Obama: AS Tidak Akan Perangi Rusia

Islam

Times -

Mengesampingkan aksi militer AS di Ukraina, Obama mengatakan,

"Ada jalan yang lebih baik, saya pikir...terlibat secara militer dengan

Rusia tidak akan sesuai dan tidak akan baik untuk Ukraina juga."

AS, Rusia dan Gejolak Ukrainia -

Presiden AS, Barack Obama mengesampingkan keterlibatan militer di Ukraina dan mengatakan Washington seharusnya tidak memicu perang yang sebenarnya dengan Rusia.

Dalam wawancara dengan NBC News, Rabu (19/3/14), Obama mengatakan, "Kami tidak akan masuk ke ranah militer di Ukraina."

"Kami tidak perlu memicu perang yang sebenarnya dengan Rusia," katanya beberapa jam setelah USS Truxtun, kapal perusak pemandu rudal Angkatan Laut AS, memulai latihan bersama dengan kapal Rumania dan Bulgaria beberapa ratus kilometer dari lokasi pasukan Rusia yang dikerahkan di Laut Hitam semenanjung Crimea.

Tapi Obama menyatakan bahwa pemerintahannya terus menekan Rusia atas perannya dalam pemisahan Crimea dari Ukraina.

Hampir 97 % warga Crimea memilih melepaskan diri dari Ukraina dan bergabung dengan Rusia dalam referendum yang menyulut krisis terbesar dalam hubungan antara AS dan Rusia sejak Perang Dingin.

Mengesampingkan aksi militer AS di Ukraina, Obama mengatakan, "Ada jalan yang lebih baik, saya pikir...terlibat secara militer dengan Rusia tidak akan sesuai dan tidak akan baik untuk Ukraina juga."

Dalam pidatonya di sidang gabungan Parlemen Rusia di Kremlin, hari Selasa (18/3/14) Putin menyebut referendum Crimea sebagai demokratis dan sah serta mengatakan bahw wilayah tersebut merupakan bagian tak terpisahkan dari Rusia.

Pemimpin Rusia itu juga menyebut AS dan sekutunya munafik karena mereka mendukung referendum kemerdekaan Kosovo dari Serbia tapi sekarang menyangkal hak yang sama bagi rakyat Crimea. "Anda tidak biisa menyebut hal yang sama hitam pada hari ini dan putih pada esok hari." [IT/r]

Hegemoni Global AS

(Berikut adalah petikan surat seru jurnalis kawakan, Eric Sommer, yang dialamatkan kepada para koleganya yang bekerja di media massa utama yang selama ini menjadi corong kepentingan AS dan Barat)

Wahai jurnalis media massa AS, tangan sebagian besar kalian yang menulis di CNN, Fox News, New York Times, dan Washington Post berlumuran darah. Mulanya ini mungkin terdengar berlebihan, tapi kalian terlibat dalam pembunuhan massal.

Ingatkah kalian terhadap sidang Nuremberg terhadap para penjahat perang Nazi pada akhir Perang Dunia II? Saat itu jaksa penuntut dengan kuat berpendapat bahwa para jurnalis yang menggunakan propaganda untuk menjadikan masyarakat menerima kejahatan perang itu sendiri juga bersalah atas kejahatan tersebut.

Selama berangsungnya perang Irak--perang agresi tak beralasan--banyak dari kalian mengulang tanpa henti, tanpa kritik atau keraguan yang semestinya, klaim palsu rezim Bush bahwa ada senjata pemusnah massal di Irak, dan entah bagaimana, invasi militer itu dibenarkan.

Dengan membantu memproduksi persetujuan publik terhadap perang itu, dan mengintimidasi lawan perang, kalian terlibat dalam mengirimkan ribuan lelaki dan perempuan muda Amerika ke luar negeri untuk membunuh dan dibunuh, ribuan dari mereka tewas, puluhan hingga ratusan ribu terluka atau secara mental mengalami trauma, belum lagi lebih satu juta warga Irak tewas akibat perang.

"Dalam Enam Bulan Menuju Invasi", komentator sosial terkenal Bill Moyers mengatakan, "Washington Post akan mengeditorialkan dukungan terhadap perang sedikitnya 27 kali."

Di antara lusinan kolumnis berita media massa yang menyiapkan [dukungan] masyarakat terhadap perang adalah kolumnis Washington Post, Charles Krauthammer, yang bahkan berpendapat bahwa invasi Irak akan membawa demokrasi ke Timur Tengah.

Wakil presiden Wall Street Journal dan halaman editorial Paul Gigot, mengatakan kepada publik, "Pasukan Koalisi akan menemukan senjata mematikan dan membahagiakan rakyat Irak... Ketika mereka membebaskan negara ini."

Fred Barnes, kontributor Fox News, menyatakan bahwa Irak memiliki, "Senjata pemusnah massal, terdapat kendaraan pengiriman, dan itu disebut teroris, itu disebut al-Qaeda."

Tentu saja, tak ada senjata pemusnah massal atau teroris al-Qaeda di Irak, dan kehadiran al-Qaeda di Irak saat ini hanyalah *konsekuensi" dari kehancuran dan destabilisasi akibat invasi.

Sekarang banyak dari kalian yang bekerja untuk media massa korporasi lagi-lagi melakukan itu--mengutuk Rusia dan Putin, menyiapkan publik untuk menerima kebutuhan 'menghukum iblis'. Propaganda kalian menyembunyikan fakta bahwa dua partau neo-Nazi, Svoboda dan Sektor Kanan, telah menguasai militer dan aparat keamanan Ukraina--mereka sekarang para menteri departemen-departemen tersebut--melalui perebutan kekuasaan dengan cara kekerasan dari tangan pemerintah yang terpilih secara demokratis.

Kalian mengabaikan fakta bahwa Rusia memiliki pangkalan militer dan berdasar perjanjian, Rusia berhak menempatkan tentaranya di Crimea. Kalian dengan enteng menyajikan argumen pemerintah AS bahwa kesediaan Rusia untuk membantu melindungi warga Crimean dari pasukan fasis, entah bagaimana, adalah "agresi", kendati mereka tidak melepaskan satu peluru pun, dan bahwa sanksi AS atau bahkan aksi militer mungkin "diperlukan" untuk "melindungi Ukraina".

Realitas di lapangan tanpa malu-malu didistorsi oleh sejumlah besar wartawan media untuk membantu menyiapkan opini publik bagi ancaman, sanksi, atau bahkan aksi militer terhadap Rusia. The New York Times berpendapat bahwa "klaim Putin seputar ancaman langsung terhadap warga Ukraina berbahasa Rusia sebagai 'kosong'".

The Guardian Inggris mengecam salah satu pernyataan pejabat Rusia bahwa warga Ukraina berbahasa Rusia dan minoritas lainnya terancam kekuatan fasis "sebagai keliru". Ratusan artikel di media massa lainnya telah menggemakan sentimen jenis ini, seraya memberi kesan bahwa kekhawatiran Rusia tak lain hanyalah selubung bagi pencaplokan wilayah.

Kenyataannya, enam menteri dalam pemerintahan Ukraina yang tidak terpilih berasal dari dua partai fasis, Svoboda dan Sektor Kanan... Kembali ke masa Anda--menggunakan kekuatan pers--juga tanpa kritik mendukung pemerintah AS memasok senjata, pelatihan, dan uang secara besar-besaran kepada Bin Laden dan 'jihadis kekebasan' lainnya di Afghanistan. Pukulan balik dari usaha itu adalah tragedi 9/11, serta penyebaran para teroris al-Qaeda pimpinan Bin Laden yang disokong AS ke seluruh dunia.

Tanda-tanda masalah pertama dari dukungan terhadap 'para pejuang kekebasan Ukraina' sudah muncul. Beberapa anggota 'pemerintah Ukraina' yang tidak terpilih di Kiev menyerukan untuk mempersenjatai dirinya dengan senjata nuklir jika AS tidak memaksa Crimea untuk tetap menjadi bagian Ukraina. Perkembangan ini akan menempatkan senjata pemusnah massal dengan kekuatan tak terbayangkan di tangan dua partai fasis yang kini menguasai militer dan kementerian keamanan. (IT/GR/rj)

Eric Sommer: Tangan Jurnalis Media Barat "Berlumuran Darah"

Islam

Times- http://www.islamtimes.org/vdcgtw9wyak93y4.1ira.html

Wahai jurnalis media massa AS, tangan sebagian besar kalian yang

menulis di CNN, Fox News, New York Times, dan Washington Post

berlumuran darah. Mulanya ini mungkin terdengar berlebihan, tapi kalian

terlibat dalam pembunuhan massal.

Tangan-tangan media berlumur darah (http://www.sowetanlive.co.za)

(Berikut adalah petikan surat seru jurnalis kawakan, Eric Sommer, yang dialamatkan kepada para koleganya yang bekerja di media massa utama yang selama ini menjadi corong kepentingan AS dan Barat)

Wahai jurnalis media massa AS, tangan sebagian besar kalian yang menulis di CNN, Fox News, New York Times, dan Washington Post berlumuran darah. Mulanya ini mungkin terdengar berlebihan, tapi kalian terlibat dalam pembunuhan massal.

