL mining will be sought in the

Transurals, Transbaikal and Kalmykyia. Other work will be in the Urals,

Siberian, Far East Federal Districts (Zauralsky, Streltsovsky, Vitimsky

and Vostochno-Zabaikalsky, and Elkonsky ore regions).

CJSC Rusburmash (RBM) is the exploration subsidiary of ARMZ.

In December 2010 ARMZ made a $1.16 billion takeover bid for

Australia's Mantra Resources Ltd which has a prospective Mkuju River

project in southern Tanzania, which was expected in production about

2013 at 1400 tU/yr. This is now under U1H.

Domestic mining

In 2009 the government accepted Rosatom’s proposal for ARMZ and

Elkonsky Mining and Metallurgical Combine to set up the “open-type joint

stock company” EGMK-Project. The state’s contribution through Rosatom

to the EGMK-Project authorized capital will be RUR 2.657 billion,

including RUR 2.391 billion in 2009 and RUR 0.266 billion in 2010.

EGMK-Project is being set up to draw up the project and design

documentation for Elkonsky Mining and Metallurgical Combine (see below).

The Russian Federation’s main uranium deposits are in four districts:

- The Trans-Ural district in the Kurgan region between Chelyabinsk and Omsk.

- Streltsovskiy in the Transbaikal or Chita region of SE Siberia near the Chinese and Mongolian borders.

- The Vitimsky district in Buryatia about 570 km northwest of Krasnokamensk.

- The more recently discovered remote Elkon district in the Sakha Republic (Yakutia) some 1200 km north-northeast of the Chita region.

Present production by ARMZ is principally from the Streltsovskiy

district, where major uranium deposits were discovered in 1967, leading

to large-scale mining, originally with few environmental controls. These

are volcanogenic caldera-related deposits. Krasnokamensk is the main

town serving the mines.

In 2008 ARMZ said that it intended to triple production to 10,300 tU

per year by 2015, with some help from Cameco, Mitsui and local

investors. ARMZ planned to invest RUR 203 billion (US$ 6.1billion) in

the development of uranium mining in Russia in 2008-2015. It aimed for

20,000 tU per year by 2024. Total cost was projected at RUR 67 billion

($2 billion), mostly at Priargunsky, with RUR 4.8 billion ($144 million)

there by end of 2009 including a new $30 million, 500 tonne per day

sulfuric acid plant commissioned in 2009, replacing a 1976 acid plant.

Russian uranium mining

| Production centre | Region | First production | Orebody | Known resources: tU | Capacity: tU/yr |

|---|---|---|---|---|---|

| Priargunsky | Transbaikal/ Chita | 1968 | volcanic | 98,000 | 3000 |

| Dalur | Trans-ural/ Zauralsk | 2004 | sandstone | 11,000 | 800 |

| Khiagda | Vitimsky, Buryatia | 2010 | sandstone | 32,000 | 1000 |

| Gornoye | Transbaikal/ Chita | deferred | granite | 3200 | 300 |

| Olovskaya | Transbaikal/ Chita | deferred | volcanic | 8210 | 600 |

| Elkon | Yakutia/ Sakha | (2020) | metasomatite | 303,600 | 5000 |

| Lunnoye | Yakutia/ Sakha | (2016?) | polymetallic | 800 | 100 with gold |

Source: 2014 ‘Red Book’ except Olovskaya and Lunnoye.

Russian uranium production, tonnes U

| Production centre | 2012 | 2013 | 2014 | 2015 |

| Priargunsky | 2011 | 2133 | 1970 | |

| Dalur | 529 | 562 | 578 | |

| Khiagda | 332 | 440 | 442 | plan 500+ |

| Gornoye | - | - | ||

| Olovskaya | - | - | ||

| Elkon | - | - | ||

| Lunnoye | - | - | ||

| Total | 2872 | 3135 | 2990 |

Trans-Ural/Zauralsk district, Kurgan region

A modest level of production is from Dalur in the

Trans-Ural or Zauralsk uranium region. This is a low-cost (US$ 40/kg)

acid in situ leach (ISL) operation in sandstones. Uksyanskoye is the

town supporting Dalur mine. ARMZ’s 2008 plan had production at Dalur by

acid ISL increasing from 350 to 800 tU/yr by 2019 (expanding from the

Dalmatovskoye field to Khokhlovskoye then Dobrovolskoye). In 2014 it

produced 578 tU. In 2014 JSC Dalur completed further exploration of the

Khokhlovskoye deposit and increased its resources from 4700 to 5500

tonnes. Production from it will increase from 50 tU in 2015 to 200 t/yr

by 2019. Dalur reserves in 2013 were quoted by ARMZ at 9,900 tonnes.

