The World Will Run Out of Silver in Nine Years ????

http://www.wealthwire.com/news/headlines/2290

Surging silver demand – for industrial uses as well its position as a safe-haven for many investors – is creating some serious supply deficiency issues...what will this mean for the future of the silver industry?

Many financial analysts, investing experts, and even geologists have one big thing in common: a silver shortage is upon us. Peak silver is no joke.Here are a few factors contributing to many investors' wildly bullish views on silver:

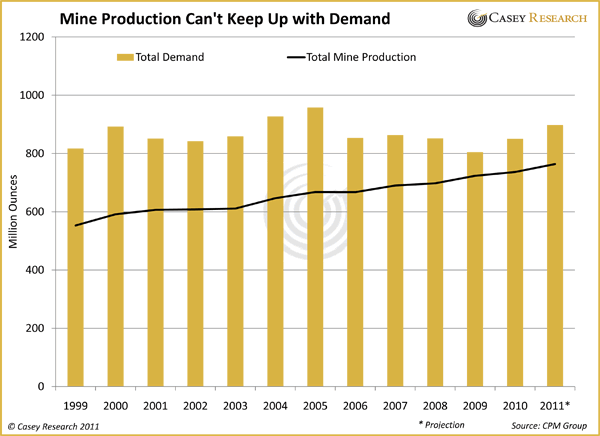

There's no denying it; the world is running out of silver. And the cheap silver has already run out.

If you don't believe that, research any major silver mining company. If you could talk to the CEOs of those companies, you would learn how many silver mining projects never really pan out successfully. More times than not, there's simply not enough silver in any given ore.

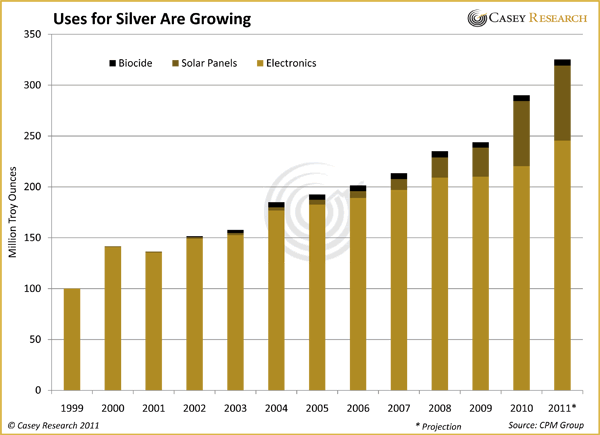

At least not enough to supply all of these growing industrial uses:

*Images coutesy of The Market Oracle.

According to metal expert Luke Burgess, "Despite the lack of global stockpiles, new technology will continue to discover more industrial applications for silver, putting a further strain on world supplies." Right in line with this assertion, the Silver Institute predicts that silver demand for industrial purposes will increase by 36% by 2015.

Industrial silver demand creates a greater sense of urgency than gold demand because it is needed rather than simply desired. Silver has been needed for decades, so it has been mined for decades in order to fulfill those needs.

Silver is required in the production of products like CDs, cell phone batteries, calculators, printed circuit boards, hearing aids, electronic switches, TV screens, catalytic converters, inks, computer monitors, RFID chips, and thousands more.

Nonetheless, silver is still very-much desired for its aesthetic value too. Burgess reported that 28% of jewelry suppliers saw silver sales increase by 25% from 2009 to 1010.

For these reasons, silver has solidified its position as a major necessity, and a highly desirable one as well, in the industrial realm.

But something has changed dramtically in the silver suppy-demand curve in the past few years. Silver is fast-becoming a top-asset choice for cautious investors.

This is happening because nations across the globe are currently digging themselves in some pretty deep holes full of unbacked fiat currencies and suffocating layers of debt. Traditional currencies are no longer safe.

Take the United States for example. Every time we run into a financial blunder, the Fed retaliates by printing bucket loads of paper money. Essentially, this overprinting trend further contributes to our region's long-term financial woes.

Take the United States for example. Every time we run into a financial blunder, the Fed retaliates by printing bucket loads of paper money. Essentially, this overprinting trend further contributes to our region's long-term financial woes.

As citizens lose faith in the spending value of these devaluing dollars, savvy investors begin to look elsewhere; specifically, the precious metals sector.

In times of recession, depression, and overwhelming uncertainty (sound familiar?) investors have few viable options. Thus, they inevitably – sooner or later – flock to the precious metals market as a safety net. Otherwise, their hard-earned wealth is at stake and many other investment options are too risky during such fragile times.

Simple statistics prove this type of investor mentality. In the past two decades alone, gold has returned investors 6.9% on their investments. In 1993, gold returned 9.6%.

But the yellow metal isn't the only big gainer. Silver has exploded in the precious metals market, especially after the financial meltdown in 2008. In 2009, silver investment increased by 184% in just one year!

By 2010, the U.S. Mint announced that they had run out of sillver bullion blanks. At the time, they also suspended production of American Eagle Silver Proof coins. Why? The answer is a simple. The didn't have the supply to meet the demand.

Economics-101: If supply decreases and demand remains unchanged, prices go up. If supply runs out, you can no longer sell the product, making it even MORE valuable in the eyes of the beholder and the product-less consumer.