Ingatkah kalian terhadap sidang Nuremberg terhadap para penjahat perang Nazi pada akhir Perang Dunia II? Saat itu jaksa penuntut dengan kuat berpendapat bahwa para jurnalis yang menggunakan propaganda untuk menjadikan masyarakat menerima kejahatan perang itu sendiri juga bersalah atas kejahatan tersebut.

Selama berangsungnya perang Irak--perang agresi tak beralasan--banyak dari kalian mengulang tanpa henti, tanpa kritik atau keraguan yang semestinya, klaim palsu rezim Bush bahwa ada senjata pemusnah massal di Irak, dan entah bagaimana, invasi militer itu dibenarkan.

Dengan membantu memproduksi persetujuan publik terhadap perang itu, dan mengintimidasi lawan perang, kalian terlibat dalam mengirimkan ribuan lelaki dan perempuan muda Amerika ke luar negeri untuk membunuh dan dibunuh, ribuan dari mereka tewas, puluhan hingga ratusan ribu terluka atau secara mental mengalami trauma, belum lagi lebih satu juta warga Irak tewas akibat perang.

"Dalam Enam Bulan Menuju Invasi", komentator sosial terkenal Bill Moyers mengatakan, "Washington Post akan mengeditorialkan dukungan terhadap perang sedikitnya 27 kali."

Di antara lusinan kolumnis berita media massa yang menyiapkan [dukungan] masyarakat terhadap perang adalah kolumnis Washington Post, Charles Krauthammer, yang bahkan berpendapat bahwa invasi Irak akan membawa demokrasi ke Timur Tengah.

Wakil presiden Wall Street Journal dan halaman editorial Paul Gigot, mengatakan kepada publik, "Pasukan Koalisi akan menemukan senjata mematikan dan membahagiakan rakyat Irak... Ketika mereka membebaskan negara ini."

Fred Barnes, kontributor Fox News, menyatakan bahwa Irak memiliki, "Senjata pemusnah massal, terdapat kendaraan pengiriman, dan itu disebut teroris, itu disebut al-Qaeda."

Tentu saja, tak ada senjata pemusnah massal atau teroris al-Qaeda di Irak, dan kehadiran al-Qaeda di Irak saat ini hanyalah *konsekuensi" dari kehancuran dan destabilisasi akibat invasi.

Sekarang banyak dari kalian yang bekerja untuk media massa korporasi lagi-lagi melakukan itu--mengutuk Rusia dan Putin, menyiapkan publik untuk menerima kebutuhan 'menghukum iblis'. Propaganda kalian menyembunyikan fakta bahwa dua partau neo-Nazi, Svoboda dan Sektor Kanan, telah menguasai militer dan aparat keamanan Ukraina--mereka sekarang para menteri departemen-departemen tersebut--melalui perebutan kekuasaan dengan cara kekerasan dari tangan pemerintah yang terpilih secara demokratis.

Kalian mengabaikan fakta bahwa Rusia memiliki pangkalan militer dan berdasar perjanjian, Rusia berhak menempatkan tentaranya di Crimea. Kalian dengan enteng menyajikan argumen pemerintah AS bahwa kesediaan Rusia untuk membantu melindungi warga Crimean dari pasukan fasis, entah bagaimana, adalah "agresi", kendati mereka tidak melepaskan satu peluru pun, dan bahwa sanksi AS atau bahkan aksi militer mungkin "diperlukan" untuk "melindungi Ukraina".

Realitas di lapangan tanpa malu-malu didistorsi oleh sejumlah besar wartawan media untuk membantu menyiapkan opini publik bagi ancaman, sanksi, atau bahkan aksi militer terhadap Rusia. The New York Times berpendapat bahwa "klaim Putin seputar ancaman langsung terhadap warga Ukraina berbahasa Rusia sebagai 'kosong'".

The Guardian Inggris mengecam salah satu pernyataan pejabat Rusia bahwa warga Ukraina berbahasa Rusia dan minoritas lainnya terancam kekuatan fasis "sebagai keliru". Ratusan artikel di media massa lainnya telah menggemakan sentimen jenis ini, seraya memberi kesan bahwa kekhawatiran Rusia tak lain hanyalah selubung bagi pencaplokan wilayah.

Kenyataannya, enam menteri dalam pemerintahan Ukraina yang tidak terpilih berasal dari dua partai fasis, Svoboda dan Sektor Kanan... Kembali ke masa Anda--menggunakan kekuatan pers--juga tanpa kritik mendukung pemerintah AS memasok senjata, pelatihan, dan uang secara besar-besaran kepada Bin Laden dan 'jihadis kekebasan' lainnya di Afghanistan. Pukulan balik dari usaha itu adalah tragedi 9/11, serta penyebaran para teroris al-Qaeda pimpinan Bin Laden yang disokong AS ke seluruh dunia.

Tanda-tanda masalah pertama dari dukungan terhadap 'para pejuang kekebasan Ukraina' sudah muncul. Beberapa anggota 'pemerintah Ukraina' yang tidak terpilih di Kiev menyerukan untuk mempersenjatai dirinya dengan senjata nuklir jika AS tidak memaksa Crimea untuk tetap menjadi bagian Ukraina. Perkembangan ini akan menempatkan senjata pemusnah massal dengan kekuatan tak terbayangkan di tangan dua partai fasis yang kini menguasai militer dan kementerian keamanan. (IT/GR/rj)

Israel Siap-siap Serang Situs Nuklir Iran!

Islam

Times - http://www.islamtimes.org/vdccx1q1x2bqe48.5fa2.html

Menurut surat kabar Haaretz, hari Rabu (19/3/14), Tel Aviv

telah mengalokasikan lebih dari 2,8 miliar dolar dari anggaran Israel

tahun ini untuk persiapan menyerang Iran.

Perang Iran vs Zionis Israel.jpg

Perdana Menteri Israel, Benjamin Netanyahu telah memerintahkan tentara Israel untuk terus mempersiapkan serangan militer pada fasilitas nuklir Iran tahun ini.

Menurut surat kabar Haaretz hari Rabu (19/3/14), Tel Aviv telah mengalokasikan lebih dari 2,8 miliar dolar dari anggaran Israel tahun ini untuk persiapan menyerang Iran.

Sejauh ini, Tel Aviv terus meningkatkan retorika perang di tengah upaya perundingan demi mencari kesepakatan final dalam program energi nuklir Iran.

Iran dan kekuatan dunia menyelesaikan putaran terbaru negosiasi mereka di Wina hari Rabu (19/3/14). Kedua belah pihak menggambarkan perundingan itu sebagai perundingan yang berguna dan konstruktif.

Israel berulang kali mengumbar serangan militer terhadap Iran terkait program energi nuklir Republik Islam itu. Sebagai jawaban, Pemimpin Tinggi Revolusi Islam, Ayatullah Sayyid Ali Khamenei memperingatkan bahwa Iran akan menghancurkan kota-kota Israel dari Tel Aviv sampai Haifa jika rezim itu menyerang fasilitas nuklir Iran.[IT/r]

Siasat Kerry untuk Caplok Ukraina, Palestina, dan Suriah (I)

Islam

Times- http://www.islamtimes.org/vdcjytetmuqemhz.bnfu.html

"Amerika Serikat telah merencanakan peristiwa keempat, 'revolusi

berwarna' di Venezuela, namun kalangan oposisi gagal menggalang

dukungan rakyat," lanjutnya. Dan, kartu ini kelak akan dimainkan.

Jhon Kerry

Tiga peristiwa mementas di kancah internasional: di satu sisi, krisis Barat-Rusia seputar Ukraina, di sisi lain, perang rahasia yang dikobarkan negara-negara Teluk satu sama lain, dan akhirnya undang-undang pemilu yang diadopsi Dewan Suriah, yang secara de facto mencoret kandidat dari warga yang kabur dari negaranya selama perang.

Demikian ungkap jurnalis pendiri Voltaire Network dan Poros Konferensi Perdamaian, Thierry Meyssan. "Amerika Serikat telah merencanakan peristiwa keempat, 'revolusi berwarna' di Venezuela, namun kalangan oposisi gagal menggalang dukungan rakyat," lanjutnya. Dan, kartu ini kelak akan dimainkan.

"Langkah pertama yang ditempuh Washington adalah, bagaimana membalik kekalahan di Ukraina menjadi kemenangan ekonomi," terang Meyssan. Krisis di Ukraina, lanjutnya, jelas-jelas dirancang dan dilaksanakan pihak Barat.

"[Untuk itu] dibutuhkan sebentuk kudeta yang berlatar belakang kekerasan ala tayangan televisi," ujar Meyssan. Namun Rusia menanggapi dengan cekatan, mengikuti strategi Sun Tzu, mengambil Crimea tanpa perlawanan seraya meninggalkan masalah ekonomi dan politik negara untuk lawan-lawannya.

"Kendati Brussels dan Washington menggerutu, pihak Barat tidak akan mengambil kesempatan kedua dan tidak akan menerapkan sanksi ekonomi yang signifikan terhadap Moskow," kata Meyssan. Pasalnya, Uni Eropa mengekspor 7 persen produksinya ke Rusia (123 miliar euro dalam bentuk peralatan mesin, mobil, bahan kimia...) dan mengimpor 12 persen kebutuhannya (terutama hidrokarbon sebesar 215 miliar euro). "Dengan begitu, Inggris, Jerman, Italia, Belanda, Polandia, dan Perancis akan sangat terpengaruh," imbuhnya.