Streltsovskiy district, Chita/ Transbaikal region

Here, several large underground mines operated by JSC Priargunsky

Industrial Mining and Chemical Union (PIMCU – 85% ARMZ) supply

low-grade ore to a central mill near Krasnokamensk. Historical

production from Priargunsky is reported to be 140,000 tU (some from open

cut mines) and 2011 known resources (RAR + IR) are quoted as 115,000 tU

at 0.159%U. In 2013 ‘reserves’ were quoted by ARMZ at 108,700 tonnes.

Production is up to about 3000 tU/yr, about one tenth of it from heap

leaching. In 2014 production was 1970 tU.

The company has six underground mines, most of them operating: Mine

#1, Mine #2, Glubokiy Mine, Shakhta 6R, Mine #8 with extraction from

Maly Tulukui deposit, and Mine #6 developing the Argunskoye and

Zherlovoye deposits. In 2014 PIMCU closed Mine #2 temporarily and

commenced full production from Mine #8. Mining the Tulukui pit

(apparently of mine #4) ceased in the early 1990s due to low grades, but

now low-cost block-type underground leaching will be employed in the

pit bottom from March 2015 to recover the remaining 6000 tU. Following

this the pit will be filled with low-grade ore for heap leaching. Mine

#2 was making a loss in 2013 due to market conditions, and stoping

operations resumed in February 2015, with production target 130 tU for

the year, from average grade 0.15%. It is now known as section 2 of

mine #8. Some production has been exported to France, Sweden and Spain.

ARMZ's 2008 plan called for Priargunsky's production to be expanded

from 3000 to 5000 tU/yr by 2020. Mine #6 development began in 2009 for

stage 1 production from 2015 to reach full capacity in 2019, at a cost

of RUR 30 billion ($975 million), but this was put on hold in 2013. In

March 2015 ARMZ said it hoped to find co-investors in the project, and

federal funds may be forthcoming. Stage 2 was to commence in 2024. Mine

#8 began producing in 2011, towards phase 1 target capacity of 400 t/yr

by the end of 2014. Total cost of development will be RUR 4.8 billion

(RUR 3.5 billion for phase 1). However, a re-evaluation of reserves in

2012 suggested that mineable resources apart from Mine #6 amounted to

only 32,000 tU. Mine #8 resources were quoted at 12,800 tU in December

2012. In 2014 PIMCU investigated the

Streltsovskoye ore field, as part of the Kaldera project. Four

promising areas over 100 sq km were identified with resources estimated

at 80,000 tU, and they will be explored over 2015-17.

In 2014 PIMCU completed an upgrade of its sulfuric acid plant to take

daily production from 400 to 500 tonnes, for use in both the

conventional mill and in underground and heap leaching. Also the mill

(hydrometallurgical plant) process was improved.

Development of Olovskoye and Gornoye deposits* in

the Transbaikal region near Priargunsky towards Khiagda would add 900

tU/yr production for RUR 135 billion ($5.7 billion). Measured resources

together are 12,200 tU and inferred resources 1600 tU, all at 0.072%

average (JORC-compliant). In 2007 newly-formed ARMZ set up two companies

to undertake this, and possibly attract some foreign investment:

- Gornoye Uranium Mining Company to develop the Gornoye and Berezovoye mines in the Krasnochikoysky and Uletovsky districts in Chita, with underground mining and some heap leach (ore grade 0.226%U) to produce 300 tU/yr from 2014.

- Olovskaya Mining & Chemical Company to develop the Olovskoye deposits in the Chernyshevsk district of Chita region with underground, open cut and heap leach to produce 600 tU/yr from 2016.

- However, according to the 2014 'Red Book', both these are on hold.

* 2006 plans were for 2000t/yr at new prospects in

Chita Region and Buryatia (Gornoye, Berezovoye, Olovskoye, Talakanskoye

properties etc.), plus some 3000t at new deposits.

In 2006 Priargunsky won a tender to develop Argunskoye and Zherlovoye

deposits in the Chita region with about 40,000 tU reserves. Dolmatovsk

and Khokhlovsk have also been identified as new mines to be developed

(location uncertain).

Vitimsky district, Buryatia

JSC Khiagda's operations are at Vitimsky

in Buryatia about 570 km northwest of Krasnokamensk, serving

Priargunsky's operations in Chita region, and 140 km north of Chita

city. They are starting from a low base – in 2010 production from the

Khiagdinskoye ore field was 135 tU, rising to 440 tU in 2013 (fully

utilising the pilot plant) and targeting 1000 tU/yr from 2018 with a new

plant. These are a low-cost (US$ 40/kg) acid in situ leach (ISL)

operations in sandstones, and comprise the only ISL mine in the world in

permafrost. Groundwater temperature is 1-4°C, giving viscosity

problems, especially when winter air temperature is -40°C. The main

uranium mineralisation is a phosphate, requiring oxidant addition to the

acid solution. In the Khiagdinskoye field itself there are eight

palaeochannel deposits over 15 x 8 km, at depths of 90 to 280 metres

(average 170 m). Single orebodies are up to 4 km long and 15 to 400 m

wide, 1 to 20 m thick.