Bottom line: prices appreciate.

Fast forward to November of 2011 and that trend is on track. In fact, silver prices are increasing exponentially.

At the beginning of this week, both silver and gold got going on a positive note. As the situation in Europe is slowly working itself out less dramatically than originally anticipated, silver is set to advance even higher. Those benefits will seep over into the new year as well.

Heading into the New Year, silver could be poised to see an uptick. "Conditions in 2012 are likely to remain highly supportive of further growth in investment demand, underpinning additional price gains," Philip Klapwijk, Global Head of Metal Analytics for the group, told an annual meeting of The Silver Institute.

And profit they will continue to do...until supply runs dry. But, experts warn that may be sooner than you realize. And you don't want to be kicking yourself ten years from now for the investment opportunity still available to you right now.

*Indented excerpt from The Bedford Report.

Gold Bullion

http://gold.bullionvault.com/How/GoldBullion

|

Buying gold bullion is now cheaper and easier than ever before. And it's still, by a long way the safest way to own gold. Learn how.

To learn more about what gold bullion is please read on ...

Gold Bullion is valuable precious metal - namely gold or silver. It comes in two main forms :- Gold bullion bars, and Gold bullion coins. What makes it gold bullion is simply that its value derives entirely from its precious metal content.

Unlike jewelry, or numismatic coins, gold bullion has no artistic component in its value. Some people do not understand why without that artistic component a relatively useless material like gold should have such a high value. To understand that you need to understand gold's monetary role.

If you want to buy some gold bullion these days it is relatively easy to do so. Learn how.  |

Gold bullion coins trade quite close to the world gold price, but you will still pay a premium of perhaps 4% when you buy in quantity, and usually 8% when you buy smaller amounts. You should expect to suffer a similar 4-8% discount when you sell gold bullion coins back to the dealers too.

Bullion bars come in many sizes. Bought from private suppliers for private possession you will usually pay dealing costs similar to those for bullion coins.

Gold bullion bars can weigh anything from a few grams upwards. 1kg and 100 oz (~3kg) bars are sometimes accepted by participants in professional bullion markets in Zurich and New York - though under strict controls to ensure bullion integrity. There is usually a premium on those locations, because London is the world's main physical bullion marketplace.

In London the market deals in the London Good Delivery gold bullion bar. These gold bars are what most people think of as bullion.

|

This London Good Delivery bar of bullion weighs 400 troy ounces - about 12.4 kilograms - and is about eleven inches long. It is stamped on the top (the bigger face) with the manufacturer's name, the weight, and the assayed purity.

This bullion is commodity gold, and is handled as such in the vaults where the bars are stored. They don't have the idealized super-smooth finish you sometimes see in photographs of mock bullion. The bullion is so soft that the bars are frequently scratched on their faces, and flattened on their edges and corners. Also you can see the finish is slightly dented where the bars have been stacked up on top of one another.

Neverthless, the London Good Delivery bar is the most important bullion product in the world. Loco London (meaning the physical bullion bars will be passed from seller to buyer in London) is the de-facto standard for bullion spot trading all around the world.

All bullion delivered against a London spot market trade (i) must be at least 99.5% pure, (ii) must come in bars of a standard shape weighing about 400 oz (iii) must have been accurately assayed so that he exact gold content of the bar is known (weight and purity are stamped on the bar) (iv) must have been manufactured by one of a listed group of refiners, and (iv) in almost all cases are only accepted from one of a very small number of accredited bullion vaults/couriers.

London Good Delivery bullion is the cheapest form of gold to deal and own, and it fetches the best prices when it is sold. But bullion in this form is not very accessible to private buyers. The reasons are (i) that the bars - being so big - are expensive, and (ii) that the bullion vaults where they must be kept do not deal with the public.

But fortunately if you do want to own bullion as an investment, whether in London, New York or Zurich, you can now access professional market London good delivery bullion through BullionVault.

If you are keen on buying some bullion gold you might like to continue your research by examining advantages and disadvantages of several different ways of buying gold.

Etymology#

The word "bullion" itself certainly comes from French; though whether bouillon (boiling), bille (medieval ingot), or buillun (cauldron) is not entirely clear. These three are related to each other anyway.Gold Jumps after Central Banks Launch Liquidity Measures

U.S. dollar gold bullion prices leapt 1.7% in 30 minutes Wednesday lunchtime in London – hitting $1744 an ounce – following an announcement of coordinated action from central banks worldwide aimed at increasing Dollar liquidity in the global financial system.

The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank will all lower the price on existing Dollar liquidity swap arrangements by 50 basis points (0.5 percentage points), effective Monday.

As well as strengthening Dollar liquidity provision, the central banks "judge it prudent" to make arrangements to offer enhanced liquidity provision in other currencies " so that liquidity support operations could be put into place quickly should the need arise", a Bank of England statement said.

On the currency markets the Dollar fell sharply following the central banks' announcement.

Despite its rally, the price of gold bullion this lunchtime remained only marginally above where it began the month.

Spot market silver bullion prices also surged – jumping 3.5% to $32.51 per ounce in the space of 36 minutes – while stocks and commodities also rallied.

*Post courtesy of Ben Traynor, BullionVault

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

Tidak ada komentar:

Posting Komentar