Citibank, lanjut Meyssan, sebagian besar dibiayai aset Rusia yang mulai menguap, sebagaimana diperlihatkan secarik memo internal Downing Street yang difoto pers Inggris. "Perusahaan BP, Shell, Eni, Volkswagen, Continental, Siemens, Deutsche Telecom, Reiffsen, Unicredit, dan masih banyak lainnya, akan jatuh," ujarnya.

Di AS, kata Meyssan, situasinya lebih baik, namun beberapa perusahaan multinasional, seperti perusahaan terbesar kedua di negara itu, Exxon, punya aset cukup besar di Rusia. "Kendati begitu, Washington tetap menggunakan bahasa sangat keras yang menuntutnya untuk bereaksi," sambungnya.

Kudeta (Ukraina) memang disiapkan kaum radikal rezim (Victoria Nuland, John McCain...) dan awalnya mempermalukan Obama. "Namun, setiap hal yang terjadi justru menawarkan kesempatan tak terduga bagi penyelesaian krisis ekonominya dengan mengorbankan para sekutunya: bila kerusuhan di Ukraina menyebar ke kancah ekonomi atau kebijakan di Eropa, modal yang saat ini bertumpuk di benua tua itu akan mengalir ke Wall Street," papar Meyssan.

Ini akan mewujudkan doktrin Wolfowitz 1992 (mencegah Uni Eropa menjadi pesaing potensial AS) dan teori Christina Romer 2009 (selamatkan ekonomi AS dengan menyerap modal Eropa sebagai akhir dari krisis 1929). "Itulah mengapa kita, setidaknya 'seolah-olah', harus mengharapkan penangguhan hubungan diplomatik Washington-Moskow dan resesi parah di Eropa pada 2014," tegasnya.

Dengan kondisi tersebut, lanjut Meyssan, penerapan perjanjian umum bagi perdamaian di Timur Tengah akan semakin sumir... "Sampai sekarang, proyek Jenewa 3 untuk Suriah dihentikan selamanya, sementara "perdamaian" 'Israel'-Palestina... ditorpedo Liga Arab yang untuk saat ini menentang [hanya] pengakuan terhadap 'Israel' sebagai 'Negara Yahudi' (bukan eksistensinya--red.)," ujarnya. (IT/VN/rj)

Siasat Kerry untuk Caplok Ukraina, Palestina, dan Suriah (2)

Islam

Times- http://www.islamtimes.org/vdcd9o0sfyt09f6.lp2y.html

"Lupakan anatema antara Pelayan-Dua-Tempat-Suci (Khadimul

Haramayn) dan Pemimpin Besar Revolusi Islam Iran yang dengan rendah hati

menawarkan rekonsiliasi. Pertengkaran [di antara negara-negara Arab

Teluk] itu muncul seputar anggapan bahwa Ikhwanul Muslimin bukan gerakan

ideologis, melainkan kartu yang sedang dimainkan,"

John Kerry

"Elemen baru berikutnya adala perang diam-diam di antara negara-negara Teluk," kata Meyssan. Qatar mendukung upaya kudeta Ikhwanul Muslimin di Uni Emirat Arab (UEA) pada November tahun lalu.

"UEA, Arab Saudi, dan Bahrain baru-baru ini menangguhkan hubungan diplomatik dengan Qatar dan Saudi mensponsori pengeboman di Doha," ujar Meyssan. Qatar tampaknya tidak siap untuk menyerah terkait (dukungannya pada) Ikhwanul Muslimin--kelompok yang digunakan Washington untuk mengorganisasikan "Musim Semi Arab" sebelum menjatuhkannya.

Kebijakan negara-negara Teluk, ujar Meyssan, tak akan menjadi sekumpulan persoalan rumit jika saja para raja operet itu tidak mencampuradukkan kepentingan negaranya dengan ambisi pribadi dan dayatarik duniawi. "Lupakan anatema antara Pelayan-Dua-Tempat-Suci (Khadimul Haramayn) dan Pemimpin Besar Revolusi Islam Iran yang dengan rendah hati menawarkan rekonsiliasi. Pertengkaran [di antara negara-negara Arab Teluk] itu muncul seputar anggapan bahwa Ikhwanul Muslimin bukan gerakan ideologis, melainkan kartu yang sedang dimainkan," paparnya.

Adapun unsur baru ketiga, lanjut Meyssan, adalah musyawarah Parlemen Suriah yang disiarkan televisi mengenai UU Pemilu berikutnya. "Pihak parlemen akhirnya mengadopsi ketentuan yang menyatakan bahwa para calon presiden harus pernah tinggal di negara itu selama sepuluh tahun terakhir. Ketentuan ini secara de facto mencoret warga yang melarikan diri dari Suriah selama perang [dari daftar calon presiden]," imbuhnya.

Utusan Khusus Sekretaris Jenderal Liga Arab dan PBB, Lakhdar Brahimi, kata Meyssan, langsung menyatakan bahwa pilihan ini kemungkinan akan menghentikan proses negosiasi seputar resolusi konflik. "Perancis kemudian mengajukan draft pernyataan pada Dewan Keamanan PBB untuk menghidupkan kembali perundingan Jenewa," ujarnya.

Kendati tidak menyebutkan undang-undang pemilihan umum baru tersebut, ini merupakan usaha terakhir Barat untuk mempertimbangkan perang di Suriah sebagai "revolusi" dan menyerahkan perdamaian berupa kesepakatan antara Damaskus dan oposisi boneka, sepenuhnya ke tangan Arab Saudi.

"Mantan juru bicara Dewan Nasional Suriah (SNC), Basma Kodmani, yang diculik di kedutaan Saudi, menekankann bahwa 'rezim Damaskus' tak akan mampu menggelar pemilihan presiden dan mengusulkan agar mempertimbangkan kegagalan di masa perang ini sebagai bukti bahwa itu merupakan kediktatoran," terang Meyssan.

NATO karenanya dapat kembali ke atas panggung dan menyelsaikan urusanya dengan Bashar al-Assad sebagaimana yang telah direncanakan sejak 2003, kendati telah kehilangan kesempatan (untuk mengeksploitasi) "pembantaian" pada 2011 dan "penegboman kimia" pada 2013. "Namun, setelah berdamai dengan Riyadh dan mengorganisasikan perundingan Jenewa 2 berdasar kebijakannya sendiri, Washington kembali kehilangan minatnya untuk berkolaborasi dengan penguasa Saudi dalam urusan Suriah," kata Meyssan.

Jika tak ada perundingan Jenewa 3, lanjutnya Barat akan menyerang Suriah (yang tidak lebih mungkin dari mengambil Crimea, sebagaimana yang telah kita saksikan musim panas ini), atau membiarkan situasi membusuk selama satu dekade, atau bahkan mengklaim bahwa "revolusi" itu dikooptasi kaum jihadis takfiri serta mengakui bahwa perang itu kini menjadi persoalan menarik bagi anti-terorisme global.

"John Kerry, sosok yang lebih sebagai pengusaha ketimbang diplomat, tak punya kebijakan pra-penetapan, melainkan hanya siasat," tegas Meyssan. Seperti biasa, Washington tidak akan memilih salah satu di atara pilihan itu, namun akan berupaya mati-matian untuk mendukung hasil yang lebih baik baginya, seraya mengejar pilihan lain... Tak lagi mampu bernegosiasi dengan Rusia, Washington akan melakukannya dengan sekutu militer Suriah lainnya, yaitu Iran.

Sepanjang tahun ini, (setelah gagal menyulut kerusuhan sipil di Iran beberapa tahun silam) Departemen Luar Negeri AS mengadakan pembicaraan dengan Republik Islam Iran, pertama di Oman, dan secara resmi dengan presiden baru, Hassan Ruhani (kendati, seluruh pembicaraan itu, sebagaimana ditegaskan Pemimpin Besar Revolusi Islam Ayatullah Ali Khamenei, harus dilaksanakan dalam kerangka diplomatik yang jujur, beritikad baik, dan saling menguntungkan).

"Tak ada urgensi bagi AS untuk menyelesaikan masalah Suriah," ujar Meyssan. Namun, sebaliknya, AS memandang penting untuk menjamin kelangsungan permukiman Yahudi di Palestina. Dalam hal ini, lanjutnya, Iran kembali menarik perhatian Departemen Luar Negeri AS seputar pengaruhnya yang dapat dikerahkan: atas perintahnya, kelompok Jihad Islam secara tiba-tiba membombardir perbatasan "Israel".

"Teheran, yang dikeluarkan dari perundingan Jenewa 2, telah melibatkan dirinya dalam sesuatu yang jauh lebih penting: negosiasi regional," kata Meyssan. Dalam keadaan ini, Senat AS akan menggelar sidang tentang "Suriah pasca Jenewa" dalam sepuluh hari. Pengistilahan itu menunjukkan bahwa perpanjangan "konferensi perdamaian" itu telah dikesampingkan.

"Para senator tidak akan mendengar dari kalangan pakar lembaga think-tank 'Israel' di Washington, seperti yang biasa mereka lakukan saat membahas Timur Tengah. Mereka hanya akan mendengar dari pemegang arsip di Departemen Luar Negeri yang menjadi strategis gerilya terbaik dan salah satu dari dua pakar Iran terkemuka mereka," papar Meyssan.