JSC Khiagda has resources of 55,000 tU amenable to ISL mining, with

potential estimated at 100,000 tU, though in 2013 ‘reserves’ were quoted

by ARMZ at 39,800 tonnes. The 2008 ARMZ plan envisaged production from

JSC Khiagda's project increasing to 1800 tU/yr by 2019, but in 2013 the

higher target was postponed. In 2014 JSC Khiagda continued construction

of the main production facility and on the sulfuric acid plant which is

due for commissioning in mid-2015. Its design capacity is 110,000 t/yr.

The company aims to start mining the Istochnoye and Vershinnoye deposits

5-10 km from Khiagdinskoye from 2016 and 2017 respectively, and

development of these is proceeding. In 2013 reserves were confirmed for

the Dybrynskoye, Koretkondinskoye, Kolichikanskoye and Vershinnoye

fields or deposits. The other two fields in the immediate vicinity are

Namaru and Tetrakhskoye. All these occur over an area about 50 x 20 km

and within 15 km of Khiagdinskoye field. There are also plans to install

plant for extracting rare earth oxides (REO) as by-product. The nearest

towns are Romanovka, 133 km north of Chita, and Bagdarin.

Elkon district, Sakha/Yakutia

ARMZ’s principal focus is development of the massive Elkon

project with several mines in the Sakha Republic (Yakutia) some 1200 km

north-northeast of the Chita region. The Elkon project is in a

mountainous region with difficult climate conditions and little

infrastructure, making it a challenging undertaking. Production from

metasomatite deposits is planned to ramp up to 5000 tU/yr over ten

years, for RUR 90.5 billion ($3 billion), and 2020 start up is now

envisaged. Elkon is set to become Russia's largest uranium mining

complex, based on resources of over 270,000 tU. It will involve

underground mining, radiometric sorting, milling, processing and uranium

concentrate production.

Elkon Mining and Metallurgical Combine (EMMC) was set up by ARMZ to

develop the substantial Elkonsky deposits. The Elkon MMC project

involves the JSC Development Corporation of South Yakutia and aims to

attract outside funding to develop infrastructure and mining in a

public-private partnership, with ARMZ holding 51%. Foreign equity

including from Japan, South Korea and India is envisaged, and in March a

joint venture arrangement with India was announced. The Elkon MMC

developments are to become “the locomotive of the economic development

of the entire region”, building the infrastructure, electricity

transmission lines, roads and railways, as well as industrial

facilities, from 2010. Of 15 proposed construction sites, three have

been tentatively selected: at the mouth of Anbar River, Diksi Village

and Ust-Uga Village. The building of four small floating co-generation

plants to supply heat and electricity to northern regions of Yakutia is

linked with the Elkon project in southern Yakutia.

There are eight deposits in the Elkon project with resources of

320,000 tU* (RAR + IR) at average 0.146%U, with gold by-product: Elkon,

Elkon Plateau, Kurung, Neprokhodimoye, Druzhnoye (southern deposits), as

well as Severnoye, Zona Interesnoye and Lunnoye (see above). In mid

2010 ARMZ released JORC-compliant resource figures for the five southern

deposits: 71,300 tU as measured and indicated resources, and 158,500 tU

as inferred resources, averaging 0.143%U. ARMZ pointed out that the

resource assessment against international standards will increase the

investment attractiveness of EMMC. However, in September 2011 ARMZ said

that production costs would be US$ 120-130 /kgU, which would be

insufficient in the current market, and costs would need to be cut by

15-20%.

* 257,800 tU of this was in the five southern

deposits. The 2011 Red Book gives 271,000 tU resources for Elkon, or

319,000 tU in situ.

First production from EMMC was expected in 2015 ramping up to 1000

tU/yr in 2018, 2000 tU/yr in 2020 and 5000 tU/yr by 2024 based on the

southern deposits as well as Severnoye and Zona Interesnoye. This

schedule has slipped by about five years. Also, it is remote, and mining

will be underground, incurring significant development costs. ARMZ and

EMMC are seeking local government (Sakha) support for construction of

main roads and railways to access the Elkon area, and make investment

there more attractive.

JSC Lunnoye was set up by ARMZ at the same time as

EMMC to develop a small deposit jointly by ARMZ (50.1%) and a gold

mining company Zoloto Seligdara as a pilot project to gain practical

experience in the region in a polymetallic orebody. Lunnoye is expected

in full production in 2016, reaching 100 tU/yr. It has reserves of 800

tU and 13 t gold, and is managed by Zoloto Seligdara. ARMZ in mid 2011

expressed impatience with the rate of development.

Further prospects

The Federal Subsoil Resources Management Agency (Rosnedra) was

planning to transfer about 100,000 tonnes of uranium resources to