Pada akhirnya, "perdamaian" regional, jika harus terjadi, hanya dapat seperti yang dibayangkan John Kerry: mengorbankan rakyat Palestina ketimbang koloni Yahudi (zionis). "Sayyid Hassan Nasrallah jauh-jauh hari telah memperingatkan ketidakadilan ini," ujar Meyssan. Kini setiap orang tahu bahwa para pemimpin utama Palestina telah mengkhianati konstituennya sendiri. (IT/VN/rj)

Program Spionase Global AS

Salah satu pendiri Google, Larry Page mengutuk upaya spionase pemerintah AS sebagai ancaman terhadap demokrasi.

Page menutuk hal itu hari Rabu (19/3/14) di Vancouver, Kanada, setelah Sergey Brin (rekannya dalam pendirian Google) melakukan pertemuan virtual dengan whistleblower AS, Edward Snowden sehari sebelumnya.

"Sangatlah mengecewakan, pemerintah [AS] diam-diam melakukan semua hal ini dan tidak memberitahu kami," kata Page.

Page memperingatkan bahwa efek spionase online akan memicu pemblokiran penggunaan informasi pribadi untuk tujuan-tujuan yang bermanfaat.

Sebelumnya, CEO Facebook Mark Zuckerberg juga mengkritik Washington karena program spionase besar-besaran AS. Dia mengatakan pemerintah AS telah merusak kepercayaan publik terhadap internet dengan kegiatan surveilans AS itu.

Dokumen yang dirilis tahun lalu oleh Snowden mengungkapkan bahwa NSA secara sistematis memata-matai hubungan telepon dan aktivitas online jutaan orang di seluruh dunia.[IT/r]

Here's how to front-run

their $3.4 trillion plan

with a $1.00 gold miner.

Dear Reader,

http://www.angelnexus.com/o/web/57042?r=1

China has a problem we'd all like to have: too much cash.

In all, more than $3.4 trillion of it.

This mountain of currency comes in the form of euros, yen, pounds sterling, and — most of all — American dollars.

In fact, more than half of the Chinese foreign reserves are in U.S. dollars — close to $2 trillion at this point.

It's enough money to buy 1,000 B2 Stealth bombers, 140 nuclear-powered aircraft carriers, or all the real estate in Manhattan two and a half times over.

Now, while you might think this is a nice problem to have, to the Chinese, it's not so nice.

You see, China's cash holdings, like I mentioned, are broken up into several major world currencies:

More than 60% is invested in the good ol' greenback.

More than 60% is invested in the good ol' greenback.

Problem is that the greenback, like the yen and the euro, is a constantly depreciating asset.

In fact, when compared to the dollar of 100 years ago, today's money buys you barely 4% of what it did back when Henry Ford was turning out Model Ts...

Which means the Chinese are sitting on a mountain of money that's constantly eroding.

At today's dollar inflation rate, Chinese reserves are shedding $40 billion in purchasing power per year.

At today's dollar inflation rate, Chinese reserves are shedding $40 billion in purchasing power per year.

That's $110 million per day... $4.5 million per hour... $76,000 per minute.

In the time it took you to read the last two sentences, China's stash of greenbacks became $12,000 less valuable.

And that's not even counting the other $1.4 trillion in foreign currency, which drops in value at comparable rates as the European and Japanese economies tackle their own debt crises.

Losses like these are not sustainable even for a stagnant economy. For a burgeoning economy trying to support a rapidly developing national infrastructure, losses like these are catastrophic.

The Chinese, however, aren't the sort to just sit by and hope for the best.

Even as you're reading this, they're making moves that will ensure their own economic stability in the decades to come... and if it's something that has to come at the price of the dollar's unquestioned dominance in global economics, so be it.

In a few minutes, I'm going to explain China's master plan to shelter itself from the instability of a dollar-based global economy.

More importantly, I'm going to tell you about the commodity it's hoarding to make this happen...

... And let you in on how private citizens just like you and me can use the resulting boom market to personally profit.

But first, I want to show to you why the Chinese are doing what they're doing and introduce you to the shadowy man — perhaps the most powerful economic official alive today — who's pulling all the strings.

The Greenback's Retiring...

And You're Coming to the Party

(Whether You Like it or Not)

68 years ago, as the world

was emerging from the destruction of the Second World War to regroup and

rebuild, one nation emerged a superpower.

And with its rise, the U.S. gave the world the almighty dollar, which has been used as the world's default reserve currency ever since.

Whenever anything is evaluated today, whether it's a tract of land in Zambia or a shipyard in Japan, the universal measuring stick of its value is always dollars and cents.

For about four decades after the end of the war, this all worked very well for the U.S.

America was the world's biggest creditor, produced most of the world's goods, sold most of the world's goods, and spent most of the world's money.

It was only natural for the dollar to reign.

But eventually, sometime in the late 1980s, that balance shifted.

America went from a nation of producers to a nation of borrowers... on a personal as well as national level.

For most people drowning in debt, the first step to recovery is to limit spending.

For most people drowning in debt, the first step to recovery is to limit spending.

However, the situation is a bit different when you're the world's biggest economy and the owner of the world's reserve currency.

To pay off its debts, the U.S. usually just prints more money...

Millions upon millions of fresh new greenbacks — because that's what the world runs on.

As a nation, it's this privilege alone that allows us to maintain the cushy lifestyle, the public spending, the wars, and, most of all, the trillions in federal stimulus without cutting into our wealth too much.

The dollar is, after all, too big and too stable to ever falter, right?

Well, not exactly.

As we print more to cover our borrowing, the dollar's value — which is conjured out of thin air during additional late-night sessions over at the national mint — starts to approach zero.

Which is exactly what's been happening.

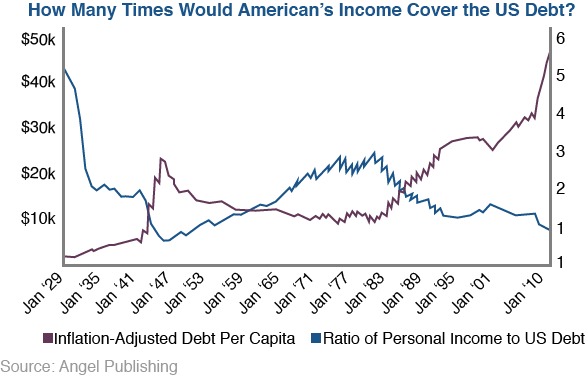

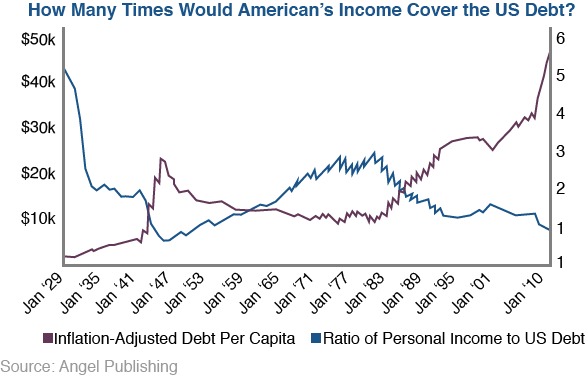

Now, you might look at the

above chart and claim that the rate of decrease is itself decreasing.

Heck, it's almost flat-lined at this point, so that's a good thing,

right?

Now, you might look at the

above chart and claim that the rate of decrease is itself decreasing.

Heck, it's almost flat-lined at this point, so that's a good thing,

right?

Again, not exactly... You see, the closer the value comes to zero, the smaller the fractional increments appear on a chart.

Going from 10% of the dollar's original 1900 buying power to 5% doesn't look that significant on a chart tracking the last 110 years of devaluation, but rest assured it's still a 50% hit to your wallet as the price of everything from bread to gas to iron ore doubles.

And it's all because the Fed keeps pumping out those dollars... more now, in fact, than ever before.

According to a recent Business Insider article:

It's exactly this policy

that raises the dollar value of financial assets like gold and silver,

allowing people who are already rich (who don't need to spend all or

most of their income on expendables like gas and food) to become even

richer as their hard assets achieve higher dollar values.

It's exactly this policy

that raises the dollar value of financial assets like gold and silver,

allowing people who are already rich (who don't need to spend all or

most of their income on expendables like gas and food) to become even

richer as their hard assets achieve higher dollar values.

But more to the point, it's this sort of thing that erodes the power of the dollar until, one day, it's not so strong and stable anymore.

And then the unthinkable happens.

Dick Bove, vice president of equity research at Rafferty Capital Markets, sums it up well:

Dick Bove, vice president of equity research at Rafferty Capital Markets, sums it up well:

To most Americans, the first and clearest sign of the dollar's demise is rising food prices:

To investors, however, the

most telling symptom is how Wall Street responds to any talk of ending

the 'quantitative easing' that has been pumping phantom dollars into the

system for the last five years.

To investors, however, the

most telling symptom is how Wall Street responds to any talk of ending

the 'quantitative easing' that has been pumping phantom dollars into the

system for the last five years.

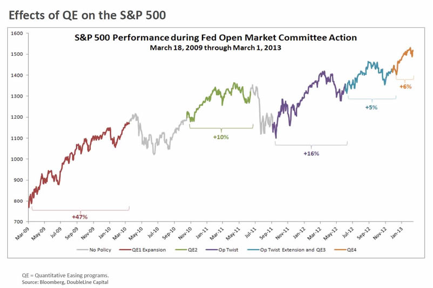

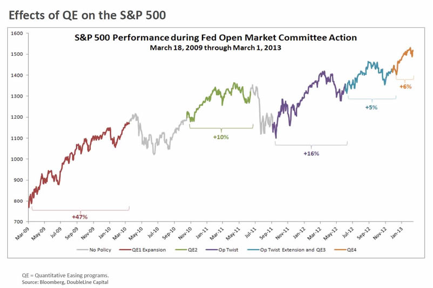

The chart below shows S&P performance during the height of the post-crisis bull market.

The line is color-coded, separated into periods of varying Federal Reserve policies regarding the creation of new debt...

Notice what happens when the policy is to do nothing (marked in gray):

As a recent Business Insider article stated:

As a recent Business Insider article stated:

You're looking at 10%–15% losses, consistently, every time the flow of stimulus is halted.

You're looking at 10%–15% losses, consistently, every time the flow of stimulus is halted.

It happened in June 2013, when the DOW shed almost 700 points on mere whispers of "winding down" the flow of money.

It shed another 1,200 points in February 2014 as the Fed underwent a changing of the guard and "taper talk" continued.

The picture you should be getting in your mind now isn't a pleasant one.

It's an image of a gradually inflating stock market, powered entirely by an unstoppable stream of fresh, crisp $100 bills, each one slightly less valuable than the one that came before it.

Some call it inflation... I call it a death spiral.

And when debt grows to the point that mere interest payments become too much to handle, that death spiral finally hits the ground...

... The U.S. defaults, and the dollar loses its status as the most reliable currency in the world.

Some believe that moment is right around the corner:

Do you really think they're just going to sit around and wait for a massive chunk of their wealth to evaporate because we dropped the ball?

The Chinese have done a spectacular job growing their giant, diversified economy over the last decade or so.

They're not about to let us ruin it for them.

They're not about to let us ruin it for them.

They will not sit back and let us drag them into another recession just because we have a debt addiction we can't shake.

And there's a man high up in the party ranks whose entire existence is dedicated to making certain what's happening here never happens over there.

His name is Gao Hucheng.

Who is Gao Hucheng?

We have our Federal Reserve Chairman... The Chinese have their Minister of Commerce.

A secretive man in control of the world's second-biggest economy and a multi-trillion dollar foreign reserve war chest.

Like most individuals in Chinese politics, Mr. Hucheng's individual persona is unimportant.

Like most individuals in Chinese politics, Mr. Hucheng's individual persona is unimportant.

What we know is that he is Western-educated, multi-lingual, highly feared, and extremely autocratic.

That much was expected.

What he represents, more to the point, is the most formidable enemy to American success and the American lifestyle since the reign of the Soviets.

Unlike the Soviets, however, Mr. Hucheng has a real chance of accomplishing his mission.

And it won't be done with bombs or missiles.

It will be done with the same weapon America has used since the start of the Cold War to get its policies passed: buying power.

Right now, Hucheng's central bank is using its buying power to gradually, carefully (so as not to corner the market and drive up prices) acquire vast stores of the oldest and most popular financial hedge in the history of mankind.

For the last several years, China has been at it.

Even as gold prices took

recent hits, the Chinese have continued their bullish attack on the

global bullion market with no end in sight.

Even as gold prices took

recent hits, the Chinese have continued their bullish attack on the

global bullion market with no end in sight.

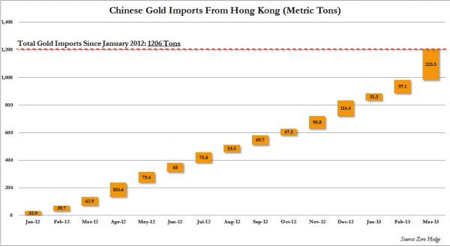

According to Bloomberg:

But here's where it gets really interesting...

But here's where it gets really interesting...

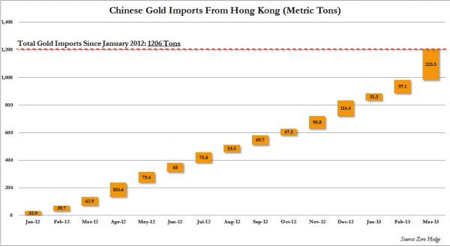

Official Chinese gold reserve holdings haven't been updated by the PRC's Ministry of Commerce since 2008.

Back then, official reports put the figure at 1,057 tonnes.

In the five years since, rate of acquisition has been improving... to say the least.

In March of 2013 alone, even as gold declined 10% below 2011 highs, the Chinese acquired 223.5 tonnes, bringing the total for the prior 12 months to 1,206 tonnes.

The Chinese remain mum on

exactly how much they have, but by any reasonable interpretation of

their policies, it's at least several times their official reserve

figures stated back in 2008.

The Chinese remain mum on

exactly how much they have, but by any reasonable interpretation of

their policies, it's at least several times their official reserve

figures stated back in 2008.

Even the most conservative estimates are anything but conservative:

But based on all the standard indicators, this is just the beginning.

Remember that China, aside from being the fastest-growing hoarder of gold on the planet, is also the biggest foreign holder of dollars, with $2 trillion (along with $1.4 trillion in other currencies) in its coffers to add backbone to any financial dealings it decides to engage in.

The more it has, the more wealth it stands to lose as each currency gradually inflates away buying power.

Which means it needs to get rid of those greenbacks as fast as possible, converting a depreciating asset into an appreciating one.

Or, as the Financial Times phrased it:

More gold has to be the answer... a lot more of it.

More gold has to be the answer... a lot more of it.

But how much, exactly?

Well, they'd need 77,000 tonnes of it to fully convert their $3.4 trillion in foreign reserves.

Of course, nobody has all of their foreign reserves in gold... not even the U.S., which keeps 76% of its reserves in gold.

For the Chinese, whose foreign reserves are 22 times greater than the U.S.'s, just matching the U.S.'s 76% gold/foreign currency ratio would require 58,000 tonnes — or about one-third of the total gold ever mined in the history of the world.

This puts China in a bad spot.

They can either sit and watch their cash inflate... or go out and snatch up all the gold they can find.

Every day the Chinese central banks stay in these dollars, euros, and yen is another day spent watching their wealth take this sort of trajectory:

While gold maintains this one, along the same timeline:

While gold maintains this one, along the same timeline:

Which would you choose to own?

Which would you choose to own?

The one that lost 30% in 10 years, or the one that gained 400%?

Want an example that will really put things into perspective?

Check out this simple comparison...

Back in 1917, 13 ounces of gold was worth $260... Roughly the price of one Model T — the car that made Henry Ford rich and his name synonymous with the American automotive industry.

Today, that same 13-ounce nugget, now worth close to $17,000, would buy you a respectable Chevy Volt.

$260 in cash, on the other hand, might get you an iPhone... With a 2-year service contract, of course.

Putting all this together,

you can see the Chinese plan to turn the yuan into the world's premier

gold-backed reserve currency isn't some sort of devious plot or

conspiracy.

Putting all this together,

you can see the Chinese plan to turn the yuan into the world's premier

gold-backed reserve currency isn't some sort of devious plot or

conspiracy.

It's more like their only way out...

The American dollar will lose its stability and footing just as the British pound did before it — only instead of a world war, it will be the post-Great Recession printing campaigns that did it.

What you need to take away from this is that the Chinese hold more greenbacks and, very likely, more gold than anybody besides the U.S. itself.

Their natural tendency, as the dollar loses buying power, will be to trade one for the other.

Dollars for gold... A depreciating asset for an appreciating one... Putting more and more tonnage of that yellow metal in their own version (or more likely, versions) of Fort Knox.

Right now, despite China's characteristic silence on the topic, the evidence all points to just this:

As one falls... the other rises.

As one falls... the other rises.

As they do this, the stage will become set for their ultimate goal...

As they do this, the stage will become set for their ultimate goal...

Ending the reign of the dollar by backing the yuan with the world's biggest gold reserve...

... And succeeding the U.S. as the world's leading economic power.

Front-Running a $3.4 Trillion "Supertrend"

What does this mean to you and me?

It basically means that for the next couple decades at least, China will work day and night to import and produce as much gold as their 1.3 billion sets of hands can.

And in case you think they'll get spooked by down-trending gold prices, think again.

This isn't your typical skittish precious metals investor.

The Chinese know what they're doing.

But there's still a long, long way to go.

In order to achieve even a reasonable gold/foreign exchange ratio (say, 50%), they would need to be either importing or producing close to 3,000 tonnes per year for the next ten years.

In 2012 — their banner year for gold acquisition — they only managed to produce/import about 1,200 tonnes.

So even with acquisition rates hitting new records monthly, they're only getting warmed up.

According to the World Gold Council:

To me, that sounds like something that, a few years from now, you'll kick yourself for ignoring.

Go Where Chinese Bankers Cannot

China's problem of too much cash is the private investor's greatest advantage...

You see, with that much money to convert, Chinese investment bankers will rarely, if ever, get to participate in the one sector of the gold market that has time and time again beaten gold percentage gains by leaps and bounds.

I'm not talking about gold certificates or ETFs. I'm definitely not talking about physical gold.

I'm talking the early-stage gold plays... The companies that make the big discoveries...

... The companies that excavate, produce, and refine the gold for the first time.

It's the absolute ground floor of the gold market.

Think of it this way...

On the one side, you have the Chinese and their $3.4 trillion war chest, as well as a few million private investors from around the world, looking for hard assets to hedge against inflation and other destabilizing economic forces.

And on the other side is you... owning shares in a company that produces the gold itself.

Not sales or resales. Actual production of pure, nontarnishable, yellow gold.

When you invest in mining exploration companies, you are effectively paying for shares of the properties they own and the unrefined gold within those properties.

You're investing in the future production of that gold — often hundreds of millions or even billions of dollars' worth — but you're paying for shares in a company often valued at less than $100 million... Sometimes even less than $50 million or $20 million.

Just imagine... a $20 million company sitting on $2 billion worth of gold.

If you think that sort of math is unique, you'd be wrong. It's actually somewhat common.

Companies with resource values tens or even hundreds of times their stock values are out there, working day and night to pull that gold out of the ground and make their owners filthy rich.

It's this kind of investment that was making overnight millionaires decades before the first dot-com IPO ever saw the light of day.

But because these companies are so small and can only support a couple dozen, maybe a couple hundred private investors at a time, the big bad Chinese don't get to participate.

Instead, China's monstrous demand for the metal guarantees that all those companies searching for and digging up the gold will always have a willing buyer for the final product once it's out of the ground.

Which is why China's problem is your biggest advantage today.

However, you should know that finding the best of these companies isn't always easy.

You really need to know how the business works and, most of all, the people involved.

You need to understand which companies are winners and which are going nowhere.

You need an expert with a recognized name and a proven record.

That's where I come in.

An Industry Where

Everybody Knows My Name

My name is Nick Hodge.

Just about anyone familiar with the investment newsletter industry, either as a reader or as an insider, knows who I am.

For the last seven years, I've been a regular on the investment lecture circuit and a routine guest speaker on major media outlets like Yahoo!, Stock News Now, and The Business News Network.

The reason I'm in demand is that during my career, I've developed one of the most consistently profitable portfolios in existence anywhere in the industry — with thousands of premium subscribers who use my recommendations as the very foundation of their investment activities.

How do I know?

The most obvious way there is.

Every day, I get messages like these in my inbox:

And:

And:

And:

And:

That's a lot of pretty profound praise for a guy who's only 30 years old.

That's a lot of pretty profound praise for a guy who's only 30 years old.

But I'm not here to talk about personal achievements or wealth... I want to talk about what I consider to be the most important goal of wealth management today.

You see, even from a young age, I knew there was no such thing as a free lunch...

I started a landscaping business by the time I was 12 years old. I made up my own fliers, maintained a client list, and billed them with invoices I made on the computer.

I took to business like a retriever takes to water. It just came naturally. I was drawn to it.

But even more than innate leadership and drive is a looming notion I've had since high school that something was wrong with "the system."

The notion that nothing was real anymore... That all modern valuations were based on debt and unsubstantiated speculation, and that neither model would hold up well in the long-term when it came to building and maintaining a serious portfolio.

I made it my life's mission to become independent of the system, to build my wealth to the point where things like employment and inflation no longer mattered.

The problem was, few people saw what I was seeing.

Maybe you feel the same way.

I saw zombies — or worse, actuaries — being created. And it seemed like no one even noticed the meat grinder they were being put through.

Not me. I refused to be pigeonholed. I refused to choose from a template of futures: doctor, lawyer, teacher, et cetera...

All I knew was I wanted to be successful — and on my own terms.

All I knew was I wanted to be successful — and on my own terms.

Maybe you felt — and still feel — the same way.

You see, I grew up on a farm, which meant cutting firewood, fixing fences, working on the well for the barn, tilling, planting, managing livestock, building wagons, and baling hay. I learned how to fish and hunt from my father. And later, I learned to be a butcher as I worked through college.

Today, I can catch or shoot dinner, skin it, dress it or fillet it, and cook it. In fact, my freezer is full of venison, wild fowl, fish, and other game.

When it comes to money, I have no non-mortgage debt. Plus, I manage all my own finances — including a SIMPLE IRA, traditional IRA, and brokerage accounts totaling hundreds of thousands of dollars.

Professionally, I've written two best-selling books about investing and have helped thousands of individuals make a lot of money with my financial research over the past few years...

I'm talking about gains like:

Had you invested in any of those plays, you could have easily doubled your money...

So why is all this important?

Well, earlier I mentioned the most important goal of wealth management.

To anybody who hasn't yet achieved it, the best way to phrase that goal is: Total financial independence from employment income and current/future debt.

Or more succinctly: Freedom from your paycheck.

To spread the knowledge I've amassed on how to immunize yourself from revolving debt, recession, and unemployment, I created a new investment and lifestyle community called Like Minded People.

Initially, I offered to Like Minded People subscribers a handful of reports crucial to anybody striving to live a debt-free existence.

This collection is the cornerstone of any realistic plan to build and protect net worth in a time when stagnation and wealth-dilution is the only reality many of us remember.

The reports are titled:

But that wasn't enough...

So I created some potentially controversial (yet incredibly useful) reports for new members, including:

What I'm offering to you right now, if you agree to sign up for a 100% risk-free test drive of Like Minded People, isn't a book or an instructional manual.

It's a single stock — designed specifically to play into China's $3.4 trillion secret gold-buying campaign and allow you to cash in gains quickly, reliably, and repeatedly.

It's the simplest plan of them all, and it will very rapidly help you to achieve a debt-free existence by increasing your liquidity.

Because after all, long-term strategies are important, but there is no over-emphasizing the importance of cold, hard cash.

And this is just the investment play to make it happen for you.

Sign up to Like Minded People by clicking the link at the end of this presentation, and get immediate access to your exclusive copy of, "The Golden Key: Front-Running China's $3.4 Trillion Gold Plan."

Inside, you'll quickly get briefed on why this is a one-step strategy to making China's buying spree work for you.

Because let me assure you, the numbers from this company's main project in central Idaho are pretty staggering:

There are more than 4 million ounces inferred, boasting enviable precious metal concentrations on easy-to-mine, low-risk, readily accessible, open pit sites.

They project a total cost per ounce of gold produced at less than $450 — meaning that even in today's market, that's over $800 of profit for every ounce extracted once production really takes off.

Now, to put this into perspective... This company's plan is to hit annual production of 390,000 ounces on this property — if it isn't bought out by a major gold producer first.

At today's prices (which this rapidly-unraveling Chinese conspiracy is starting to drive upwards even as you read this), the company stands to log profits of over $310 million annually for the life of the mine, which is expected to be about eight years.

For a company whose stock still trades below $2 with a total market capitalization of less than $160 million, this sort of revenue would make history.

Just think... almost twice the value of the company back in net revenue every year.

If the image I'm painting here seems aggressively optimistic, there's a reason for that.

This company's management team might be its most valuable asset yet.

More than a century of industry experience and billions in collective market capitalization growth under its belt puts this group into a class of its own.

You see, when gold properties of this caliber are properly managed, annual returns of 500%, 600%, even 1,000% are not unheard of.

Three- and four-figure gains might seem impossible in other sectors, but in precious metals mining, they are the hallmark of talent and due diligence.

Now, I can't give you too many details on the company that owns this world-class gold property, but I will say this:

If you had to choose a single, well-managed, perfectly balanced, cash-rich firm (this company holds more than one-third of its book value in cash reserves, making it one of the most liquid among its peers) to ride out the Chinese run on the global gold supply, this is the one.

In fact, it would be a buy even without the Chinese working around the clock to hoard the world's gold.

Want to know why?

Well, it involves a crucial industrial metal... One whose name few know but is nevertheless an endangered species today from overuse.

This metal is vital to modern industry because it's used in the production of everything from ball bearings to firearms ammunition to fire retardants to industrial solder.

However, as seems to be happening more and more often these days, the Chinese are already the world's biggest producer of this metal, with 90% of the market locked up.

Global supplies are starting to dwindle as the Chinese tighten their grip on exports.

Global supplies are starting to dwindle as the Chinese tighten their grip on exports.

And yet there's only one mine producing this metal in all of North America.

Well, the management team behind my new gold miner is seeing to it that all that changes... because they plan to hedge their investments by producing this industrial metal right alongside gold.

It's staring them in the face, it's worth billions, and there are almost no additional production costs.

Want the bottom line?

You remember that list of past recommendations I listed earlier? All percentage gains were well into the triple digits.

I think that sort of record gives me the authority to say this one might be the biggest hit yet.

Six months from now, chances are I'll be listing it first in the list of my best winners.

This one is so undervalued right now that its small silver reserves alone account for a full half of its market capitalization.

Just understand this: A disconnect between net worth and market cap of this magnitude will not last forever.

By the time this company's book value starts to reflect the value of the resources it owns, this stock could technically rise as much as 100-fold.

But I'm getting ahead of myself. There's a lot you should know about this company, and I'm letting you have access to the one place where you can get it all:

Get your free copy of "The Golden Key: Front-Running China's $3.4 Trillion Gold Plan," and in the next few minutes, learn every last detail you need to know about this company.

Once you do, I can almost guarantee you'll agree with everything I've said above.

And that's not all you'll get if you agree to try out my service today.

Not by a long shot.

As a premier member of Like Minded People, your privileges will include:

The easy answer to that question is: nothing.

I told you this was a risk-free trial. Here's how it works:

I always offer my readers a trial period — a test drive — during which you can use my service and check out all it has to offer.

If for any reason you don't like it, you can call in for a full, no-questions-asked refund.

Usually this test drive lasts a month or two.

Today, that changes.

When you try out a membership to Like Minded People today, you can take the next 12 months to make up your mind.

Just let me know that you'd like to give Like Minded People a risk-free look today, and we'll make sure you receive everything I mentioned in this report.

If you decide the ideas are too "out there" for you... or that you are better off sticking with mainstream conventions... simply let us know, and I'll make sure you get back the money you paid.

Believe me, there's no shame in asking for a refund.

The ideas I'll share in the newsletters and the updates, along with the ideas you'll hear about in the online forum, are certainly not for everyone.

In fact, anybody hesitant to take advantage of time-sensitive, immediately actionable information should probably stop reading right now.

Some people just have a hard time going out of their "comfort zone." And I understand that.

However, that's exactly why my strategies work so well — and why they can work to your advantage!

You see, if everyone was using these techniques and secrets and everyone felt comfortable with them, well... they'd become mainstream, and their effectiveness would basically disappear.

The nice thing is that by accepting this invitation today, you are agreeing only to try out a membership to see if you like it.

Trying out a membership in this "club" puts all the risk on MY shoulders: Either I live up to the claims I mentioned today, or you get ALL your money back.

Not some of it... not a pro-rated amount... We will refund every single penny you paid.

It's as simple as that.

And just as I promised you earlier, you'll get to keep the report, "The Golden Key: Front-Running China's $3.4 Trillion Gold Plan," completely free of charge.

The membership fee for Like Minded People, by the way, is only $199 for one full year.

That's just 54 cents a day.

At that price, I am sure there's no better bargain for access to this kind of financial research and proven wealth-building strategies.

As I say, it's highly unlikely you'll hear about these ideas anywhere else... and the fact that you can get all of this information for less than $1,000 is simply amazing. Believe me, it is worth many, many times that price.

And believe it or not, the deal gets even better...

Because I'm still actively building Like Minded People's readership, you can become a Charter Member and pay 50% LESS than what we'll ask future subscribers to pay.

Instead of paying the normal price of $199... you'll get a full year's membership, including everything I mentioned here, for just $99.

That comes to just 27 cents a day, and it could possibly be the best investment you ever make.

There is, however, a catch in order to qualify for this deal...

You see, this is the first time we've ever set up a membership community like this. And as a result, we're building out our infrastructure for it slowly. Which means we can only enroll 5,000 new members this month.

While that may sound like a lot, when you consider this report will be seen by millions of people, those spots are sure to fill up rather quickly.

So if you click on the link below to enroll and all the spots are full, you'll be placed on a VIP priority notification list... and you can get started when we open up more spots next month.

I sincerely hope you take advantage of this unique opportunity to join our growing community of Like Minded People.

Simply click the link below to get started before this half-off Charter Membership offer ends.

I look forward to welcoming you as a new member.

Click Here.

Sincerely,

Nick Hodge

Founder and Publisher, Like Minded People

P.S. The recent completion of a massive test drilling program totaling close to 12,000 total meters drilled is clear evidence that we're nearing the end of the exploratory phase. Cash reserves are in place, reported gold concentrations are as high as 9 grams/tonne, and recent stock-buying activity indicates the same thing: we could see a ramp-up into production as early as summer 2014. Do not miss what could be the last chance to get in before it all begins.

Larry Page Kecam Spionase AS

Islam Times –

http://www.islamtimes.org/vdcgqw9wwak9374.1ira.html

"Sangatlah mengecewakan, pemerintah [AS] diam-diam melakukan semua hal ini dan tidak memberitahu kami," kata Page.

Larry Page, Pembantu pendiri Google.jpg

Salah satu pendiri Google, Larry Page mengutuk upaya spionase pemerintah AS sebagai ancaman terhadap demokrasi.

Page menutuk hal itu hari Rabu (19/3/14) di Vancouver, Kanada, setelah Sergey Brin (rekannya dalam pendirian Google) melakukan pertemuan virtual dengan whistleblower AS, Edward Snowden sehari sebelumnya.

"Sangatlah mengecewakan, pemerintah [AS] diam-diam melakukan semua hal ini dan tidak memberitahu kami," kata Page.

Page memperingatkan bahwa efek spionase online akan memicu pemblokiran penggunaan informasi pribadi untuk tujuan-tujuan yang bermanfaat.

Sebelumnya, CEO Facebook Mark Zuckerberg juga mengkritik Washington karena program spionase besar-besaran AS. Dia mengatakan pemerintah AS telah merusak kepercayaan publik terhadap internet dengan kegiatan surveilans AS itu.

Dokumen yang dirilis tahun lalu oleh Snowden mengungkapkan bahwa NSA secara sistematis memata-matai hubungan telepon dan aktivitas online jutaan orang di seluruh dunia.[IT/r]

China to Buy Record Amounts of Gold

Ending the Reign of the U.S. Dollar

Ending the Reign of the U.S. Dollar

Here's how to front-run

their $3.4 trillion plan

with a $1.00 gold miner.

Dear Reader,

http://www.angelnexus.com/o/web/57042?r=1

China has a problem we'd all like to have: too much cash.

In all, more than $3.4 trillion of it.

This mountain of currency comes in the form of euros, yen, pounds sterling, and — most of all — American dollars.

In fact, more than half of the Chinese foreign reserves are in U.S. dollars — close to $2 trillion at this point.

It's enough money to buy 1,000 B2 Stealth bombers, 140 nuclear-powered aircraft carriers, or all the real estate in Manhattan two and a half times over.

Now, while you might think this is a nice problem to have, to the Chinese, it's not so nice.

You see, China's cash holdings, like I mentioned, are broken up into several major world currencies:

Problem is that the greenback, like the yen and the euro, is a constantly depreciating asset.

In fact, when compared to the dollar of 100 years ago, today's money buys you barely 4% of what it did back when Henry Ford was turning out Model Ts...

Which means the Chinese are sitting on a mountain of money that's constantly eroding.

That's $110 million per day... $4.5 million per hour... $76,000 per minute.

In the time it took you to read the last two sentences, China's stash of greenbacks became $12,000 less valuable.

And that's not even counting the other $1.4 trillion in foreign currency, which drops in value at comparable rates as the European and Japanese economies tackle their own debt crises.

Losses like these are not sustainable even for a stagnant economy. For a burgeoning economy trying to support a rapidly developing national infrastructure, losses like these are catastrophic.

The Chinese, however, aren't the sort to just sit by and hope for the best.

Even as you're reading this, they're making moves that will ensure their own economic stability in the decades to come... and if it's something that has to come at the price of the dollar's unquestioned dominance in global economics, so be it.

In a few minutes, I'm going to explain China's master plan to shelter itself from the instability of a dollar-based global economy.

More importantly, I'm going to tell you about the commodity it's hoarding to make this happen...

... And let you in on how private citizens just like you and me can use the resulting boom market to personally profit.

But first, I want to show to you why the Chinese are doing what they're doing and introduce you to the shadowy man — perhaps the most powerful economic official alive today — who's pulling all the strings.

The Greenback's Retiring...

And You're Coming to the Party

(Whether You Like it or Not)

And with its rise, the U.S. gave the world the almighty dollar, which has been used as the world's default reserve currency ever since.

Whenever anything is evaluated today, whether it's a tract of land in Zambia or a shipyard in Japan, the universal measuring stick of its value is always dollars and cents.

For about four decades after the end of the war, this all worked very well for the U.S.

America was the world's biggest creditor, produced most of the world's goods, sold most of the world's goods, and spent most of the world's money.

It was only natural for the dollar to reign.

But eventually, sometime in the late 1980s, that balance shifted.

America went from a nation of producers to a nation of borrowers... on a personal as well as national level.

However, the situation is a bit different when you're the world's biggest economy and the owner of the world's reserve currency.

To pay off its debts, the U.S. usually just prints more money...

Millions upon millions of fresh new greenbacks — because that's what the world runs on.

As a nation, it's this privilege alone that allows us to maintain the cushy lifestyle, the public spending, the wars, and, most of all, the trillions in federal stimulus without cutting into our wealth too much.

The dollar is, after all, too big and too stable to ever falter, right?

Well, not exactly.

As we print more to cover our borrowing, the dollar's value — which is conjured out of thin air during additional late-night sessions over at the national mint — starts to approach zero.

Which is exactly what's been happening.

Again, not exactly... You see, the closer the value comes to zero, the smaller the fractional increments appear on a chart.

Going from 10% of the dollar's original 1900 buying power to 5% doesn't look that significant on a chart tracking the last 110 years of devaluation, but rest assured it's still a 50% hit to your wallet as the price of everything from bread to gas to iron ore doubles.

And it's all because the Fed keeps pumping out those dollars... more now, in fact, than ever before.

According to a recent Business Insider article:

But more to the point, it's this sort of thing that erodes the power of the dollar until, one day, it's not so strong and stable anymore.

And then the unthinkable happens.

Generally

speaking, it is not believed by the vast majority that the American

dollar will be overthrown, but it will be, and this defrocking may occur

in as short a period as five to 10 years... the United States will lose

the right to print money to pay its debt.

After this frightening milestone is reached, things only get worse. According to Michael Pento of Pento Portfolio Strategies:

The

No. 1 security issue we have as a nation is the preservation of the

U.S. dollar as the world's reserve currency. It's a thousand times more

important than a nuclear bomb being tested by North Korea. It's a

thousand times more important that we keep the dollar as the world's

reserve currency, and yet we are doing everything to abuse that status.

Unfortunately, this view

isn't uncommon in the financial industry. In fact, it's almost

universally accepted, as evidenced by Sam Zell, chairman of Tribune

Company and Equity Group Investments:

My

single biggest financial concern is the loss of the dollar as the

reserve currency. I can't imagine anything more disastrous to our

country. I think you could see a 25 percent reduction in the standard of

living in this country if the U.S. dollar was no longer the world's

reserve currency. That's how valuable it is.

I would like to emphasize one thing: The unthinkable event isn't just going to happen — it's already showing telltale symptoms...To most Americans, the first and clearest sign of the dollar's demise is rising food prices:

The chart below shows S&P performance during the height of the post-crisis bull market.

The line is color-coded, separated into periods of varying Federal Reserve policies regarding the creation of new debt...

Notice what happens when the policy is to do nothing (marked in gray):

It happened in June 2013, when the DOW shed almost 700 points on mere whispers of "winding down" the flow of money.

It shed another 1,200 points in February 2014 as the Fed underwent a changing of the guard and "taper talk" continued.

The picture you should be getting in your mind now isn't a pleasant one.

It's an image of a gradually inflating stock market, powered entirely by an unstoppable stream of fresh, crisp $100 bills, each one slightly less valuable than the one that came before it.

Some call it inflation... I call it a death spiral.

And when debt grows to the point that mere interest payments become too much to handle, that death spiral finally hits the ground...

... The U.S. defaults, and the dollar loses its status as the most reliable currency in the world.

Some believe that moment is right around the corner:

Five

to 10 years — that would be an outlier. I would say 2015, 2016, that

would be the time when it becomes a particularly salient issue. When

we're spending 30 to 50 percent of our revenue on debt service payments,

we enter into a bond market crisis. The dollar starts to drop along

with bond prices. That would set off the whole thing. — Michael Pento, president of Pento Portfolio Strategies

Now, think back to what I said about the Chinese and their $2 trillion in American dollars stored away in their national banks.Do you really think they're just going to sit around and wait for a massive chunk of their wealth to evaporate because we dropped the ball?

The Chinese have done a spectacular job growing their giant, diversified economy over the last decade or so.

They will not sit back and let us drag them into another recession just because we have a debt addiction we can't shake.

And there's a man high up in the party ranks whose entire existence is dedicated to making certain what's happening here never happens over there.

His name is Gao Hucheng.

Who is Gao Hucheng?

A secretive man in control of the world's second-biggest economy and a multi-trillion dollar foreign reserve war chest.

What we know is that he is Western-educated, multi-lingual, highly feared, and extremely autocratic.

That much was expected.

What he represents, more to the point, is the most formidable enemy to American success and the American lifestyle since the reign of the Soviets.

Unlike the Soviets, however, Mr. Hucheng has a real chance of accomplishing his mission.

And it won't be done with bombs or missiles.

It will be done with the same weapon America has used since the start of the Cold War to get its policies passed: buying power.

Right now, Hucheng's central bank is using its buying power to gradually, carefully (so as not to corner the market and drive up prices) acquire vast stores of the oldest and most popular financial hedge in the history of mankind.

For the last several years, China has been at it.

According to Bloomberg:

Official Chinese gold reserve holdings haven't been updated by the PRC's Ministry of Commerce since 2008.

Back then, official reports put the figure at 1,057 tonnes.

In the five years since, rate of acquisition has been improving... to say the least.

In March of 2013 alone, even as gold declined 10% below 2011 highs, the Chinese acquired 223.5 tonnes, bringing the total for the prior 12 months to 1,206 tonnes.

Even the most conservative estimates are anything but conservative:

In

2009, a State Council advisor in China stated that a group of officials

and economists from Beijing and Shanghai established a 'task force' to

discuss measures to add to the nation’s gold holdings. 'We suggested

that China's gold reserves should reach 6,000 tonnes in the next 3-5

years and perhaps 10,000 tonnes in 8-10 years,' the advisor noted.— GoldAlert.com

Given that they've been

documented bringing in more than 1,200 tonnes in the last 15 months

alone, many reputable sources place current Chinese gold reserves at

somewhere around 4,000–6,000 tonnes... putting them solidly in second

place behind the U.S.But based on all the standard indicators, this is just the beginning.

Remember that China, aside from being the fastest-growing hoarder of gold on the planet, is also the biggest foreign holder of dollars, with $2 trillion (along with $1.4 trillion in other currencies) in its coffers to add backbone to any financial dealings it decides to engage in.

The more it has, the more wealth it stands to lose as each currency gradually inflates away buying power.

Which means it needs to get rid of those greenbacks as fast as possible, converting a depreciating asset into an appreciating one.

Or, as the Financial Times phrased it:

But how much, exactly?

Well, they'd need 77,000 tonnes of it to fully convert their $3.4 trillion in foreign reserves.

Of course, nobody has all of their foreign reserves in gold... not even the U.S., which keeps 76% of its reserves in gold.

For the Chinese, whose foreign reserves are 22 times greater than the U.S.'s, just matching the U.S.'s 76% gold/foreign currency ratio would require 58,000 tonnes — or about one-third of the total gold ever mined in the history of the world.

This puts China in a bad spot.

They can either sit and watch their cash inflate... or go out and snatch up all the gold they can find.

Every day the Chinese central banks stay in these dollars, euros, and yen is another day spent watching their wealth take this sort of trajectory:

The one that lost 30% in 10 years, or the one that gained 400%?

Want an example that will really put things into perspective?

Check out this simple comparison...

Back in 1917, 13 ounces of gold was worth $260... Roughly the price of one Model T — the car that made Henry Ford rich and his name synonymous with the American automotive industry.

Today, that same 13-ounce nugget, now worth close to $17,000, would buy you a respectable Chevy Volt.

$260 in cash, on the other hand, might get you an iPhone... With a 2-year service contract, of course.

It's more like their only way out...

The American dollar will lose its stability and footing just as the British pound did before it — only instead of a world war, it will be the post-Great Recession printing campaigns that did it.

What you need to take away from this is that the Chinese hold more greenbacks and, very likely, more gold than anybody besides the U.S. itself.

Their natural tendency, as the dollar loses buying power, will be to trade one for the other.

Dollars for gold... A depreciating asset for an appreciating one... Putting more and more tonnage of that yellow metal in their own version (or more likely, versions) of Fort Knox.

Right now, despite China's characteristic silence on the topic, the evidence all points to just this:

Ending the reign of the dollar by backing the yuan with the world's biggest gold reserve...

... And succeeding the U.S. as the world's leading economic power.

Front-Running a $3.4 Trillion "Supertrend"

It basically means that for the next couple decades at least, China will work day and night to import and produce as much gold as their 1.3 billion sets of hands can.

And in case you think they'll get spooked by down-trending gold prices, think again.

This isn't your typical skittish precious metals investor.

The Chinese know what they're doing.

The culture in Asia is such that they will absorb the physical metal when the price drops.

— Dick Poon, Hong Kong-based general manager at refiner Heraeus

While average gold demand in other major markets remains basically stable, China's continues to grow.— Dick Poon, Hong Kong-based general manager at refiner Heraeus

But there's still a long, long way to go.

In order to achieve even a reasonable gold/foreign exchange ratio (say, 50%), they would need to be either importing or producing close to 3,000 tonnes per year for the next ten years.

In 2012 — their banner year for gold acquisition — they only managed to produce/import about 1,200 tonnes.

So even with acquisition rates hitting new records monthly, they're only getting warmed up.

According to the World Gold Council:

If

gold demand in China continues to accelerate and becomes more

comparable with other major markets, we expect it to double in tonnage

terms within the next decade.

To me, that sounds like a serious economic trend in the making.To me, that sounds like something that, a few years from now, you'll kick yourself for ignoring.

Go Where Chinese Bankers Cannot

You see, with that much money to convert, Chinese investment bankers will rarely, if ever, get to participate in the one sector of the gold market that has time and time again beaten gold percentage gains by leaps and bounds.

I'm not talking about gold certificates or ETFs. I'm definitely not talking about physical gold.

I'm talking the early-stage gold plays... The companies that make the big discoveries...

... The companies that excavate, produce, and refine the gold for the first time.

It's the absolute ground floor of the gold market.

Think of it this way...

On the one side, you have the Chinese and their $3.4 trillion war chest, as well as a few million private investors from around the world, looking for hard assets to hedge against inflation and other destabilizing economic forces.

And on the other side is you... owning shares in a company that produces the gold itself.

Not sales or resales. Actual production of pure, nontarnishable, yellow gold.

When you invest in mining exploration companies, you are effectively paying for shares of the properties they own and the unrefined gold within those properties.

You're investing in the future production of that gold — often hundreds of millions or even billions of dollars' worth — but you're paying for shares in a company often valued at less than $100 million... Sometimes even less than $50 million or $20 million.

Just imagine... a $20 million company sitting on $2 billion worth of gold.

If you think that sort of math is unique, you'd be wrong. It's actually somewhat common.

Companies with resource values tens or even hundreds of times their stock values are out there, working day and night to pull that gold out of the ground and make their owners filthy rich.